By Benjamin Picton and Michael Every of Rabobank

The USA’s 10% additional tariffs on imports from China – described by Donald Trump as an “opening salvo” - took effect yesterday. China retaliated swiftly by announcing 15% tariffs on US coal and LNG, and 10% tariffs on crude oil, agricultural machinery and large engine cars. Those retaliatory tariffs only effect a small proportion of US exports, but they are surgically designed to cause maximum discomfort for iconic US companies like Chevrolet and Ford.

To prove that they know where the sensitivities lay, China has also launched anti-trust investigations into Google and NVIDIA, and is considering fresh scrutiny of Intel. Additionally, new export controls on critical minerals that are needed for the manufacture of high-tech products, and for which China dominates global production, have been announced.

Despite the tit-for-tat between the world’s two largest economies, which seems likely to escalate further, markets were still luxuriating in their relief that a North American trade war has been averted for at least the next 30 days. Consequently, 10-year Treasury yields fell 4.5bps to 4.51%, the Bloomberg Dollar Spot Index fell almost 1% to be back below 108, and US stocks rallied with gains led by the NASDAQ – up 1.35%.

A soggy JOLTS report that showed job openings falling by more than 500,000 from November to December also contributed to the softer Dollar and lower bond yields, but market pricing for the path of Fed policy rates is little changed. Layoffs fell from November’s upwardly-revised figure of 1.8mn to 1.77m, but this was still well above the 1.74m median estimate on the Bloomberg survey.

European equities shrugged off early wobbles following China’s tariff announcements to get in on the rally. The EuroStoxx 50 gained 0.89%, the CAC40 was up 0.66% and the German DAX rose 0.36%. Britain’s FTSE100 was conspicuous as one of the few losers on the day.

Crude oil prices continued a recent run of divergence as the WTI front future fell 0.66% to $72.70/bbl (thanks to the China tariffs), but the more international Brent crude front future rose 0.32% to $75.96, in part due to President Trump signing an executive order directing “maximum pressure” on Iran to prevent Iranian acquisition of a nuclear weapon and to drive Iranian oil exports down to zero! Sensationally, Trump also let slip that he has left instructions for Iran to be “obliterated” if he happens to be assassinated by an Iranian agent. All of this is apparently only worth a small uptick in Brent prices.

The differing price action in WTI and Brent is interesting as an illustration of the effects of tariff barriers on globalised markets. Are we going to see more and more basis effects introduced into financial instruments? Probably. This will create new headaches for financial risk managers to go alongside the headaches faced by supply chain managers.

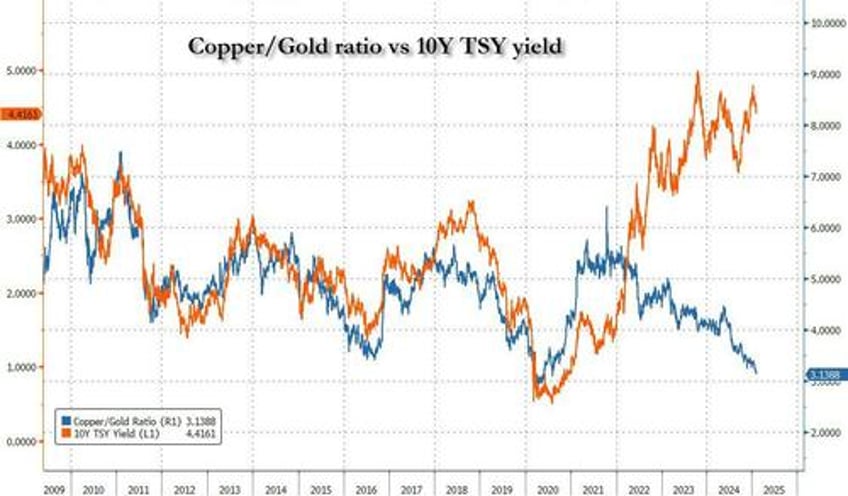

Also notable for its price action on the day was gold. It hit a fresh all-time high of $2,842/oz, continuing a stellar run since mid-December and a longer-term bull market that stretches back to mid-2022 (rate hikes at the time notwithstanding). This is interesting for loads of reasons, whether it be the buying of foreign central banks who want to get out of reach of US sanctions by holding a no-counterparty asset, or investors buying up the yellow metal as an inflation hedge. There is also an interesting divergence occurring between the copper/gold ratio and US 10-year treasury yields. Does this divergence close at some point for the historical correlation to resume? If so, does that happen via lower gold prices (central banks may have to become sellers), lower yields (in a world of rising tariffs?), higher copper prices (perhaps courtesy of massive energy investment?) or some combination of all of the above?

Equity markets may be choosing to accentuate the positives, but clearly we are watching a rapid re-ordering of how the world works. Somewhat lost in the hubbub around Trump tariffs being delayed and China imposing its own fresh duties was news of Elon Musk’s progress in closing down USAID and firing thousands of federal workers, comments from Trump’s crypto Czar David Sacks that the administration is still examining the feasibility of establishing a strategic Bitcoin reserve, and news that the United States would be removing the $800 de minimis exemption from tariffs for low value packages being shipped from China to the USA. That final point is a big deal for Chinese e-tailers Shein and Temu, and a strategic free kick for US competitor Amazon.

On top of that, Bloomberg is reporting that Panama may be poised to cancel contracts with Hutchison Ports, the Hong Kong domiciled operator of two of the five ports adjacent to the Panama Canal. This follows bellicose rhetoric from President Trump regarding China’s influence over the canal, and comments from Secretary of State Marco Rubio who described China’s interest in a piece of infrastructure that is vital to US strategic interests as “unacceptable”.

As if all of that wasn’t geopolitical turbulence enough, Gaza is back in the headlines and maybe takes the cake for the most consequential news of the past 24 hours.

In a joint press conference with Israeli Prime Minister Netanyahu, President Trump said that the USA will be taking some form of ownership over Gaza; redeveloping it into a "Rivieria" to bring jobs and peace. This will involve relocating the Gazan population to Jordan and Egypt - both of whom are not thrilled by this idea - before they can eventually return.

This comes at a time when the Houthis had been making some conciliatory noises about allowing resumption of Western shipping (ex-Israel) through the Red Sea, but now surely raises the prospect of further ongoing disruptions to the Suez Canal.

Within four weeks the U.S. will announce its new stance over the Israel-Palestine issue, with the implication that a two-state solution may no longer be on the table. This is all floated as opening the door to Israel-Saudi normalisation - which the Israeli press has suggested actually depends on the U.S. and/or Israel striking Iran to remove its nuclear threat (!).

At the same time, Turkey is close to striking a deal for defense bases in its former Ottoman territory, the now Islamist-led Syria.

In short, welcome to the era of conspicuous volatility and conspicuous statecraft.