Gold looks well poised to build on this year’s gains, with speculative momentum seeming to entice marginal buying and perpetrating a virtuous circle.

Bullion is on track for a fourth successive monthly rally, with its gains so far this year of over 15%.

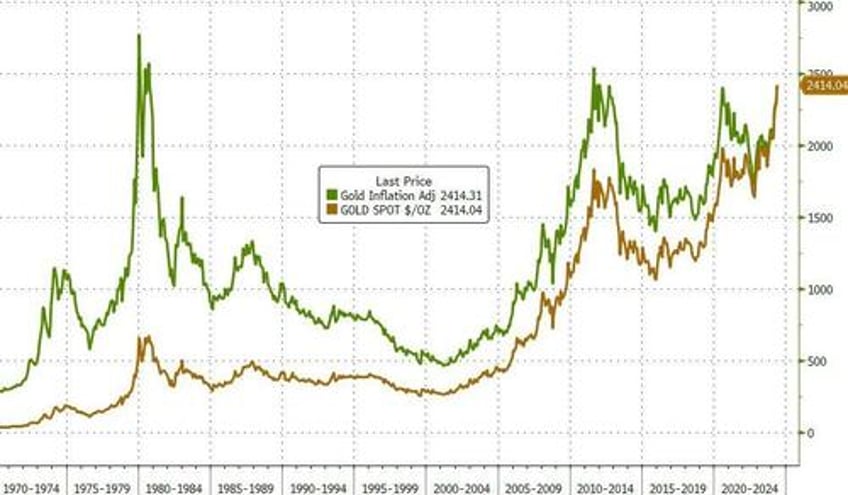

While those gains appear stunning, in reality, gold adjusted for prices in the economy is far less impressive. At around $2400, it is in line with the 2011/12 highs after adjusting for inflation.

Gold must be viewed for what it actually is: an asset that delivers inflation-adjusted returns in fits and spurts with a highly inconsistent trajectory. Even so, given that we are now in a world where there is little conviction of returning to a 2% inflation regime anytime soon, bullion has room to grind higher.

Over in the US, the markets are again warming up to the idea of interest rate cuts from the Fed after the softer-than-forecast inflation prints for April. Traders now seem to be converging on September for a first reduction and are factoring in nearly two cuts by year-end. Whether or not that positioning proves accurate needs to be seen, but gold traders will be inclined to price those cuts into bullion pricing first and ask questions later.

And with geopolitical tensions staying elevated, gold will find the extra bid going in its favor.