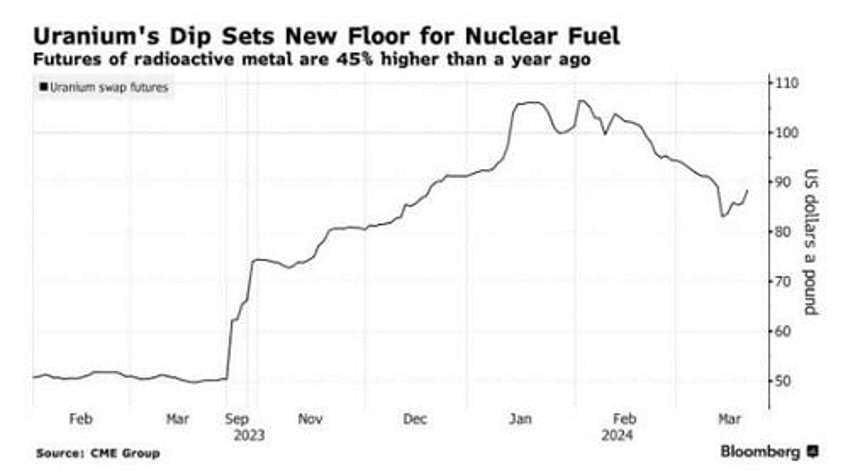

Uranium prices may have dipped slightly over the last 4 months, but its looking like the new "top" we've set over the last year is going to likely act as "support" as we forge forward into what Bloomberg is calling a "nuclear future".

In New York, the price of uranium futures has dipped to $88.50 per pound, a decrease from the peak seen in February, which was a 16-year high, yet remains significantly above the average price of $66.60 recorded last year.

Jonathan Hinze, president of UxC, a nuclear industry research firm told the news outlet: “We have reached a bottom. The fundamentals are still strong, with increased demand and supply that hasn’t fully responded.”

According to Cantor Fitzgerald analyst Mike Kozak, there's evidence to suggest that uranium prices have stabilized. Kozak forecasts a resurgence of fundamental buyers in the market, which is expected to propel prices upwards once more, Bloomberg wrote this week.

Optimistic investors are focusing on uranium's future, driven by an increasing supply shortage and higher demand, as nations (finally pull their heads out from their a** and) seek nuclear energy solutions for climate change.

This interest is highlighted amid supply warnings from Canada's Cameco and Kazakhstan's Kazatomprom, the leading producers responsible for half of the worldwide uranium supply. Kazatomprom forecasts a significant supply deficit escalating from 21 million pounds in 2030 to 147 million pounds by 2040.

Geopolitical tensions, including a U.S. proposal to ban Russian uranium imports, which are essential for nuclear power and weapons, add complexity to the supply scenario, the report says. However, the potential resurgence of dormant mining operations due to rising uranium prices poses a risk of dampening the market rally, reminiscent of the recent boom-to-bust cycle in battery metals.

“We have a number of geopolitical factors that have a really significant influence on buyer behavior, even though fundamentally nothing has changed. Buyers can use the spot to tell them the sentiment of the day, but must look at the long-term market to see that it is marching steadily up, it hasn’t taken a hiccup at all,” concluded Treva Klingbiel, president of uranium price provider TradeTech.