A recovery in US stocks into year-end hinges on whether an expected strong upswing in earnings growth will be enough to counteract a weakening technical and liquidity backdrop.

Information is surprise. This was a concept formulated by Claude Shannon in his groundbreaking Information Theory, the foundation of digital computing. The true content of information comes not from what is expected, but from what is unexpected. Nowhere is this more valid than in markets, which have their most outsized moves when there are surprises.

They can be endogenous and exogenous, and naturally a rapid escalation in the conflict in the Middle East would represent a negative surprise of the latter type for the market. But if we focus on endogenous surprises, then there is potentially a sizable positive one in the pipeline in the shape of US earnings.

That’s signaled by multiple leading indicators, which are pointing to an increasingly pronounced and protracted recovery in large-cap earnings growth, which fell to flat from an annual rate of more than 50% last year.

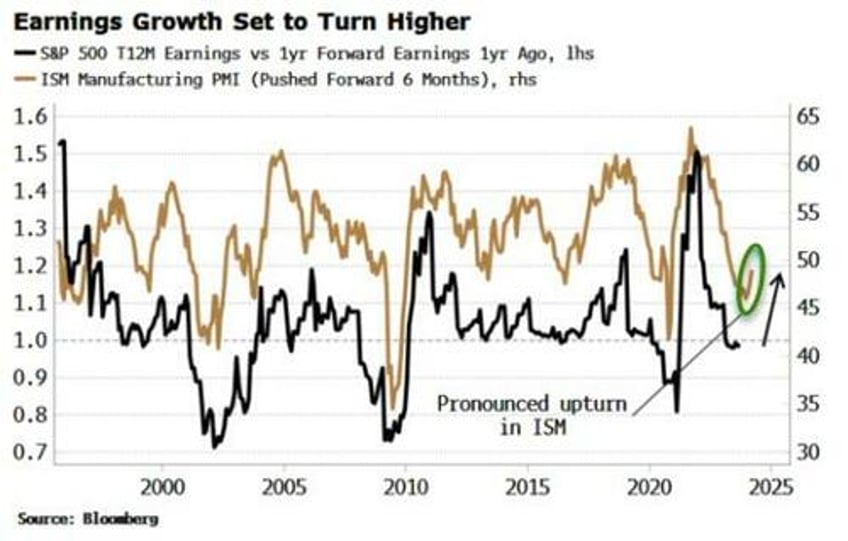

First, there is the manufacturing ISM, which has been persistently rising all summer. This points to earnings surprising to the upside in the coming months, with trailing earnings beginning to outperform forward ones.

The manufacturing ISM crops up all over the place in macro analysis because it’s one of the best standalone leading indicators for global stock markets and the economy.

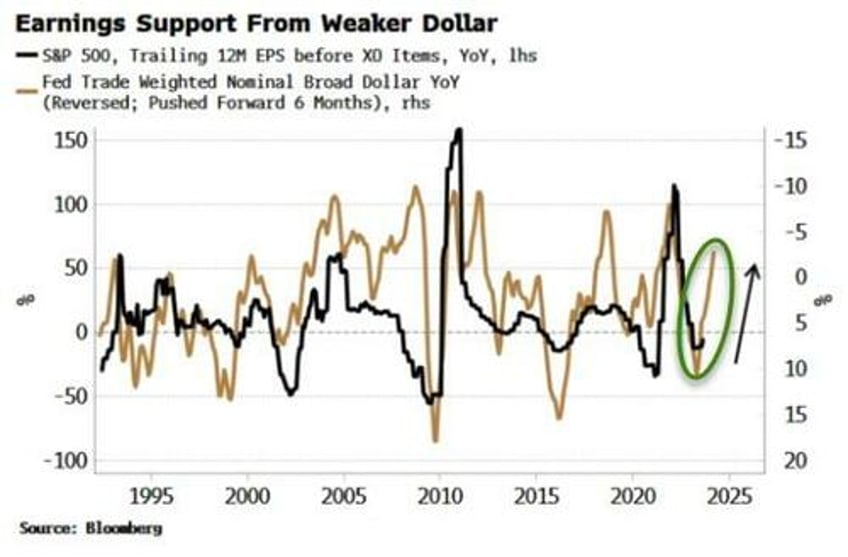

Tailwinds for earnings are also in the pipeline from a weaker dollar. It has strengthened in recent months, but economy-market relationships operate with lags. The lagged impact from the weaker dollar since last year is unlikely to have had its full positive impact on US earnings yet.

