A continued bear steepening in the yield curve may deter the Treasury from significantly increasing auction sizes in longer-term debt at its quarterly refunding announcement next Wednesday.

If proof were needed that the lines between fiscal and monetary policy are becoming ever more blurred, and that total central-bank independence is – de facto – a thing of the past, then the market’s heightened attention to Treasury refunding announcements is it.

Both of the last two were market-moving events. The next one may be too, but that will depend on by how much auction sizes of different maturities are expected to rise, and the behavior of yields and the curve in the run-up to the announcement.

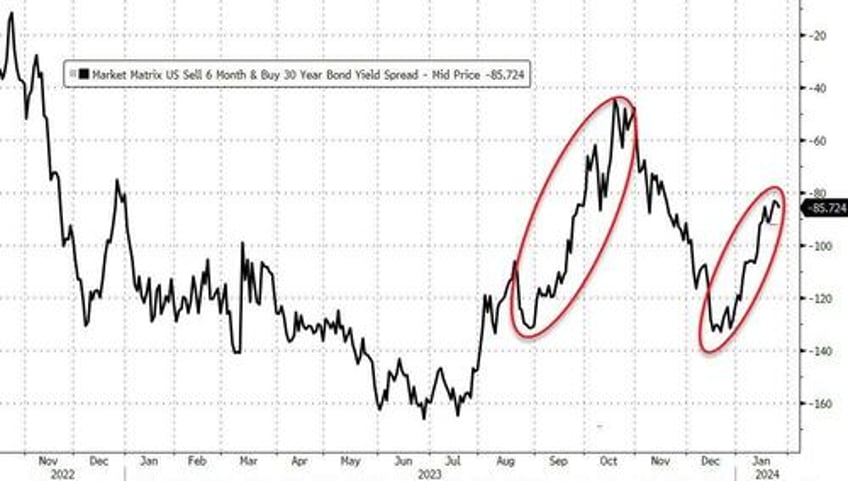

In the August report, longer-duration auction sizes were increased, driving the bond sell-off seen through September and October. It was around that time the Fed, notably Chair Powell, highlighted rising term premium as a concern.

In the run-up to the November announcement, the market was anticipating another large increase in the issuance of longer-maturity bonds, keeping yields on a rising track.

The curve was bear steepening, as often happens when term premium rises during a hiking a cycle (it was not yet clear the Fed was done raising rates).

The Treasury, perhaps mindful of this suboptimal environment, did increase longer-dated auction sizes, but not by as much as expected.

Yields fell through the rest of the year.

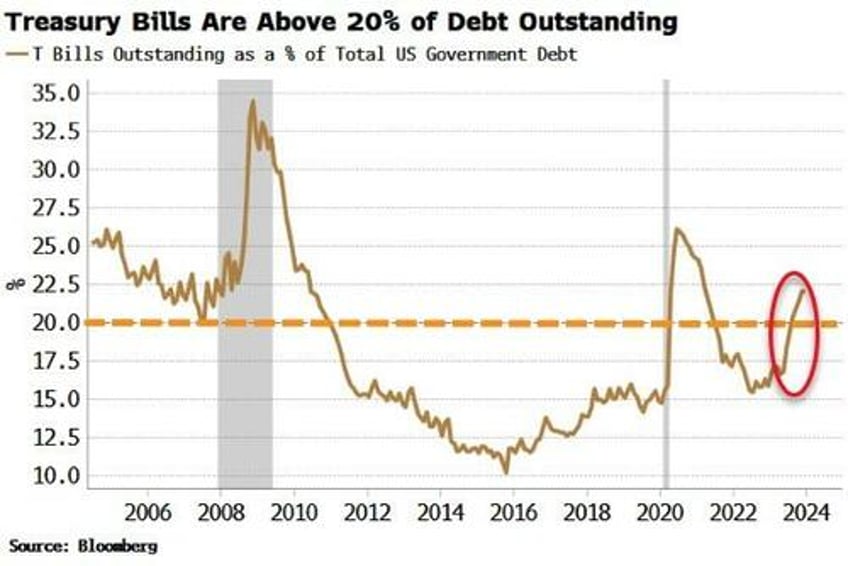

The Treasury has motivation to increase longer-term auction sizes as bill issuance is already above the 20% ratio to total debt outstanding it has generally preferred to keep it below.

Nonetheless, even though yields are still lower than they were last October, they have been rising again while the curve is bear steepening.

Term premium is rising again too. If this trend persists, then it may deter the Treasury from swinging too much back towards issuing longer-duration debt for now.

If, on the other hand, yields and term premium were to fall between now and the announcement next Wednesday (on softer-than-expected data for example), it might give the Treasury more confidence to increase auctions sizes, and thus risk bonds selling off.