The market's initial reaction to Powell's prepared remarks (see below) are very dovish with yields and the dollar sliding notably:

Highlights include:

Dovish

"Doing too much could also do unnecessary harm to the economy..."

"...indicators of wage growth show a gradual decline toward levels that would be consistent with 2 percent inflation over time."

"Along with many other factors, actual and expected changes in the stance of monetary policy affect broader financial conditions, which in turn affect economic activity, employment and inflation.

Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy."

Neutral

"Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully.

We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks."

Hawkish

“We are attentive to recent data showing the resilience of economic growth and demand for labor,” he said.

“Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

“In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” he said.

* * *

As we detailed earlier, in the main event of the week, Fed Chair Jerome Powell will speak at the Economic Club of New York at 12ET.

The prepared remarks will be followed by a Q&A.

A multitude of Fed speakers have reinforced the messaging of 'higher for longer' and 'we are not necessarily done hiking yet' in recent days, echoing Powell's comments from the last FOMC on September 20:

"the fact that [the Committee] decided to maintain the policy rate at [the September FOMC] meeting doesn’t mean that we’ve decided that we have or have not at this time reached that stance of monetary policy that we’re seeking."

But some Fed speakers have been more dovish, providing hope for equity bulls (despite rate-cut expectations forf2024 having plunged in recent days).

The fear is that Powell may choose to reinforce the "we're not done yet" narrative and be more hawkish:

"I don't think Powell will take a definitive position as some on the FOMC have taken that interest rate hikes are behind us," said Avery Shenfeld, chief economist of CIBC Capital Markets.

As a reminder, The Fed's "dots" still indicate one more 25bps hike this year (at either the Nov or Dec meeting).

The recent surge in longer-term bond yields has some suggesting this represents investor doubts at The Fed's inflation-fighting prowess (or determination). Robert Brusca, chief economist at FAO Economics warned:

"They all seem to have this kind of gravity model view of inflation that says 'well they don't have to do very much because inflation is going to fall by itself to 2% because that's where it was'," Brusca said.

"I don't trust it and I think the markets are showing signs they don't trust it," he added.

Matthew Luzzetti, chief U.S. economist at Deutsche Bank, also warned Powell will have to strike a relatively more hawkish tone about December given the recent batch of data "that does seem to increase uncertainty about how much progress they are making" on growth, labor market and inflation."

Will Powell feel empowered to be more hawkish by recent events in the Middle East, and their effects on oil markets (and thus inflation)?

"Markets are now conscious that US headline inflation remains uncomfortably high at 3.7% and that war in the Middle East brings further upside risk for inflation," said Saxo Bank's senior fixed income strategist Althea Spinozzi.

"With the labor market remaining tight, the bond market cannot call the end of the Fed's interest rate cycle with certainty."

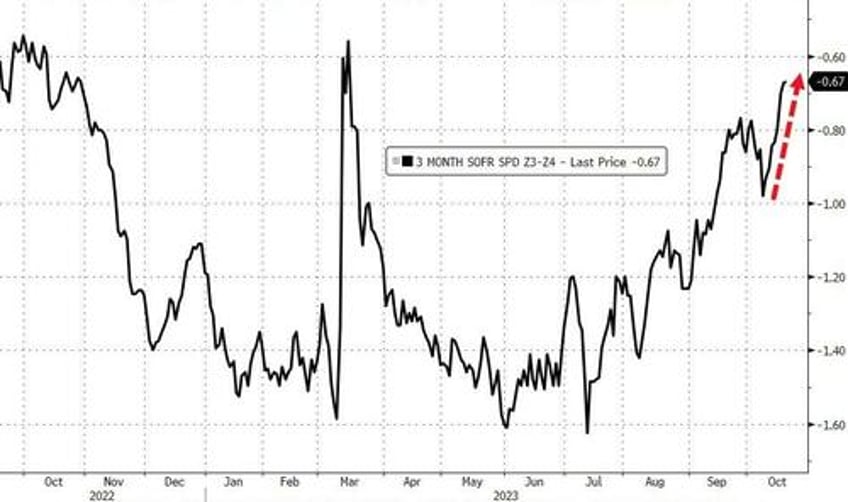

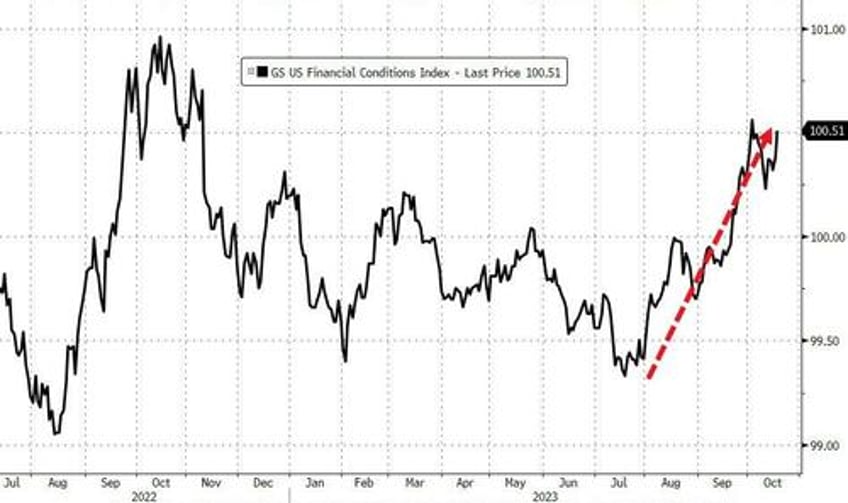

Will Powell mention the fact that "markets are doing their job for them" as financial conditions have tightened so dramatically in recent weeks...

