By Eric Peters, CIO of One River Asset Management

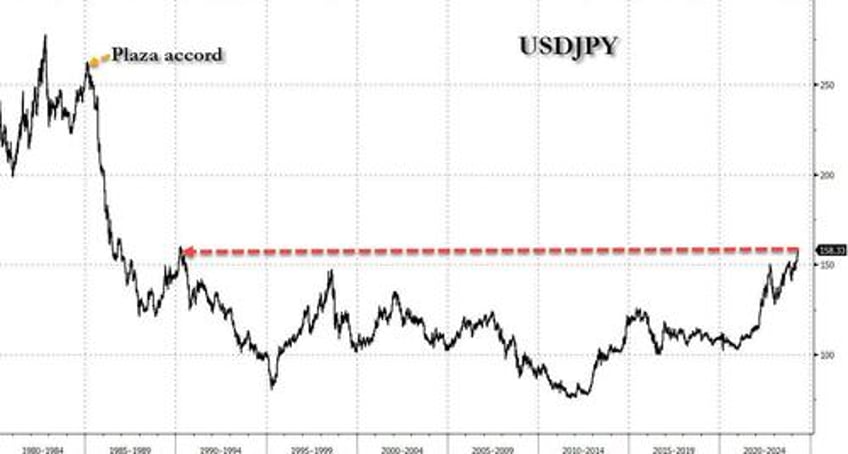

"What is the sound of one hand clapping," asked Kazuo Ueda, sitting alone in seiza. The dollar had just crossed above 158 to the yen, a level not seen in 34-years, back when he joined the University of Tokyo as professor of economics.

“What is the sound of one hand clapping,” asked Ueda, letting the question drift gently across his mind. It is one of the great Zen koans, a question without answer, a tool to help us achieve satori, awakening.

After its utter destruction in the war, Japan had become an economic wonder. By 1989 its Nikkei 225 equity index had surged to 38,915, the yen followed, and the governor’s palace was estimated to be worth as much as California.

“What is the sound of one hand clapping,” asked Ueda, desperate to tap into the power of being fully present, but unable to calm his mind. From that wild 1989 market peak, it all came crashing down. Had policy makers and politicians allowed a short depression, the nation would have experienced something profoundly different from its lost deflationary decades.

“What would have happened,” asked Ueda, instantly angry his attention had drifted from the koan. It had been one year since he became Bank of Japan Governor. He had restored simplicity to policy, returning interest rates to positive from negative, letting go of yield curve control. He accomplished this without compromising government finances, which are so vulnerable after decades of the stunningly large deficit spending required to maintain economic and social stability, that even a modest interest rate rise would prove catastrophic.

“What is the sound of one hand clapping,” whispered Ueda.

In his year at the helm, the Nikkei 225 had surged to finally reclaim the 1989 highs, driven in part by the collapsing yen, which showed no signs of stabilizing in the absence of material interest rate hikes. And this, of course, risks devastating Japan’s government finances.

“What is the sound of one hand clapping.”