Having met the expectations of leaving rates unchanged, and confirming their 'patience', the big question is - can Jay Powell avoid all the traps being set for him in the press conference?

Growth expectations are tumbling - so cut, right?

But Trump wants lower rates... so they can't do what he wants.

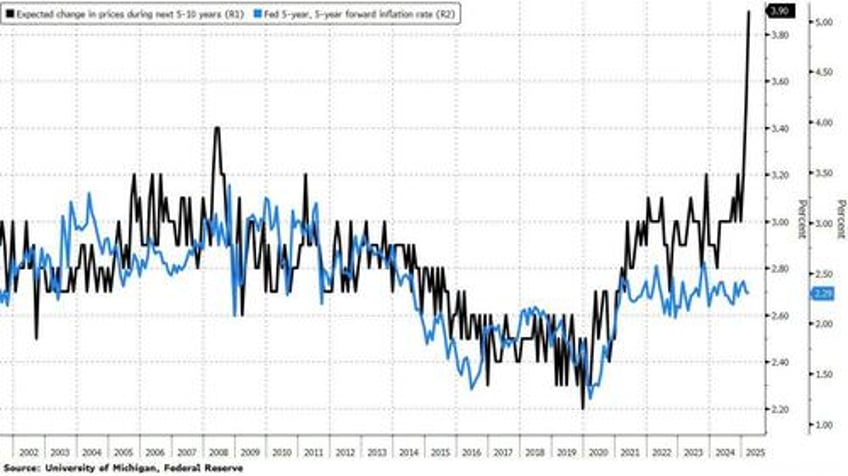

Inflation data has been wildly noisy (and expectations are soaring) - so hike rates, right?

But Dems would love The Fed to hike rates now and kill Trump's economy before we get to the 'good stuff'... so they can't do that.

...(and will Powell shrug off the insane partisanship seen in the UMich inflation data that he once praised so highly)

