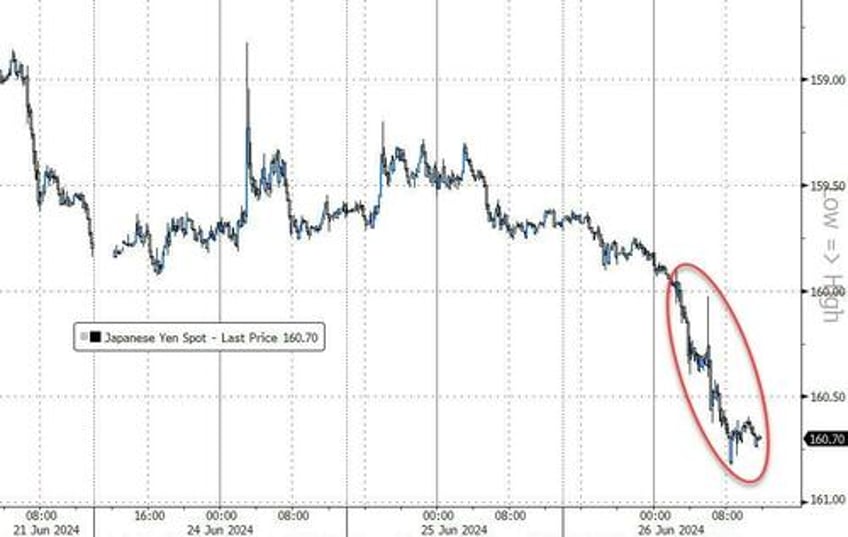

Today's market was brought you by the number 160 (yen per dollar) and the letters 'A' and 'I' as Japan's Kanda spoiled the party in the FX markets and NVDA's Huang failed to spark a panic back into AI stocks during today's shareholder meeting.

USDJPY broke above 160 for the first time since 1986 as Japan's currency chief failed to ignite enough fear with his comments about intervention...

Source: Bloomberg

NVDA failed to follow-through on yesterday's big rebound even as CEO Jensen Huang delivered a rousing vision of the future for the use of his company's products...

Source: Bloomberg

Well, everything went fucking vertical in the last few seconds of the day smashing NVDA into the green...

...and then Micron earnings hit after hours and NVDA tanked back into the red...

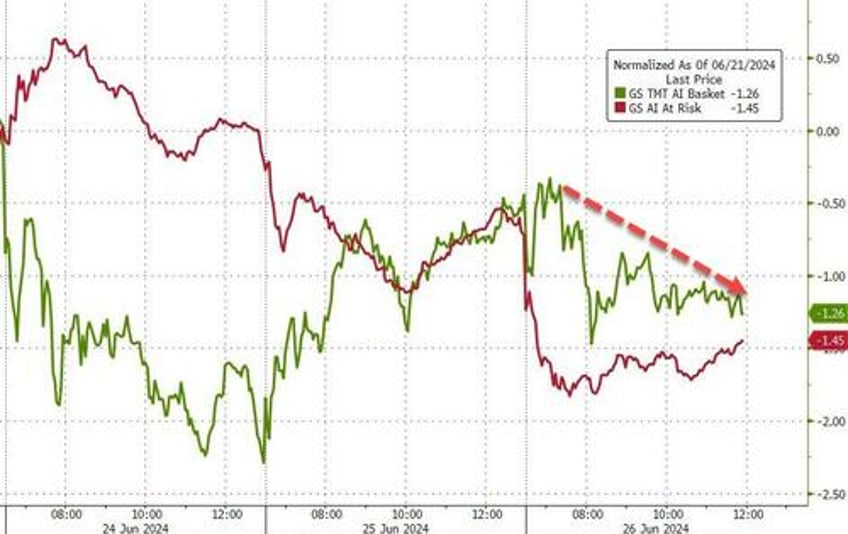

AI companies overall faded today, giving back much of yesterday's gains (but the selloff was more broad-based today)...

