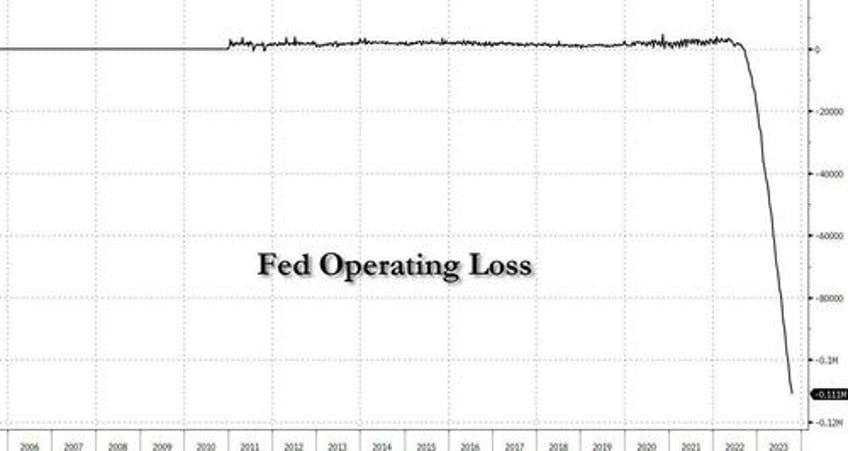

Two weeks ago we reminded the world that thanks to soaring interest rates, which will only keep rising until the Fed figures out what "big-enough" crisis it uses to trigger QEx+1, the staggering losses on global fixed income securities which according to the IIF amount to $307 trillion - as calculated by DB's Jim Reid - amount to a little bit over $100 trillion (and rising). And while thanks to such facilities as the BTFP much of the MTM risk has been transferred if only for the time being away from commercial banks and to the Fed, the cumulative losses at central banks are now absolutely staggering, starting with the biggest and baddest one of all, where the Fed operating loss is now $111 billion and rising with every day that the Fed pays out more in interest to banks and money market funds than it collects on its bond portfolio...

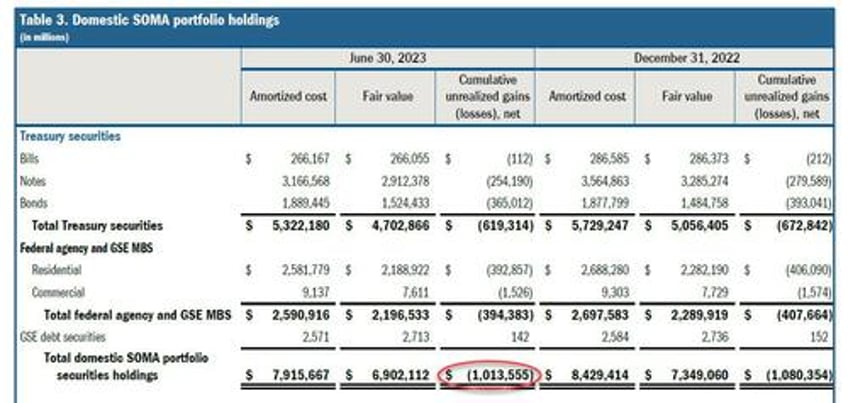

... while the cumulative MTM loss on its multi-trillion bond and MBS portfolio is now a staggering, hold on to your hats, $1+ trillion (this despite unwinding more than $1 trillion in assets on its balance sheet since the early 2022 peak).

And yet, as everyone knows by now, the Fed will never go bankrupt thanks to printing the world's reserve currency. That's right: the accounting treatment of record income or balance sheet losses is, well, none: they just assume that the Fed will merely print enough to plug any hole, and so the Fed is exempt from the ordinary rules of capitalism where a big enough loss will eventually put you out of business. Which is a bit of a philosophical paradox: on one hand, the Fed by default remits its profits to the Treasury, be they $1 or $1 trillion... yet when it has a net loss at the end of the year, the Treasury is not bound to bail it out, which is the sweetest form of crony capitalism ever conceived, and is by far the biggest benefit to whatever nation is the issuer of the world's reserve currency du jour.

The same, however, can not be said for other central banks such as the Bank of England (which about a hundred years ago relinquished global reserve currency status to the US), and which one year ago had to be bailed out by the UK Treasury after the central bank suffered its first huge losses from the QE program (see "Treasury bails out BoE for first losses on QE programme".)

The same can certainly also not be said of the world's oldest, and arguably most experiment of central banks, Sweden's Riksbank, which not only is the world's oldest central bank but also the first one to implement negative rates. Now it hopes to also be the first one to surpass the BOE in getting the biggest central bank bailout in history.

In a press release/speech by Riksbank governor Erik Thedeen before the Swedish parliament’s committee on finance Tuesday, he said that the now insolvent central bank needs a capital injection of at least SEK80 billion, or just over $7 billion, representing a little over 1% of Sweden's GDP.

That would restore its equity to at least the basic level of SEK40 billion stated in the Sveriges Riksbank Act, as per figures at the end of September 2023, to wit: "In the annual accounts for the financial year 2022, the Riksbank reported a loss of just over SEK 80 billion. As a result of the loss, the Riksbank's equity was negative, SEK -18 billion."

