Oil prices have continued their recent gains - with WTI back near 3-month highs - after a slowdown in US consumer price inflation suggests a potential end to interest-rate hikes. This helped traders shrug off China's slowdown (Q2 GDP miss) with OPEC+ cuts bring balance to the physical market, but could face challenges in propping up prices if demand stays subdued.

API

Crude -797k (-1.8mm exp)

Cushing -3.00mm

Gasoline -2.8mm (-1.1mm exp)

Distillates -100k (+200k exp)

DOE

Crude -708k (-1.8mm exp)

Cushing -2.891mm - biggest draw since Oct 2021.

Gasoline -1.066mm (-1.1mm exp)

Distillates +13k (+200k exp)

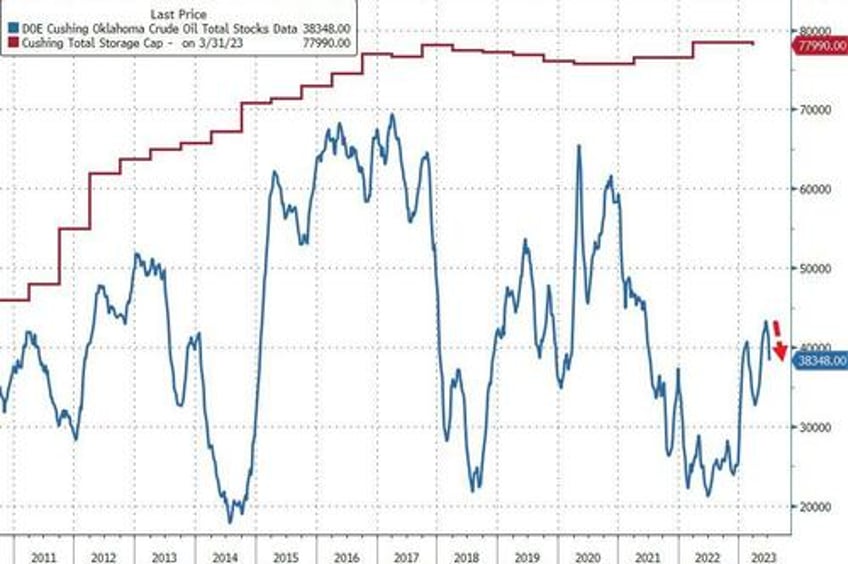

US crude stocks drew-down by 708k barrels last week (less than expected) after the prior week's big build. Stocks at the Cushing hub crashed by 2.9mm barrels - the biggest draw since Oct 2021.

Source: Bloomberg

For the first time since March, the Biden admin did not drain the SPR (it rose by a rounding error of 1k barrels)...

Source: Bloomberg

Stocks at the Cushing hub are back to their lowest since May...

Source: Bloomberg

US Crude production was flat at 12.3mm b/d (near cycle highs) despite the continued collapse in the rig count...

Source: Bloomberg

WTI was hovering around $76.50 ahead of the official data, above the pre-OPEC+ cut levels from March...

But, despite the draws, WTI tumbled back towards $75 after the print...

WTI futures are once again ignoring a bullish report and only responding to macro markets. This has been a common occurrence in the past few weeks, especially due to summer trading.