As the Federal Reserve proceeds with quantitative tightening, markets are increasingly sensitive to funding and liquidity conditions. That makes it paramount to identify - ahead of time - when funding stress is about to manifest.

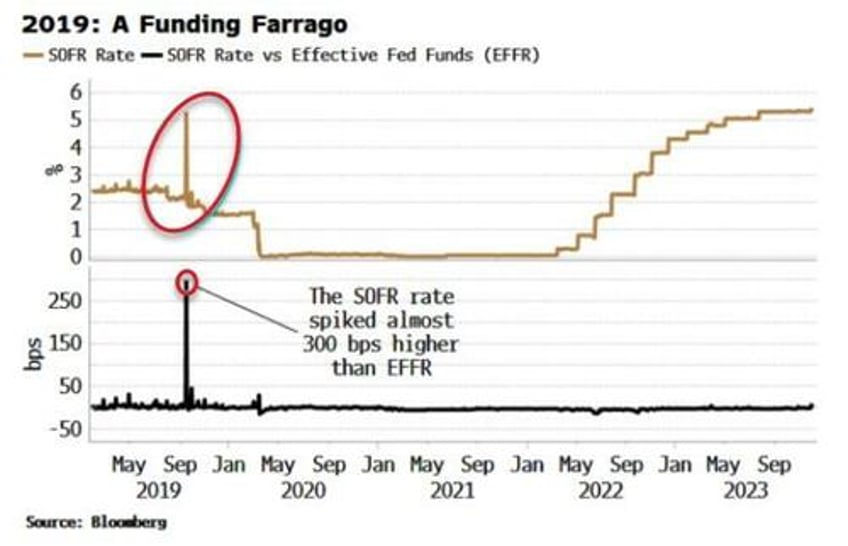

September 2019 is not a month the Fed wants to revisit. Funding conditions rapidly deteriorated, leading to spikes higher in repo and other short-term interest-rates that are at the base of financial markets. Without smoothly functioning funding markets all assets are vulnerable, as the cost of financing positions becomes punitive, or evaporates altogether.

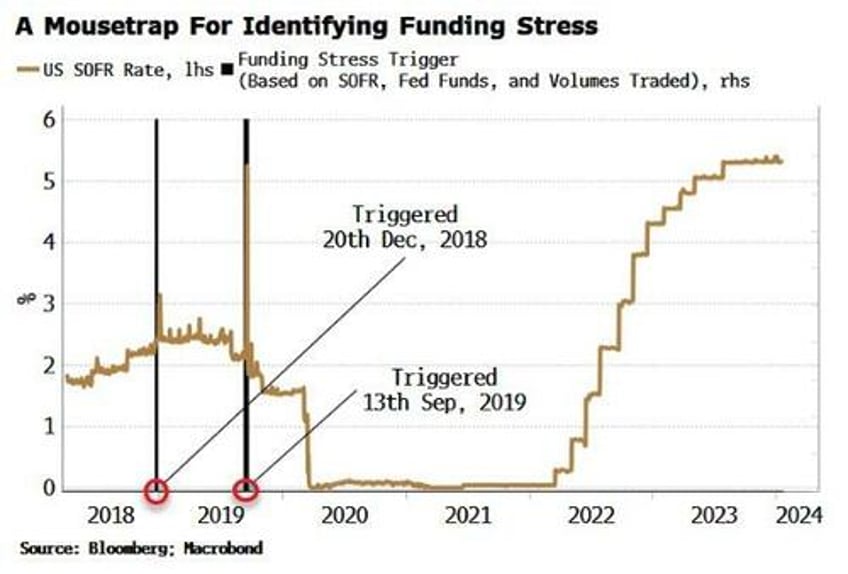

Can we identify when funding stress is imminent? It’s not easy, as it typically happens abruptly. But we can build a Funding Stress Trigger that in the past has given at least a crucial day or two notice that funding rates may be about to shift notably higher. If and when the trigger activates in the current cycle would be sign QT has run its course (if the Fed hadn’t already ended it by then).

First, a brief reminder on 2019.

Then, as now, the Fed had been reducing the size of its balance sheet, while at the same time Treasury issuance was rising. Even though the Fed had stopped its balance-sheet run-off in August 2019, reserves continued to fall as other liabilities on its balance sheet, such as the Treasury account (TGA), rose.

The straws that broke the camel’s back were a corporate tax-payment day and a large settlement of long-term USTs. The tax payment drained reserves as the Treasury deposited the proceeds at the TGA, while the settlement of USTs meant dealers’ demand for repo funding jumped.

Cue a sudden and non-linear deterioration in funding markets that led to the Fed having to step in and offer term and overnight repo loans.

Funding rates quickly fell back down, but the risk to financial markets from a repeat of this episode is real and therefore very much worth trying to prepare for.