Of course, this is peanuts compared to the gargantuan losses at the Fed, but then again when is the last time anyone outside of Sweden used the krona. Some more excerpts from his speech:

“The loss and negative equity are due to the sharp rise in interest rates in 2022. This has led to a fall in the value of the bonds purchased by the Riksbank during the period 2015-2021 to maintain confidence in the inflation target, secure the credit supply during the coronavirus pandemic and contribute to good economic development,” said Mr Thedéen.

When the value of the Riksbank's holdings of bonds decreases, it leads to unrealised losses that burden the Riksbank's result and equity. “A negative equity does not affect the Riksbank’s ability to conduct monetary policy in the short term. But to maintain confidence in an independent monetary policy in the long term, it is necessary that the Riksbank is financially independent, that is, has sufficient equity and earnings to cover its costs,” continued Mr Thedéen.

And then, perhaps to mitigate the impact of the unprecedented bailout demand, Thedeen clarified that "the Riksbank’s asset purchases took place in a situation of international stress, when the major central banks around the world were making extensive asset purchases."

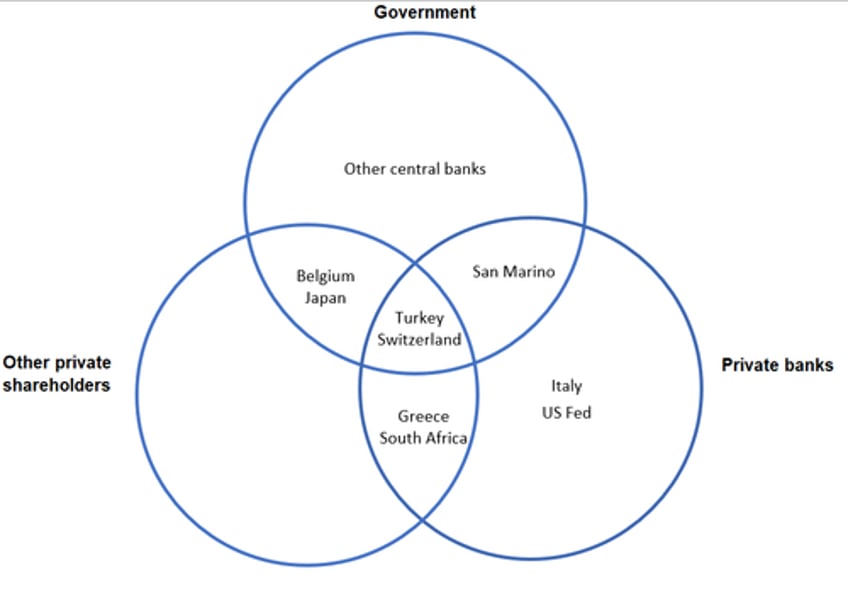

Now while the Fed may sneer at the concept of negative equity, simply because it can literally print money to plug whatever equity hole there is which it simply calls "deferred asset" and can continue to pretend it does not have over a trillion dollars in losses on its books. But for other banks, especially those which are not privately-owned by a secretive cartel of bankers like the Fed (you didn't know that the Fed is a privately-owned entity? you may want to read up on it)...

... and are instead wards of the state, telegraphing to the world that they are - well - insolvent, can be a problem.

As such, the Riksbank said that it will now continue to work on the petition to parliament, and when its annual report for 2023 is completed in February 2024, the Executive Board intends to make a decision on a petition that includes a request for capital injections and possibly also proposals for additional earnings capacity

“The size of the capital injection in the petition will be based on the Riksbank’s equity and reported results for 2023. The intention is to submit the petition to Parliament in March 2024,” Thedeen said.

The central bank is mandated to seek a bailout after it passed a new Riksbank Act in 2022 that require it to target capital of at least SEK40 billion; if this amount falls below SEK 20 billion the Riksbank has to go to the Swedish parliament to ask for more money. Therefore, Thedeen’s speech yesterday was the first step in the bailout process.

Commenting on the announcement, SEB analysts Amanda Sundström and Olle Holmgren said that that Thedéen’s speech implies a SKr80bn capital injection will be sought, which of course is what he said too:

The size of the capital injection is uncertain and there are risks both to the downside and upside. To reduce the risks in the balance sheet, the Riksbank has started hedging a quarter of the foreign exchange reserves. Realized profits made on FX hedging could potentially act to offset some of the need for capital injections.

There are also potentially profits from other Riksbank holdings, e.g. gold and the FX reserve in general which could limit the size of the capital injection, although this is uncertain given discrepancies between the Riksbank’s accounting principles and the Riksbank Act. Profits from the currency hedging is a downside risk for the capital injection but Mr Thedéen also indicates that equity needs to be restored to above the base level to in order to generate sufficient earnings to guarantee the Riksbank’s independence.

The Riksbank states that it is also investigating the prospects for additional earnings. The low amounts of currency in circulation in Sweden means that the Riksbank could struggle to generate sufficient earnings also with capital at the target level (SEK 60bn) and Mr Thedéen indicated that the Riksbank could petition that the bank should have the possibility for additional earnings which in comments to the press was specified as fees from the financial sector.

But while the Riksbank's bailout request is certainly novel, it may be challenged for novelty (and size) by none other than the Bank of England, which as noted above, already demanded that the UK government bail it out to the tune of £29 billion (after suffering similar massive MTM losses on its duration exposure). That's just the start: over the next two years, the total BOE bailout amount may rise to £90 billion according to Deutsche Bank. And then, when all other central banks that similarly do not print reserve currencies, join the fray in this "higher for longer" environment, that's when the grassroots realization of how naked the global monetary emperor truly is, will finally dawn.