Source: Bloomberg

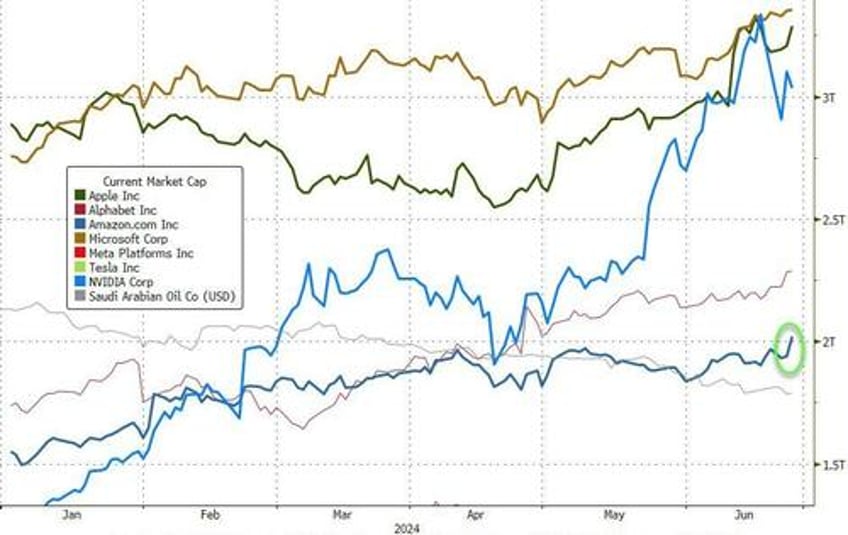

But while AI stocks were hit, MAG7 basket rallied, thanks in large part to AMZN...

Source: Bloomberg

...as AMZN hit a new record high, topping $2 trillion market cap for the first time...

Source: Bloomberg

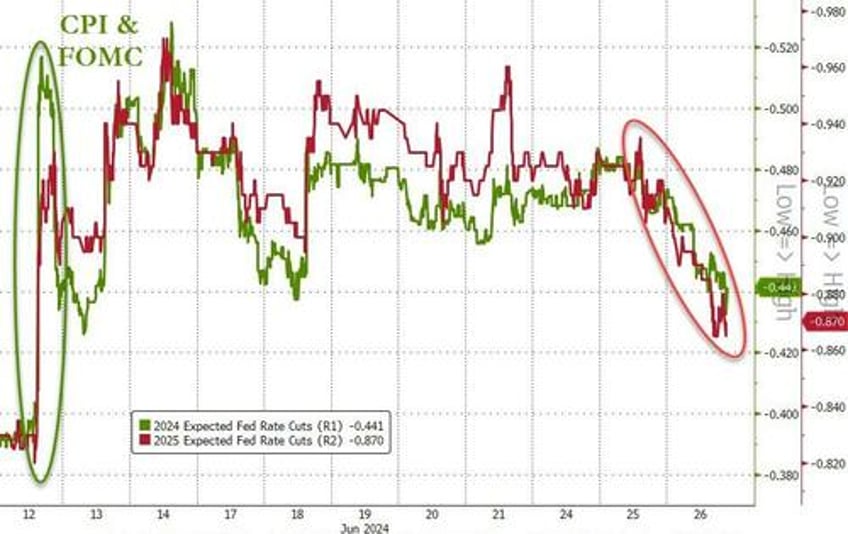

Add to all that the fact that the US housing market appears to have literally imploded in May (according to today's new home sales data) and onemight have expected a more "bad news is good news" day... but instead, rate-cut expectations fell hawkishly...