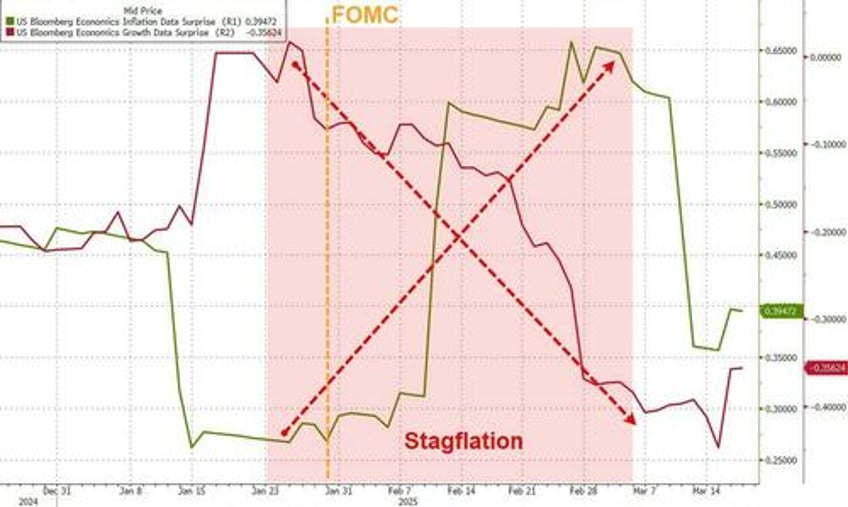

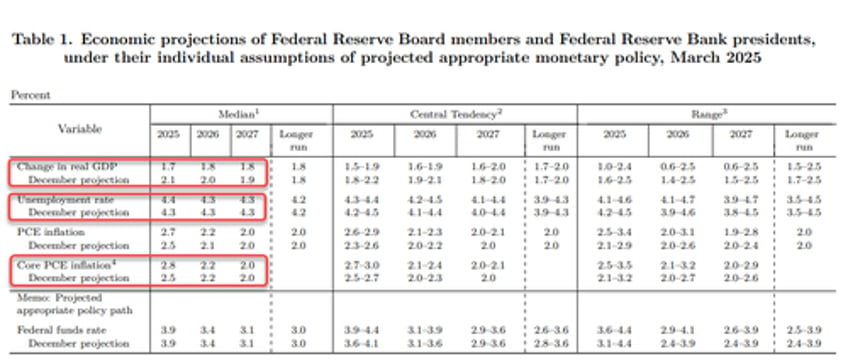

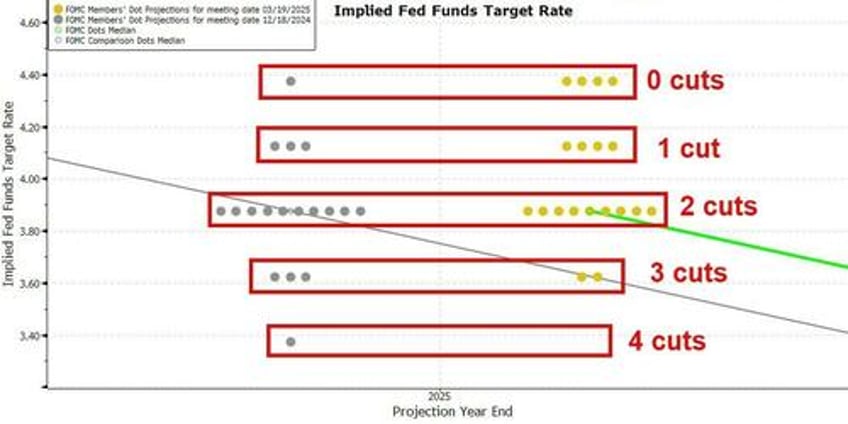

It appears that Fed Chair Powell has found the "stag" and the "flation" after all, given the adjustments to The Fed's forecast:

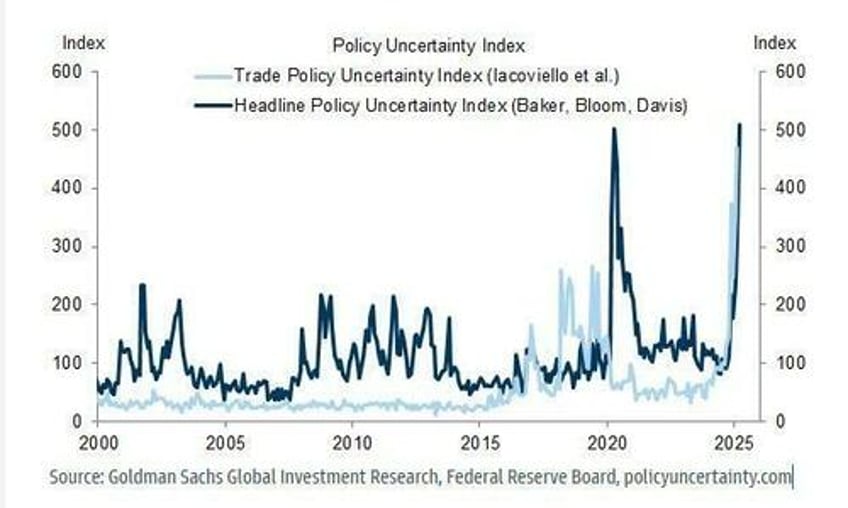

Fiscal policy uncertainty is extremely high - so cut rates to offset that tension, right?

But that would mean an implicit 'defense' of these policy moves... and Lizzy Warren will have a cow.

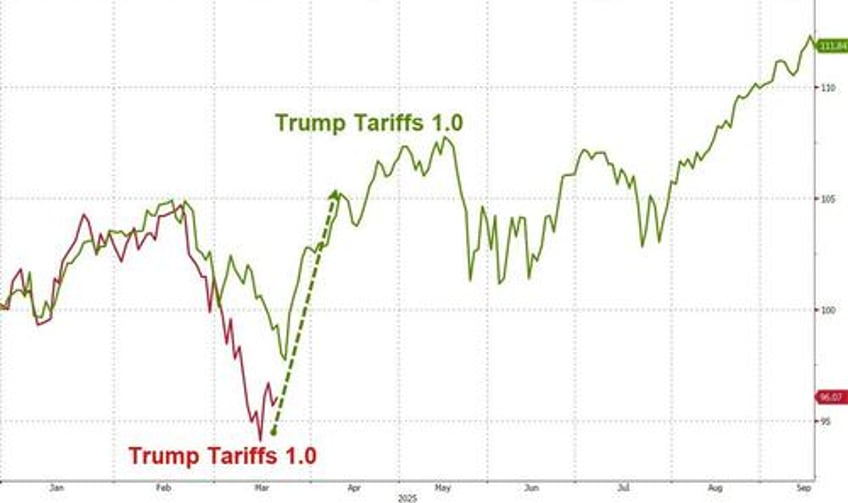

Of course, The Fed has already front-run Trump's policy prescription by shifting its dots (lower) and PCE forecast (higher) on tariff fears. The timing is right though for a Powell Put save by talking up the tapering of QT...

All the shifts in the dots are hawkish... will Powell acknowledge that?

UBS sees a glimpse of a Powell Put:

Dare anyone say “Fed put”.

Perhaps not quite, but the Fed’s message is consistent with its work from September 2018 – that reacting to the inflationary consequences of tariffs only makes the growth hit worse than it needs be.

Not quite the "Fed put" the markets have been hoping for, but in the scheme of things, the outcome of the Fed is a little more dovish than the market had expected.

The Fed shrugging off the inflationary signals from its models and instead preferring to line the dot plot up with the growth deterioration.

Watch The Fed Chair hold his press conference here live (due to start at 1430ET):