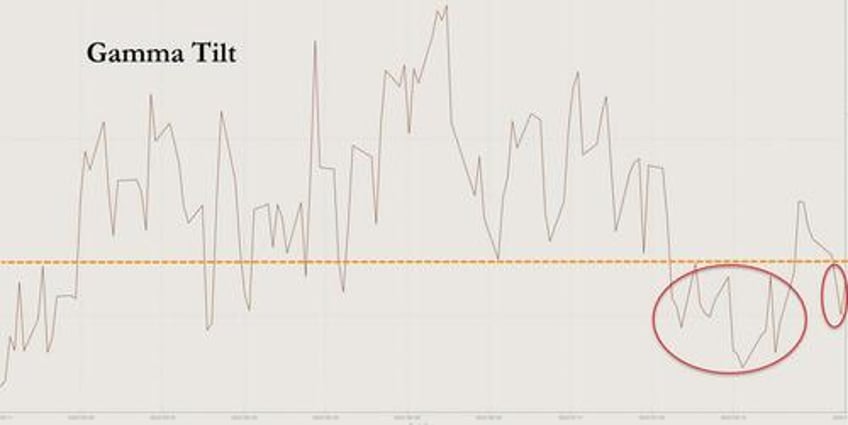

Heading into Triple Witching week (which only happens four times a year), the market has been struggling in a neutral position as it dipped into negative gamma territory for the second time this year. What we learned from the recent stretch of negative gamma in August is that context of structure and flow have become proportionately more important. This is partially because 0DTE flows have been supplementing the diminished liquidity from net negative market gamma.

When we exited the first round of negative gamma that we were in for the majority of August, we saw 0DTE flows tip the scales here by moving with the trend rather than against it (as it usually does).

If 0DTE flows begins to do this when in negative gamma, and chases a downtrend, then this could become quite dangerous for the market.

We also learned from new CBOE research this week that market makers are mostly net balanced with 0DTE positioning, at least until about the last hour when short gamma risk becomes relatively more dangerous. Strong equilibrium and balance on market maker books has a stabilizing effect for the market, but if we see anything in the flows or structure which threatens to upset these balances, then we could be looking at the ignition for a major move.

One of our most important directional signals, available for Alpha subscribers, is to see [from HIRO] when the call and put flows are heading in the same direction. When this happens, as it did here this Friday (calls in orange and puts in blue), the price tends to have great difficulty accomplishing anything but minor deviations against such coordinated flows from both calls and puts.

Since 0DTE has most generally been fighting trends before they can break out, this complicates the classic and proven dynamic of statistically-significant realized volatility expansion when in negative gamma conditions. But in order to evolve a methodology against a changing landscape, we can gain accuracy by searching for an array of considerations.

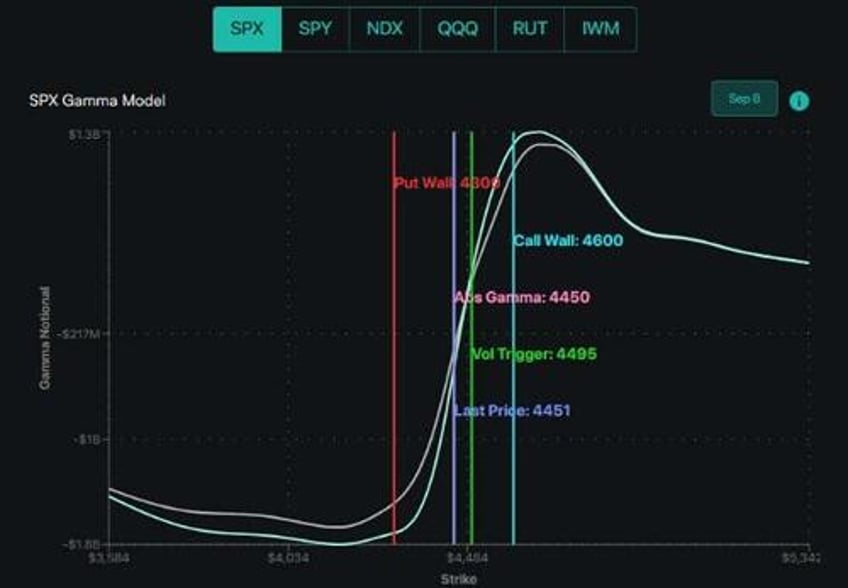

From a snapshot of our interactive gamma chart, which can be found embedded in our twice-daily newsletters, today’s gamma line is in turquoise and the day’s before is in gray. From this, we can see that Friday’s gamma curve was steeper than Thursday’s. This communicates important information, namely that overall pinning and magnetic effects in the market are gaining strength despite us still being in negative market gamma.