Source: Bloomberg

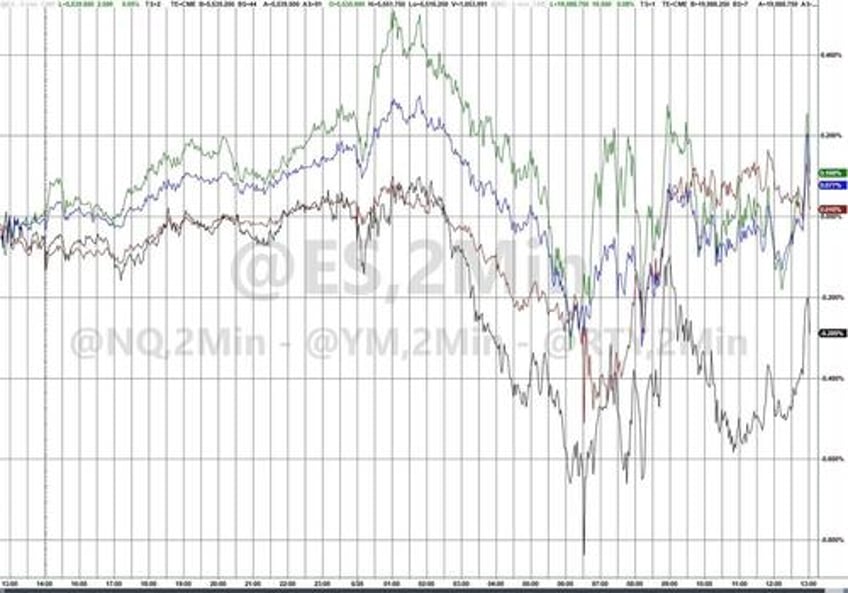

Overall, Small Caps were the day's biggest losers with the other US Majors clinging to either side of unchanged ahead of tonight's bank stress test results. The last few seconds of the day saw everything go vertical as NVDA spiked...

Goldman's trading desk noted that overall activity levels are down -5% vs. the trailing 2 weeks with market volumes flat vs the 10dma

Our floor tilts -1% better for sale, driven by HFs

HFs lean -8% better for sale but short ratio back below 50%. They are net for sale in every sector ex-REITs & Macro Products. Supply is heaviest in Tech where net supply is 3x larger than Energy, while the other sectors net supply is more modest.

LOs are +2% better to buy, buying Tech, Staples, Energy, Fins & Macro Products. Supply is heaviest in HCare & Industrials.

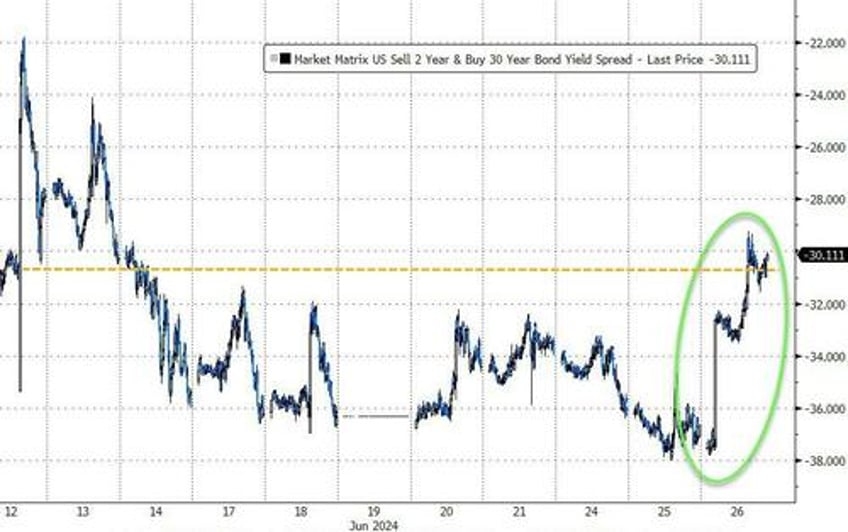

Bonds were dumped though with the longer-end underperforming on the day (2Y +4bps, 30Y +7bps)..

Source: Bloomberg

...which steepened the yield curve dramatically, back up to pre-CPI levels...