Jack Hammond, Nomura's Head of US Rates Sales, believes that “Powell will confirm (that) term-premium is the new rate hike" ...as Charlie McElligott notes that The Fed seems to be starting to get the joke that higher front-end rates may in-fact be inflationary- and growth- stimulative...

“Money funds alone now throw off more than $22 billion a month in interest income, up from a few hundred million in early 2022….

Government data show personal interest income climbed to an annualized $1.8 trillion in September, up $300 billion from a year ago. This alone could be adding more than 1% to GDP if consumers spend the interest income.”

So take your pick...dovish or hawkish? ...and guess which way the market will perceive his words.

Watch Live here (due to start at 1200ET):

Full (and brief) prepared remarks below:

Before our discussion, I will take a few minutes to discuss recent economic data and the outlook for monetary policy.

Recent Economic Data

Incoming data over recent months show ongoing progress toward both of our dual mandate goals—maximum employment and stable prices.

Inflation

By the time the Federal Open Market Committee (FOMC) raised rates in March 2022, it was clear that restoring price stability would require both the unwinding of pandemic-related distortions to supply and demand, and also restrictive monetary policy to cool strong demand and give supply time to catch up. These forces are now working together to bring inflation down.

After peaking at 7.1 percent in June 2022, 12-month headline PCE (personal consumption expenditure) inflation is estimated at 3.5 percent through September.1 Core PCE inflation, which omits the volatile food and energy components, provides a better indicator of where inflation is heading. Twelve-month core PCE inflation peaked at 5.6 percent in February 2022 and is estimated at 3.7 percent through September.

Inflation readings turned lower over the summer, a very favorable development. The September inflation data continued the downward trend but were somewhat less encouraging. Shorter-term measures of core inflation over the most recent three and six months are now running below 3 percent. But these shorter-term measures are often volatile. In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal. We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters. While the path is likely to be bumpy and take some time, my colleagues and I are united in our commitment to bringing inflation down sustainably to 2 percent.

The labor market

In the labor market, strong job creation has met a welcome increase in the supply of workers, due to both higher participation and a rebound of immigration to pre-pandemic levels.2 Many indicators suggest that, while conditions remain tight, the labor market is gradually cooling. Job openings have moved well down from their highs and are now only modestly above pre-pandemic levels. Quits are back to pre-pandemic levels, and the same is true of the wage premium earned by those who change jobs.3 Surveys of workers and employers show a return to pre-pandemic levels of tightness.4 And indicators of wage growth show a gradual decline toward levels that would be consistent with 2 percent inflation over time.5

Growth

To date, declining inflation has not come at the cost of meaningfully higher unemployment—a highly welcome development, but a historically unusual one. Healing of supply chains in conjunction with the rebalancing of demand and supply in the labor market has allowed disinflation without substantially weaker economic activity. Indeed, economic growth has consistently surprised to the upside this year, as most recently seen in the strong retail sales data released earlier this week. Forecasters generally expect gross domestic product to come in very strong for the third quarter before cooling off in the fourth quarter and next year. Still, the record suggests that a sustainable return to our 2 percent inflation goal is likely to require a period of below-trend growth and some further softening in labor market conditions.6

Geopolitical tensions are highly elevated and pose important risks to global economic activity. Our institutional role at the Federal Reserve is to monitor these developments for their economic implications, which remain highly uncertain. Speaking for myself, I found the attack on Israel horrifying, as is the prospect for more loss of innocent lives.

Monetary Policy

Turning to monetary policy, the FOMC has tightened policy substantially over the past 18 months, increasing the federal funds rate by 525 basis points at a historically fast pace and decreasing our securities holdings by roughly $1 trillion. The stance of policy is restrictive, meaning that tight policy is putting downward pressure on economic activity and inflation. Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.

My colleagues and I are committed to achieving a stance of policy that is sufficiently restrictive to bring inflation sustainably down to 2 percent over time, and to keeping policy restrictive until we are confident that inflation is on a path to that objective. We are attentive to recent data showing the resilience of economic growth and demand for labor. Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.

Along with many other factors, actual and expected changes in the stance of monetary policy affect broader financial conditions, which in turn affect economic activity, employment and inflation. Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.

Conclusion

My colleagues and I remain resolute in our commitment to returning inflation to 2 percent over time. A range of uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little. Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy.

Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully. We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.

Thank you. I look forward to our conversation.