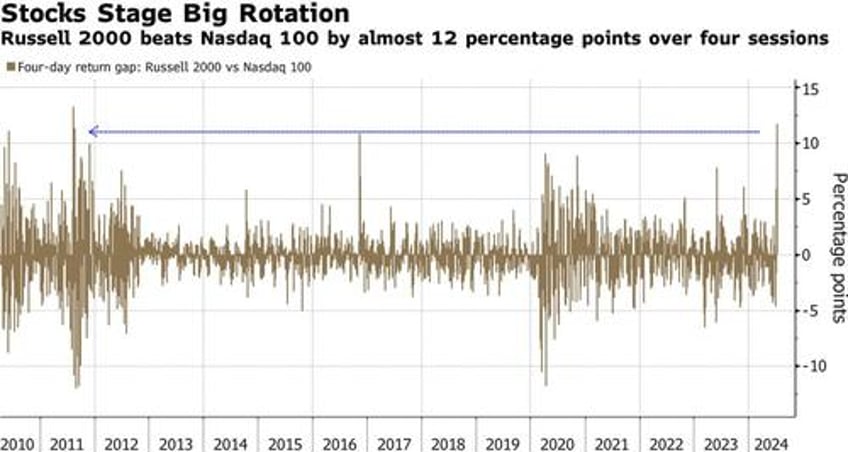

Three weeks ago, when stocks were stuck in a relentless meltup mode, we asked if the "Party Is Almost Over" as "Hedge Funds are Dumping Record Amounts Of Tech Stocks To Retail Investors." That was just the beginning, and after several weeks of active liquidations - which we duly documented - earlier this week we reported that the panic liquidations of tech stocks had reached unprecedented proportions as "Hedge Funds Flee AI Bubble, Now "Most Underweight Tech Stocks On Record." But while hedge fund exposure to tech had dropped sharply in the past two months, they were still highly exposed to all other sectors, and the violent selling in the Mag 7 sparked a burst in volatility which in turn prompted broader selling across the board, and - as Goldman's Prime desk reports overnight - amid the recent market rotation and one of the sharpest R2K vs SPX outperformance in history...

... hedge funds have been actively unwinding risk (de-grossing) across US equities. Here are the details from Goldman PB: