As we welcome in 2024, one of the most critical questions facing investors is which stocks and sectors will beat the market. Can the Magnificent 7 retain its crown? Or will some subset of the 493 other S&P 500 stocks and their neglected sectors take the throne in 2024?

The Magnificent 7 stole the show in 2023. As we wrote in: From Magnificent 7 To A New Team:

This year’s most popular investment bandwagon is the Magnificent 7, comprised of Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Meta. The graphs below, courtesy of Goldman Sachs, and our table show these 7 stocks gained 71% this year to date, while the remaining 493 stocks added a mere 6%. The outperformance pushed up their contribution to the S&P 500 to nearly 30%. Lastly, the sharp increase in stock prices led to even more extreme valuations for the group.

We ended the article as follows:

As we enter 2024, be open to the possibility that last year’s winners will not take the crown this year.

We don’t know what will replace the Magnificent 7 or when, but we will be sure to keep our bias in check and stay open to new ideas.

In the spirit of being open to new ideas, we study market valuations and earnings expectations to see if 2024’s Magnificent 7 includes names like Con Ed, Johnson & Johnson, Kraft Heinz, and other 2023 laggards.

Disclaimer On Valuations

Before we share our analysis, it’s worth emphasizing that changes in valuations, often called multiple expansion or contraction, can play an outsized role in the performance of a stock or index. Regardless of changes to earnings, sales, or other fundamental data, investors’ desire to buy or sell, if strong enough, can divorce a stock’s price from its fundamentals.

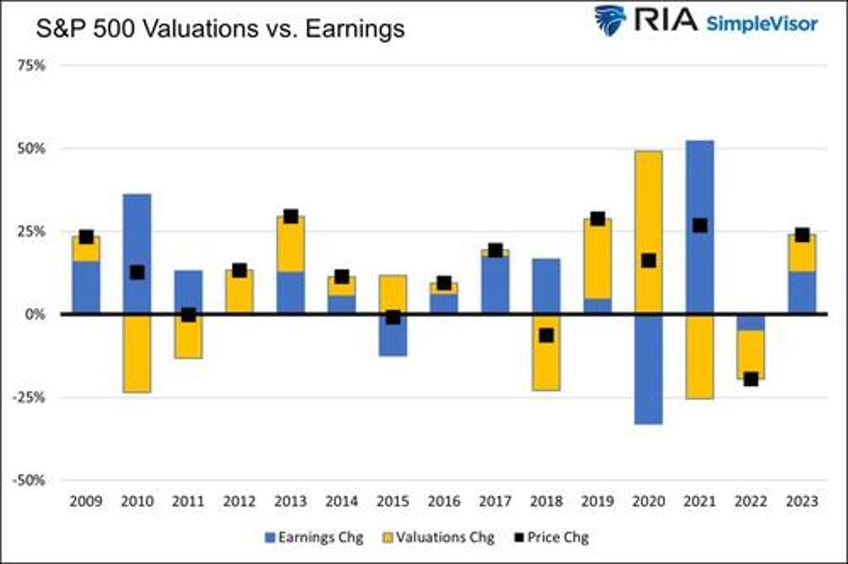

For example, last year, the S&P 500 was up 23%. Approximately half of its increase was due to rising earnings, and the other half from increasing valuations.

The graph below shows how P/E multiple and EPS changes contributed to the S&P 500 price change since 2009. In six of the fifteen years, the changes in EPS and valuations were opposites of each other. Also note the years 2020 and 2021. In 2020, a significant increase in valuations more than offset declining earnings. Conversely, in 2021, EPS spiked, and valuations gave up most of its 2020 gains. Even if you forecasted EPS to the penny at the start of those two years, your S&P 500 projection would have been dead wrong!

S&P Sector Earnings Forecasts

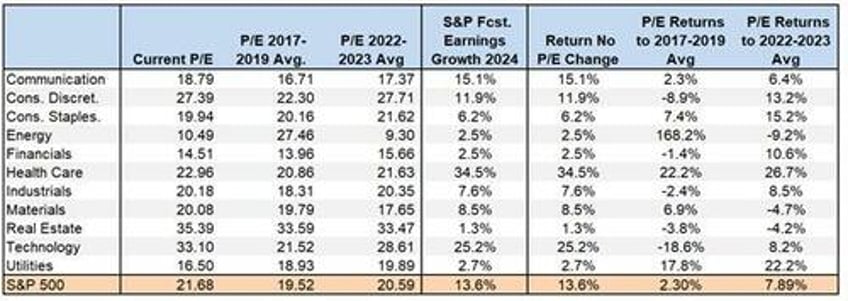

S&P Global puts out a wealth of data on the S&P 500, which we use in this analysis. The table below is broken down into the eleven S&P 500 sectors and compared to the entire index.

Given the importance of valuations, as we noted, the first three columns show the current P/E ratio next to the three-year pre-pandemic average and the average of the last two years. This comparison provides context for a valuation on which to base our analysis.

With those three price-to-earnings estimates, we can imply the potential S&P 500 return by estimating earnings per share. S&P Global provides the 2024 EPS estimates for our analysis.

If the P/E remains unchanged, the price return equals the change in earnings. The two columns furthest to the right of the table compute the potential price change if P/E reverts to the pre-pandemic average or the more recent average.

The S&P 500 will gain 13.6% if valuations remain unchanged yet only increase by 2.30% or 7.89% if valuations revert to prior averages.

May 2024 Be The Year Of The Laggards?

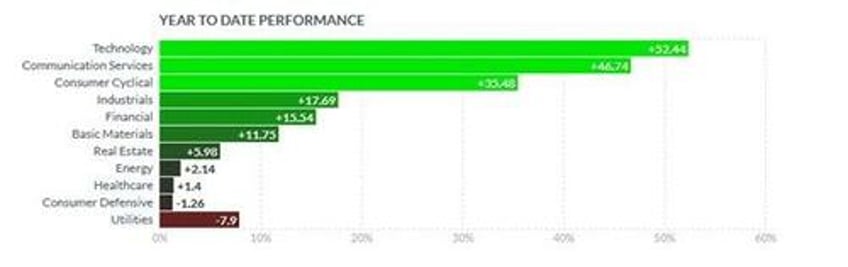

The graph below, courtesy of Finviz, highlights the large discrepancy in the returns of the S&P 500 sectors.

The three sectors with the worst performance last year, Healthcare, Consumer Staples, and Utilities, offer the best potential returns in 2024, as calculated in our table above.

In our analysis, the Energy sector could have a remarkable 168% return if its P/E returns to its pre-pandemic average. However, its P/E is volatile as its earnings swing much more than other sectors. Its long-term P/E average is in the mid-teens. If its P/E climbs back to such a level, a 50% increase in share prices is in store, assuming earnings are relatively flat.

After a strong 2023, Technology, Communications, and Consumer Discretionary (cyclical) have projections more in line with the market.

Sentiment Trumps Fundamentals

As we noted earlier, valuations play a significant role in performance. Consequently, it’s crucial to appreciate the sentiment and narratives in place. The Magnificent 7 and, to a lesser degree, large-cap Technology, Communications, and Discretionary are in vogue. Valuations are generally expensive in these sectors and are rising. Despite such high valuations, the positive sentiment toward these sectors could continue for part or all of next year.

Conversely, the out-of-vogue sectors may continue to underperform. Returning to our article From Magnificent 7 To A New Team, we compared one of the market’s hottest stocks in 2023, Nvidia, to an out-of-favor stock, Albemarle. To wit:

To help appreciate what may lie ahead, we compare Nvidia to Albemarle. Nvidia is up 230% year to date. As a result of the stock surge, Nvidia’s investors are paying a 250% premium for Nvidia’s earnings versus those of the S&P 500. Nvidia’s earnings will undoubtedly grow faster than the market for a while, but by how much and for how long? Can they avoid competition and margin pressures while keeping sales elevated long enough to justify the premium?

The world’s largest lithium producer is in quite the opposite shoes. Despite strong demand for lithium from electric vehicles (EV) and a projected shortfall of lithium to meet growing EV needs, Albemarle investors only demand a price to earnings of five, about one-fifth of the S&P 500. Its shares are down about 30% year to date.

Despite the significant value in Albemarle compared to Nvidia, investors continue to chase Nvidia and sell Albemarle.

The takeaway is that regardless of valuations, Nvidia and its six other compatriots may continue to lead the market. Albemarle and the many stocks in the out-of-favor sectors proposition may continue to languish.

Summary

The combination of earnings expectations and valuation regression argues that Utilities, Staples, and Healthcare will outperform the market.

HOWEVER, sentiment and changes in investors’ perceptions via valuation expansion or contraction can easily dominate returns.

Investor sentiment is challenging to predict but relatively easy to measure. Therefore, we must appreciate our forecast and be ready to act on it if necessary. But at the same time, respect current sentiment and appreciate recent trends. As John Maynard Keynes once said:

“The markets can remain irrational longer than you can remain solvent.”

Be flexible and respectful of current trends and sentiment but cautious and aware of evolving market conditions.