There should be more where this came from as the dollar is likely to re-establish its weakening trend based on leading indicators for the currency.

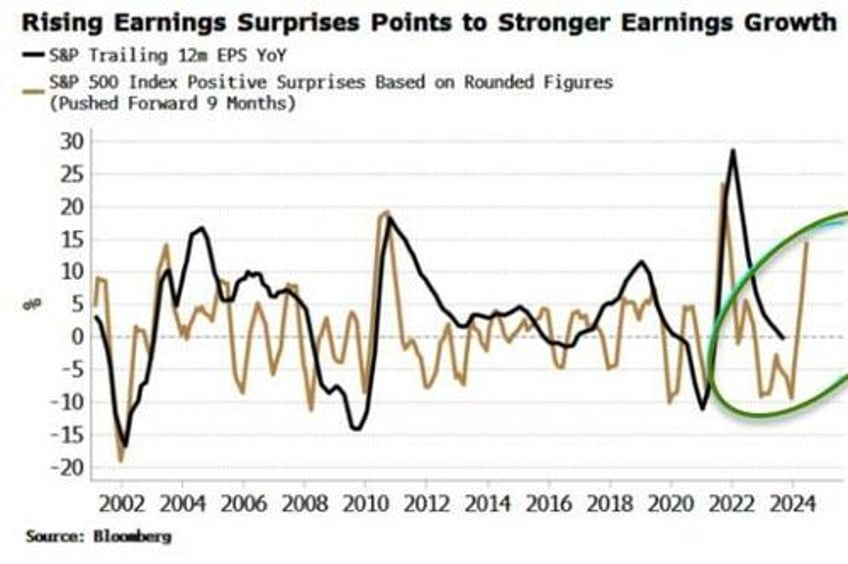

More companies have already been positively surprising on their earnings, which also points to stronger profit growth. We’ll get more color on this as another raft of US companies announce their 3Q earnings this week.

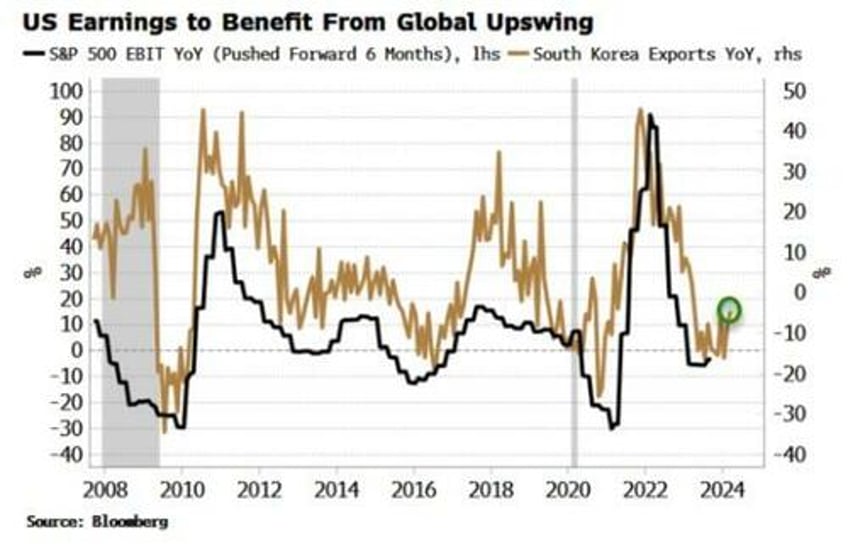

Additionally, there are increasing signs that the US may avoid a recession and global growth will experience an upturn. The exports of small, open economies are reliable leading indicators for the world economy. South Korean exports look to have bottomed and started turning up, which typically leads to a rise in the earnings growth of large-cap US companies.