Source: Bloomberg

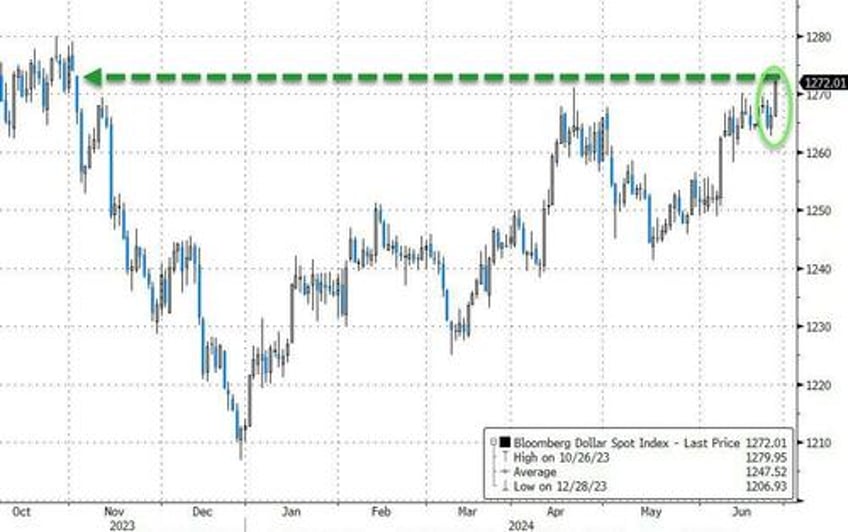

The yen weakness sent the dollar index soaring higher, closing at its highest since Nov 2023...

Source: Bloomberg

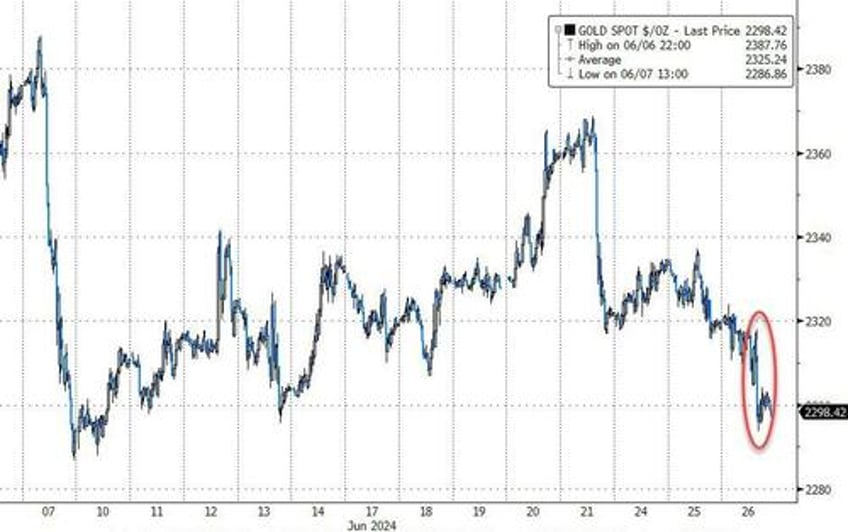

Dollar strength made gold suffer, with spot prices back below $2300...

Source: Bloomberg

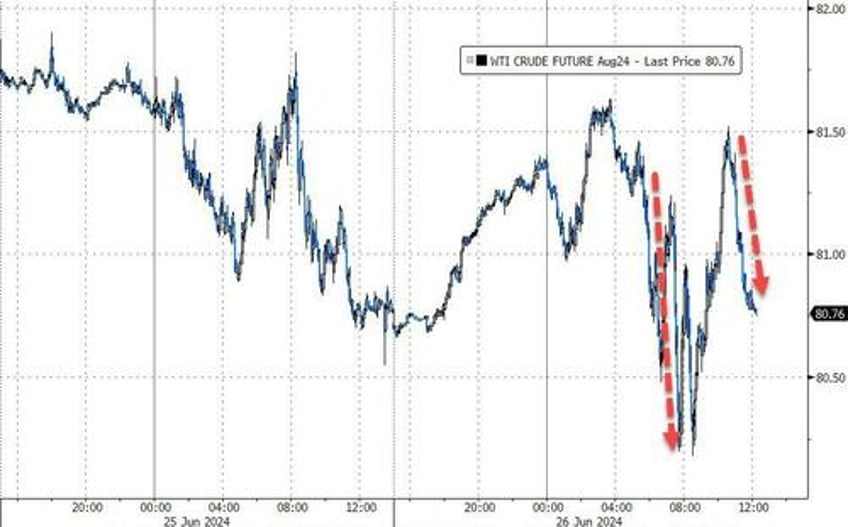

...and oil, which was also piled on from a big crude build. WTI bounced back off the early selling but was sold back down to close basically unchanged...