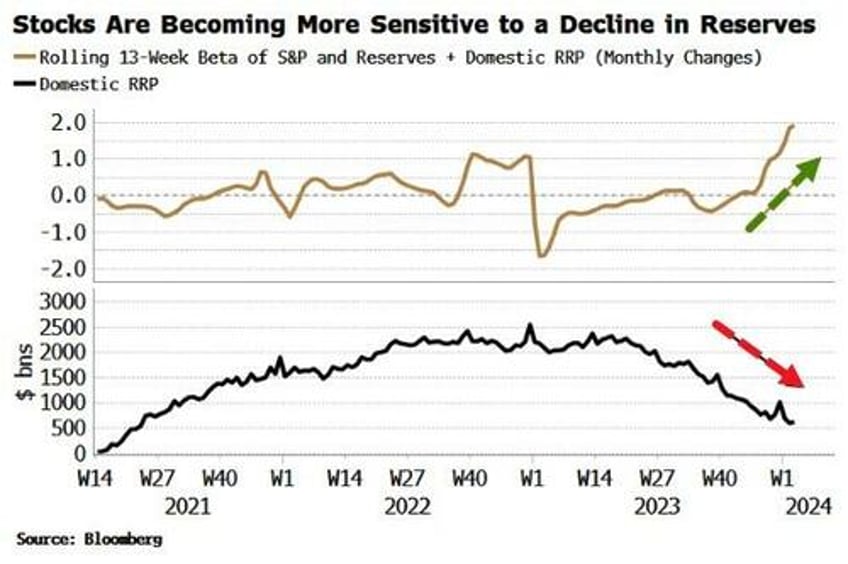

That’s even more the case as asset-prices’ sensitivity to the Fed’s balance sheet today is higher than it was in 2019. The Treasury’s decision to fund most of its borrowing using bills in this cycle - therefore making use of the trillions of reserves that have been idling in the Fed’s reverse repo facility (RRP) - has meant stocks and bonds have continued to rise despite the government running a vast fiscal deficit.

The chart below shows stocks’ sensitivity, i.e. their beta, to reserves plus the domestic RRP (the brown line). That sensitivity is rising as the RRP falls (white line in chart), indicating that stocks are becoming more vulnerable to falling reserves. Similarly for Treasuries.

That’s why holders of stocks and bonds should care about how fast the RRP is falling and the total amount of reserves in the system.

The big unknown is how many reserves are needed for the smooth functioning of funding markets. Fed member Christopher Waller has suggested that the so-called lowest comfortable level of reserves (LCLOR) is about 10-11% of GDP, i.e. ~$3 trillion, compared with the current level of $3.6 trillion. The Fed’s Senior Financial Officer Survey also asks banks what they think their LCLOR is and how much of a buffer they would prefer to hold above it.

The problem with using this information as the basis for a funding-stress signal is that it is lagging.

Reserves are released on a weekly basis, while the survey is only biannual.

Instead we need to use daily data. In building the Finance Stress Trigger we use a few key insights:

Funding stress tends to show up first at the tails of the daily repo rates traded between counterparties

Funding volumes of domestic banks in fed funds (i.e. reserves) typically rise as total reserves fall, while foreign banks’ volumes tend to decline when funding issues develop

Foreign banks are much bigger borrowers of fed funds than their domestic counterparts

Overall funding volumes (domestic + foreign banks) thus tend to initially fall, before quickly rising again, at the time of funding problems

Stress in funding markets is typically preceded by a rise in the volatility of the spread between different funding rates

The trigger is shown in the chart below. It uses only four criteria based on the above points, bearing in mind Einstein’s maxim that models should be “as simple as possible, but no simpler.”

It has only activated twice: in 2018 and 2019. In 2018 it triggered on the 20th December. This was several days before the sharp rise in funding rates at the end of that year. The normal, year-end turn when demand for cash rises was exacerbated by Basel III regulation for GSIBs (Global Systemically Important Banks), who stockpiled reserves to ensure their loss-absorbency requirements did not rise.

The trigger also activated in the 2019 funding episode, perhaps appropriately on Friday the 13th of September, ahead of the acute stress seen the following week that led to the Fed’s emergency repo provisioning.

No signal is perfect and all are necessarily subject to retrofitting bias: there’s no guarantee the next funding flare-up will manifest itself in exactly the same way as prior episodes. The possibility of a false negative means maintaining vigilance to funding-market conditions is essential even in the absence of the signal being active.

Furthermore, the Fed introduced a standing repo facility in 2021 allowing banks to access funding at a punitive rate, while it has also been trying to de-stigmatize the use of the discount window.

Nonetheless, there is no guarantee either of these would see notable use before the funding-stress cat is out of the bag. The trigger, on the other hand, uses daily price and volume data that ideally captures general signs of funding distress before it significantly worsens.

In the current environment of deeply intertwined fiscal and monetary policy, assets are increasingly sensitive to funding markets, while the latter are more prone to abrupt meltdowns.

Butterflies flapping their wings in the monetary plumbing should therefore be taken seriously by traders and investors across all asset classes.