Update (1125ET):

Wyndham Hotels & Resorts rejected the $7.8 billion hostile takeover bid by Choice Hotels International.

The stock-and-cash proposal, which Choice made public in a so-called bear hug letter Tuesday morning, undervalues Wyndham's growth potential and involves significant business and execution risks, Wyndham executives told The Wall Street Journal. Wyndham's board also has concerns over the value of Choice's stock, they added. Choice's offer includes 45% stock. -WSJ

Wyndham executives added that any deal would "extended regulatory timeline given the US government's aggressive stance on antitrust, with an uncertain outcome that could result in potential franchisee churn and excessive leverage at the combined company."

Last month, Wyndham held multiple discussions with Choice Hotels regarding regulatory and execution issues. However, they stated that their potential acquirer didn't address those concerns.

* * *

Choice Hotels International publicly offered to buy competitor, Wyndham Hotels & Resorts, in a deal valued at nearly $8 billion. The decision to go hostile came after Wyndham rejected two offers from Choice.

Here's a breakdown of Choice's proposal:

- $90.00/share for Wyndham shareholders.

- Breakdown:

- $49.50 in cash.

- 0.324 shares of Choice common stock per Wyndham share.

- Premiums:

- 26% above Wyndham's 30-day volume-weighted average closing price (ending Oct 16, 2023).

- 11% above Wyndham's 52-week high.

- 30% above Wyndham's latest closing price.

- Election Mechanism:

- Wyndham shareholders can choose:

- Cash.

- Stock.

- Mix of cash and stock (with standard proration).

- Valuations:

- Total equity value for Wyndham: ~$7.8 billion (fully diluted).

- Including Wyndham's net debt: deal worth ~$9.8 billion.

"A few weeks ago, Choice and Wyndham were in a negotiable range on price and consideration, and both parties have a shared recognition of the value opportunity this potential transaction represents, said Choice CEO Patrick Pacious.

Pacious continued, "We were therefore surprised and disappointed that Wyndham decided to disengage. While we would have preferred to continue discussions with Wyndham in private, following their unwillingness to proceed, we feel there is too much value for both companies' franchisees, shareholders, associates, and guests to not continue pursuing this transaction."

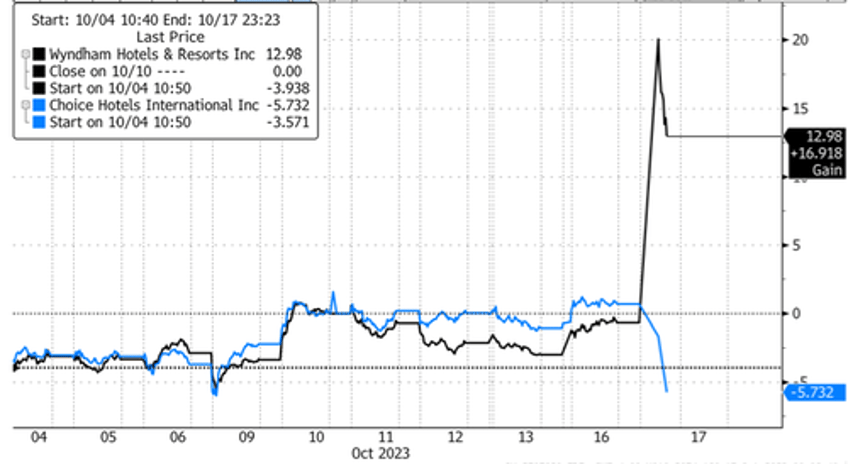

Choice Hotels shares dropped 6% in premarket trading in New York, while Wyndham shares Wyndham were up more than 12%.

This is the third offer from Choice in just half a year. In April, Choice offered Wyndham $80 per share, predominantly in stock. By September, they upped their bid to $85 per share and also increased the cash component of the proposal.

Choice noted Wyndham raised questions about the prior offers:

Wyndham acknowledged the strategic rationale of the proposal and that terms were within a negotiable range but raised questions regarding the value of Choice stock and timing for obtaining regulatory approvals. In response, Choice proposed to enter into a one-way, short-term non-disclosure agreement to facilitate Choice providing information that would address Wyndham's concerns (a draft of which was subsequently sent to Wyndham) and made its external counsel available for several discussions. However, during a follow-up call between the Chair of each company's Board and their respective advisors, Wyndham made clear their unwillingness to proceed with further discussions.

Moelis & Company LLC and Wells Fargo are acting as financial advisors for Choice, while Willkie Farr & Gallagher LLP is providing legal counsel.