By the close of trading on Thursday, the Nasdaq 100 trimmed its losses by about half from the initial declines we saw.

That recovery represents a false message of “All is well” — one that is unlikely to last in the months to come.

Stock gains can be typically decomposed into:

an enhancement of income yield;

growth in earnings;

and/or a fundamental repricing that warrants a shift in the P/E ratio that investors are willing to assign.

It’s clear that this year’s Straight-to-the-Moon rally in technology stocks has zero to do with the first; a little more to do with earnings growth, though it’s hard for corporate earnings to outgrow economic growth over the longer term.

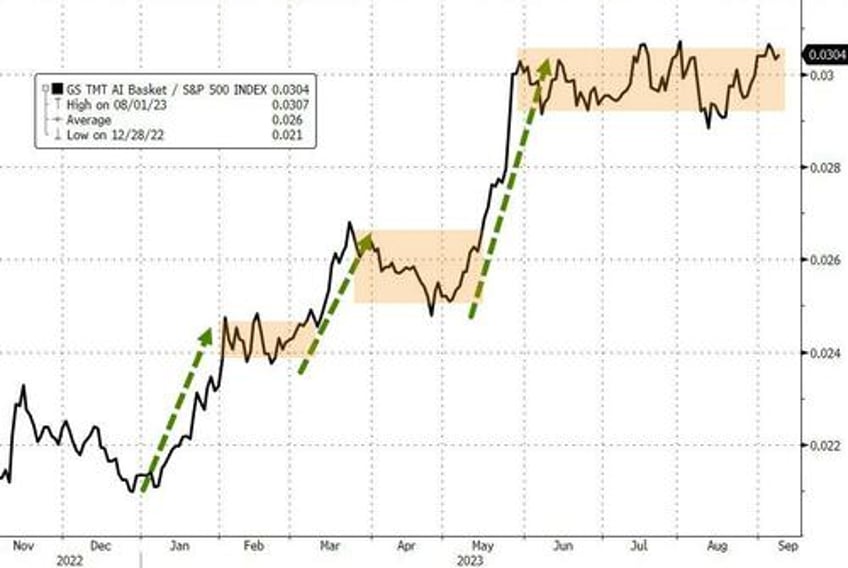

Definitely much of the optimism that has left those on the sidelines gaping is how much traders are willing to bid up anything that may be remotely associated with the theme of artificial intelligence.

A rally that is associated with a fundamental re-rating of stocks is legitimate when there is an upward shift in productivity growth.

And that will pull up stocks across the board.

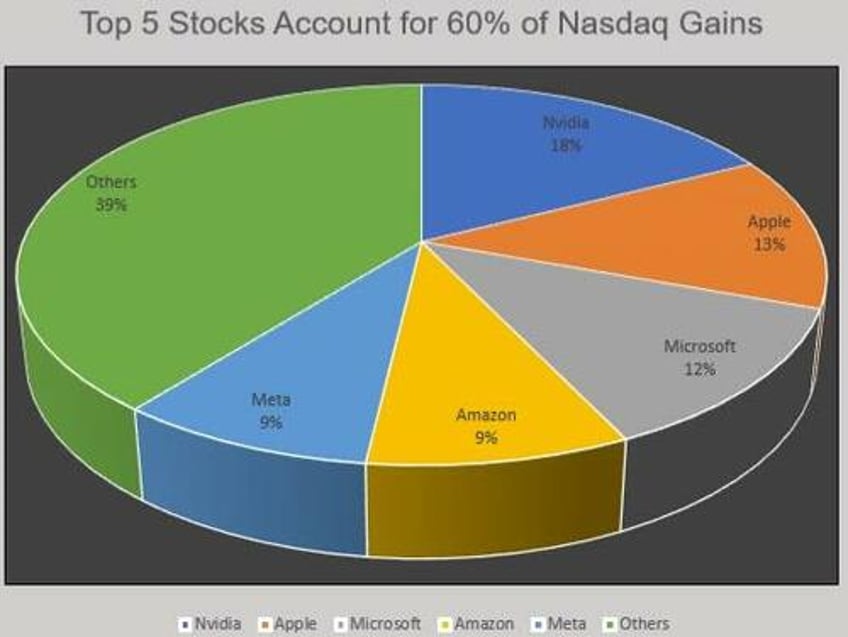

But what we have seen so far is that a handful of stocks have accounted for 60% of this year’s rally in the Nasdaq 100 basket.

If you think of the S&P 500 as a proxy for the broader economy, there is hardly any brouhaha there -while they are more or less fully valued, there isn’t any suggestion of a paradigm shift in productivity growth.

And don’t even bring up valuations, for Wall Street struggles to spell that.

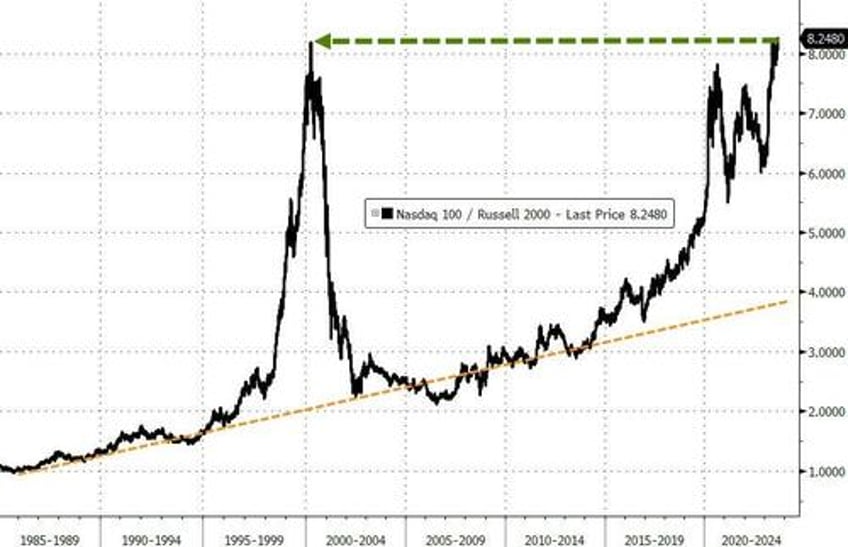

It’s probably the street’s worst-kept secret that technology stocks are overvalued. By how much is really the question.

Looking at stocks alongside the longest-dated bond available in the US tells us that the overvaluation is some 17%.

In a market so besotted with the AI narrative, it’s hard to say how far the overvaluation will correct, but what is fair to conclude is that you can’t build on a castle of cards forever and ever more.

The wobbliness we have seen so far this week is that Minsky moment of reckoning for traders -- a moment of epiphany when investors realize that they have been chasing overpriced assets and rush to the exits, and all of them at the same time.