Source: Bloomberg

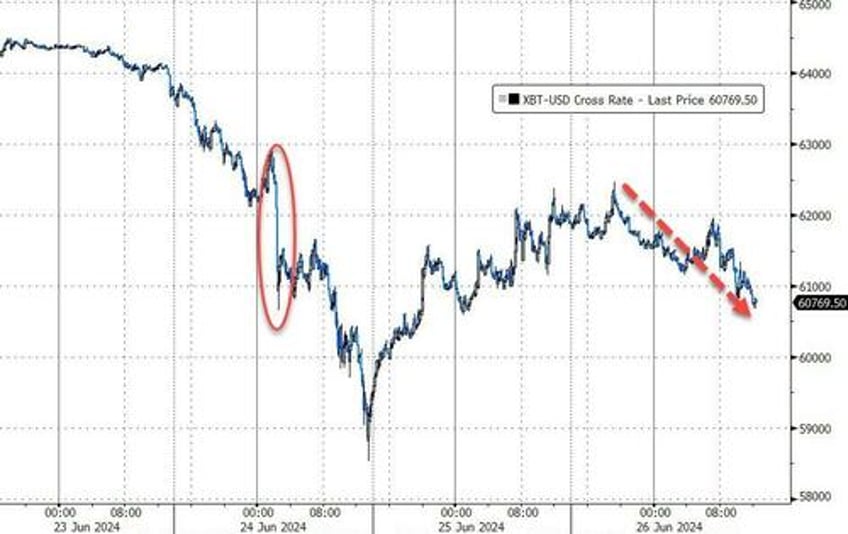

Bitcoin faded back from $62,000 as headlines around US Govt moving its Mt.Gox holdings to Coinbase sparked some selling pressure (though it appears the market has already soaked in the potential supply from that, which built on yesterday's FUD-inspiring German govt move headlines)...

Source: Bloomberg

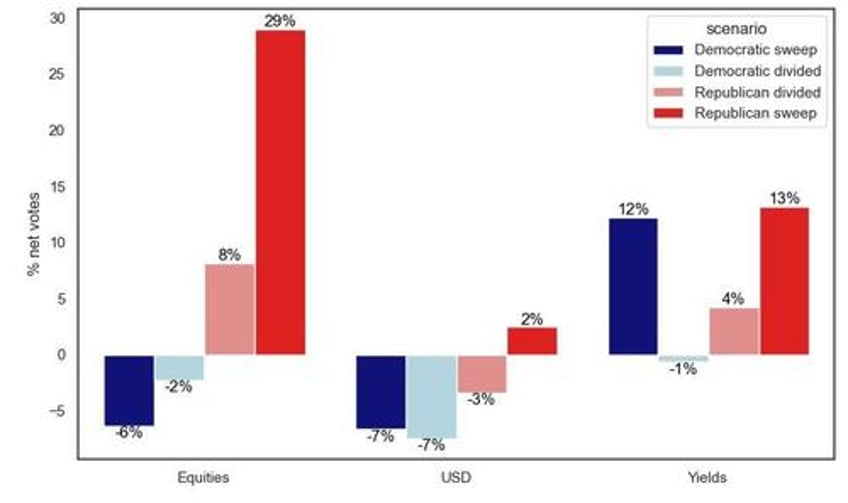

And finally, ahead of the first debate tomorrow night, Goldman Sachs shows us this chart shows how institutional investors view November's outcome...Unified government is a major risk for bonds - Equities most sensitive to a Trump win...

Source: Goldman Sachs

Did today's bond selloff and usd gains signal some bets that Trump will come away from tomorrow's brawl for the better?