It was ugly in macro-land today with existing home sales crashing (as home prices hit record highs). But a couple of Regional Fed surveys really laid an egg...

First out of the gate was the Philly Fed Services Activity Survey, which puked in July from two-year highs to near four-year lows...

Source: Bloomberg

The indexes for general activity at the firm level, new orders, and sales/revenues turned negative. The full-time employment index suggested a decline in employment, and prices are rising once again...

New orders fell to -7.1 vs 6.7

Sales fell to -3.5 vs 14.3

Prices paid rose to 30.2 vs 24.4

Full-time employment fell to -4.9 vs 14.6

Part-time employment fell to 4.0 vs 13.1

Of particular note was that the capital expenditures-equipment fell to 10.8 vs 24.5... not a great sign for the future of AI investment that is still supporting stocks.

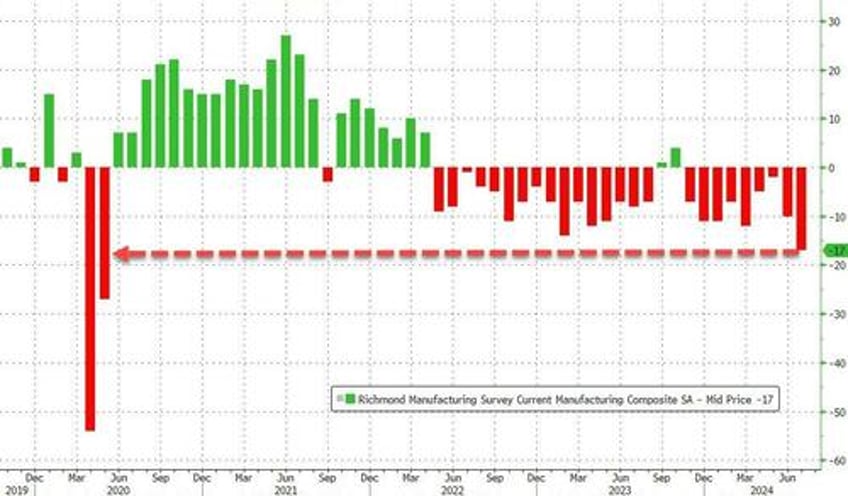

And it's not just Services, The Richmond Fed Manufacturing Survey crashed to -17 (the worst since the peak of the COVID lockdowns)...

Source: Bloomberg

And under the hood, it was even more of a shitshow...

Shipments fell to -21

New order volume slowed to -23

Order backlogs rose to -20

Capacity utilization slowed to -13

Inventory levels of finished goods increased to 20

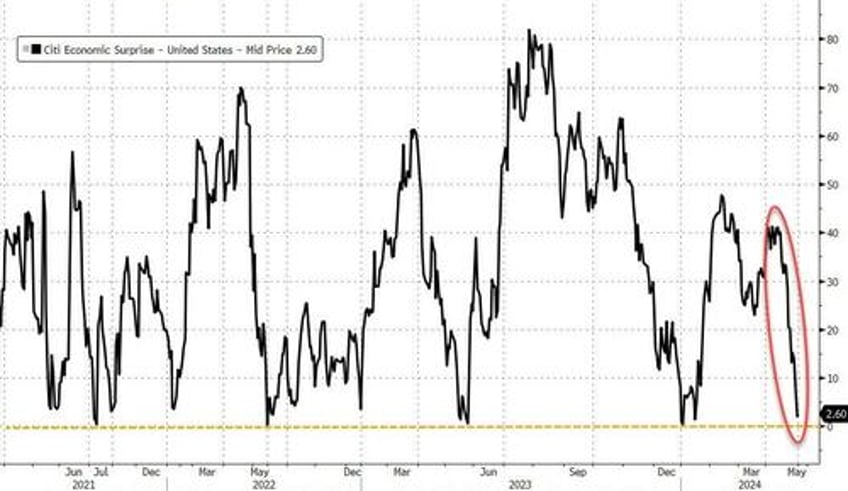

Overall, it's bad news as Bidenomics shits the bed...

Source: Bloomberg

We just cannot wait to hear what Harris has up her sleeve to 'fix' this...