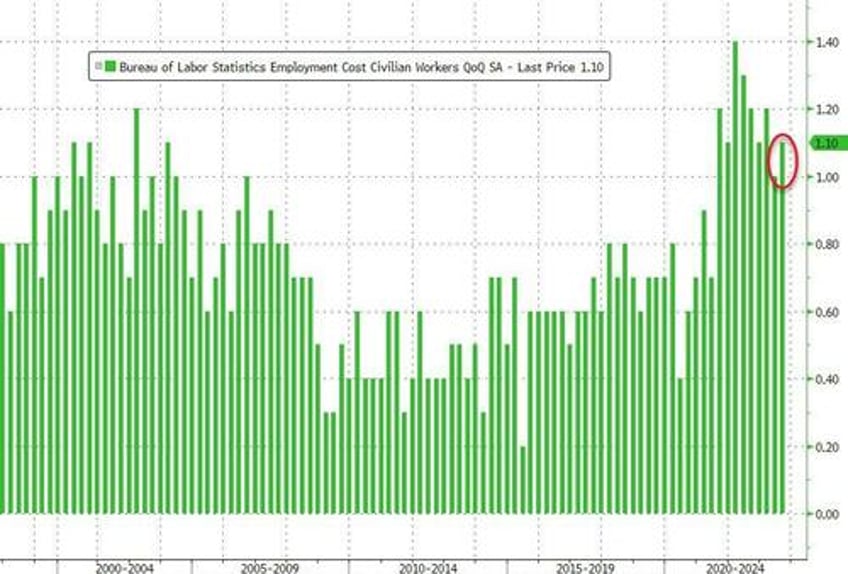

A rise in earnings, though, is not a shoo-in for higher prices. The P/E ratio at least needs to remain steady. Leading indicators are pointing in that direction just now, but a re-acceleration in inflation, which I expect at some point next year, will eventually be a negative for P/E ratios.

But before that, liquidity is a burgeoning risk for stocks. First, there is excess liquidity, the difference between real-money growth and economic growth. Rising excess liquidity has been a key tailwind for risk assets this year, but it’s showing the first signs of rolling over. If that gathers momentum, then what has been a positive for stocks will morph into a headwind, counteracting in whole or in part the tailwind from an upswing in earnings.

Liquidity will also be affected by the decisions of the Treasury, as the size of the fiscal deficit increasingly shifts the US toward fiscal dominance, where government borrowing and spending decisions overwhelm monetary policy.

As important as the amount Treasury borrows is how much its issuance is skewed toward bills. That’s been the case this year, which has meant money market funds (MMFs) have been able to absorb most of the new borrowing. MMFs have bought bills by drawing down on the RRP (reverse repo) facility, cushioning what would otherwise have been a large hit to liquidity.

Bills are now more than 20% of total UST debt outstanding, a level around where the Treasury has aimed to cap issuance in the past. A skew back toward bond issuance and away from bills is likely soon (confirmed by the Treasury) and is a non-trivial risk for the market as borrowing necessarily moves away from MMFs – holders of low-velocity reserves – to holders of high-velocity reserves such as US households.

The Marketable Borrowing Estimates released on Monday indicated a bond-bearish skew to expected issuance, but it’s on Wednesday with the recommending financing schedules we’ll get more information on the breakdown between bond and bill issuance.

To add to risks, the technical backdrop for the S&P is deteriorating. Along with several measures of breadth, one of the best – and simplest – guides to the medium-term trend of the market is on the threshold of turning negative.

The 13-26 week moving-average crossover for the S&P turned positive in February, about a month before the index bottomed and then began its rally. The crossover is very close to going back to negative-trend territory, when the market tends to struggle or sell off.

Earnings are poised to surprise strongly to the upside in the coming months. But it’s hard to be sure whether that will be enough to catalyze a strong year-end rally given the conflicting messages from technicals and liquidity.

All in, it’s difficult to disagree with Stanley Druckenmiller’s comments to Paul Tudor Jones at last week’s JP Morgan/Robin Hood conference: “It’s not exactly an environment that excites me about paying 20%-30% above the multiple for equity prices … I don’t find the equity market as a whole that interesting.”