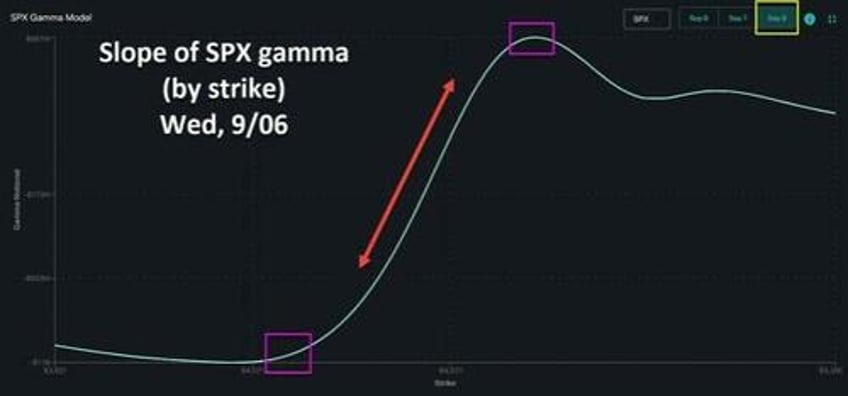

Our basic gamma chart, which can be located on our Indices page, allows a focused view of gamma where we can compare the slope of it based on the model from the past two market days. Technically, by visualizing the path of gamma with respect to changes in the underlying (x-axis), this is a representation of speed, which is a third-order Greek (changes in gamma with respect to changes in the underlying).

And then, by toggling the view back to Wednesday’s gamma model, we can see that it was even flatter than Thursday’s. The flatter market gamma is modeled, the weaker we expect pins to be, and the easier it is for trends to break out and become stronger trends.

Therefore, seeing a flattening of this model during negative market gamma would be an example of stacked structural considerations which help to make it easier for realized volatility to expand, which in turn pertains to a wider percentage range in the underlying.

Along that line, more information which this chart quantifies for us is how the ranges of the underlying are distinctly wider when the gamma curve is flatter. A flatter gamma curve has a wider range, and with more diluted pinning forces—given that it is spread out across a wider underlying range.

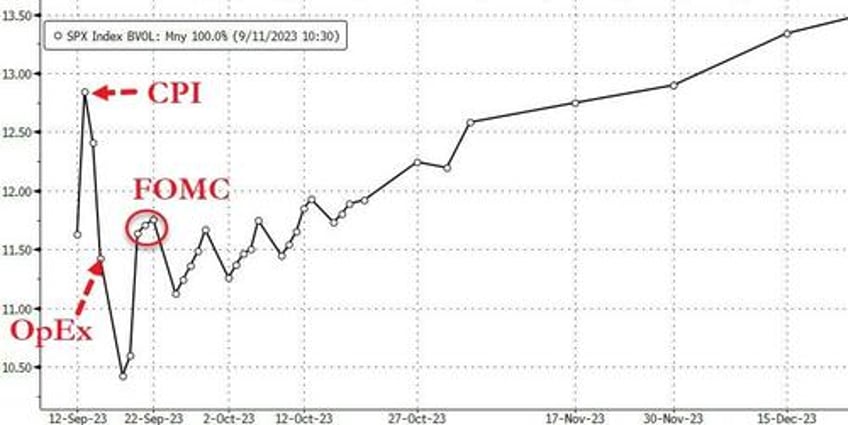

Moving forward from here, the normal course for Triple Witching would be both for realized and implied volatility to decline as we approach this major expiration on Friday.

However, unless we are able to break out of negative gamma conditions, then the market is more vulnerable than usual if we see other structural and flow signals that suggest increasing market danger.

If these 0DTE flows continue to fight trends, then this should compound the already-mean-reverting influence from Triple Witching coming up on September 15.

However, the presence of negative gamma makes this a yellow light for equities at best.

Seasonality will also be working against bulls for the next couple months.

Last week, particularly the tail end, was rather dull and we anticipate that extending into today & Tuesday.

Then, we have CPI on 9/13 feeding into OPEX on 9/15.

This should spark an increase in volatility, but a "full release" likely doesn't come until 9/20 VIX Exp/FOMC.

Following the Fed we think the S&P has the potential to push towards either 4,650 to the upside, or 4,200 to the downside by the end of Sep. These potential moves would be driven by the removal of large OPEX/VIX Exp positions, & the implied volatility shift around FOMC.

For today into tomorrow we think the S&P holds into the 445 SPY/4,450 SPX to 450/4500 range, as those strikes are emerging as the top gamma strikes over this OPEX week.

Volatility, we believe, will continue to be rather tight until Wednesday, too.

* * *

Sign up for a free trial today if you want to gain more situational awareness with your trading and to stay on top of the new dynamics surrounding this breakout positive market gamma regime—and the most likely impacts that this will continue to have on volatility and price action. We would also love to see you join us in our members-only Discord.