After yesterday's historic fisco, when the SEC announced on twitter it had approved a bitcoin spot ETF for the first time ever, only for groveling democrat lackey Gary Gensler to lisp that "Ackchyually" the SEC account had been hacked", today the most incompetent and corrupt collection of porn fanatics are expected to approve several spot bitcoin ETF, for real this time.

And while we don't have to say it, Standard Chartered's Geoff Kendrick does so anyway when he writes overnight that ETF approval has been a key driver of BTC price upside (indeed, we got a glimpse of the "sell the news", or rather "sell the hack" event yesterday) and yet according to Kendrick, this is "a watershed moment for normalizing Bitcoin participation by institutional money, and we expect approval to drive significant inflows and price upside for BTC."

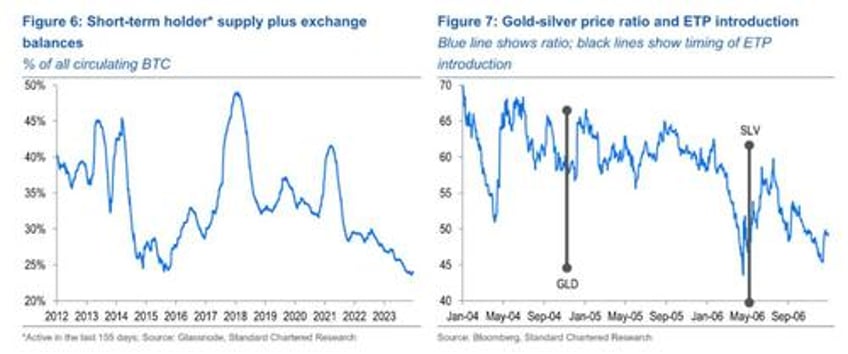

How much upside? Well, to gauge how big a driver this might become, Standard Chartered used the introduction of the first US-based gold ETP (in November 2004) as a point of comparison. The price of gold then rose 4.3x in the seven to eight years it took for gold ETP holdings to mature after the first ETP was introduced.

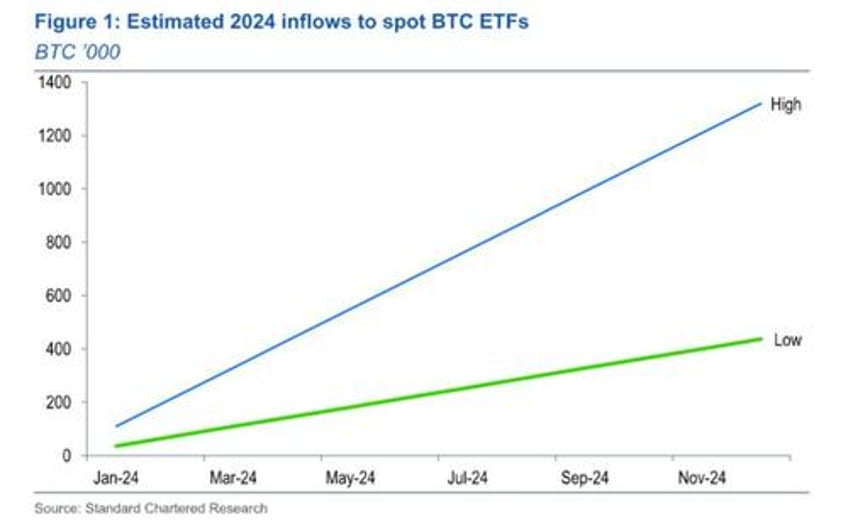

Kendrick expects Bitcoin to enjoy price gains of a similar magnitude as a result of US spot ETF approval, but he sees these gains materializing over a much shorter (one- to two-year) period, given his view that the BTC ETF market will develop much more quickly (and with Blackrock sponsoring it, that's a safe assumption). This is consistent with his end-2024 view of Bitcoin at the $100,000 level. Looking further out, and if ETF-related inflows materialize as he expects, Kendrick thinks an end-2025 level closer to $200,000 is possible. This assumes that between 437,000 and 1.32 million new bitcoins will be held in spot US ETFs by end-2024. In USD terms, this should be roughly USD 50-100Bn.

Some more details on potential inflows...

Estimating the scale of inflows to Bitcoin ETFs is difficult. Some reclassification is likely following SEC approval (as BTC holdings move from Grayscale Trust to Grayscale ETF and as futures-based ETFs may become spot ETFs), but changes to current aggregate holdings of 1.015mn are what will drive expected price upside. We look at two historical examples - BTC in 2020 and gold in 2004 - to help gauge potential inflows:

- In 2020 (which included the period before and after the last BTC halving on 11 May 2020), the combined holdings of BTC ETFs and ETF proxies increased by 437,000 BTC, or a multiple of 2.3x; the BTC price increased by 4.0x during the year. Applying the same logic to 2024, we arrive at two potential inflow scenarios:

- Addition of 437,000 BTC x current BTC price of USD 44,000 = USD 19bn of inflows

- Current BTC ETF holdings of 1.015mn x 2.3 = 2.33mn, an increase in holdings of 1.32mn BTC. At a BTC price of USD 44,000, this amounts to USD 58bn of inflows.

- For gold, it took several years after the introduction of GLD for ETP holdings to peak (in December 2012). The macro environment turned more supportive of increased gold appetite from a wide spectrum of investors. Total flows were USD 88bn, using the monthly change in the number of ounces held in ETPs multiplied by prices in each month. When GLD was introduced in November 2004, the total stock of above-ground gold was worth around USD 2.2tn, compared with BTC's current market cap of USD 0.86tn. Adjusting the USD 88bn of GLD inflows for relative market caps would suggest USD 34bn of inflows to BTC ETFs.

... and on price impact:

The above calculations provide inflow estimates ranging from USD 19-58bn to achieve the increases in BTC holdings outlined above. However, these estimates are likely to be on the low side, as they assume no BTC price impact from ETF approval or from the inflows themselves (assuming the BTC price stays stable at the current USD 44,000).

However, we think BTC price upside from current levels is likely following SEC approval. One scenario is that the BTC price reaches the USD 100,000 level by end- 2024 at a constant average monthly increase of 7% from the current level of USD 44,000. In that scenario, if inflows to BTC ETFs are constant in BTC terms, it would take USD 31Bn of inflows to achieve our lower-end estimate of a 437,000 BTC increase in holdings in 2024 (as opposed to USD 19Bn of inflows calculated above under an unchanged price assumption). The same calculation for a 1.32mn increase in ETF holdings, our upper-end estimate, yields USD 95Bn of inflows (as opposed to the USD 58bn calculated above based on no price change).

Any new demand impulse may have an even larger impact on prices given declining supply at present. We estimate the amount of immediately available supply by adding exchange balances to BTC holdings that have been active in the past 155 days (Figure 6). Both measures have been decreasing as BTC is taken off-exchange and/or enters long-term buy-and-hold wallets. This measure is at an all-time low as a percentage of total supply in circulation. In other words, supply is more price- inelastic than it has ever been.

Importantly, this measure now stands at 24%, versus 34% at the last halving. So if the 2024 increase in BTC holdings is equal to the 2020 amount (437,000), the price multiple should be more than the 4x achieved in 2020, all else being equal.

If we instead assume that the BTC price rises to an even higher (non-base case) level of USD 175,000 by end-2024 (an increase of 4x from USD 44,000, the same multiple as in 2020) and repeat the above calculations, we arrive at inflows of USD 43bn to add 437,000 BTC, or inflows of USD 130bn to add 1.32mn BTC.

Based on the above, Standard Chartered expects BTC ETF inflows in a rough range of $50-100BN in 2024, where the lowest estimate of inflows ($31bn, based on scaled-down gold ETP inflows) is likely too low, whereas the highest estimate ($130bn, based on a 4x price increase in 2024 and 1.32mn of BTC ETF holdings) is likely too high.

For a slightly less excited outlook we turn to Bloomberg ETF specialist Eric Balchunas, who yesterday responded to Standard Chartered's calculation saying that in his opinion, this is "too high especially for flows as they wouldn't include $GBTC's $30bn. Our over/under in flows by end of year is more like $15b and ballpark $50b for aum (barring massive btc price change)."

He then adds several points: "$15bn in flows for a new category is massively high, even bond ETFs didn't do anything like that in their first year(s). Also if we go out 5-10yrs we think it will be in the gold ETF range at $100b aum. Trust me tho $100b in FLOWS is crazy, would be big shocker."

Couple pts here: $15b in flows for a new category is massively high, even bond ETFs didn't do anything like that in their first year(s). Also if we go out 5-10yrs we think it will be in the gold ETF range at $100b aum. Trust me tho $100b in FLOWS is crazy, would be big shocker

— Eric Balchunas (@EricBalchunas) January 9, 2024

That said, even if the low range of the estimate is accurate, and we are looking at a $100K bitcoin in two years just on ETF inflows alone, that would still be a huge success for the crypto industry. Of course, all of this ignores the fact that tens if not hundreds of billions in what are currently record money market funds, will be diverted away into some crypto ETFs the moment the Fed announces the end of QT (and hints the restart of a new QE). At that point, the debate will be not whether bitcoin makes it to 6-digit territory, but how soon it can rise above the 7-digits.

More in the full Standard Chartered note available to professional subs in the usual place.