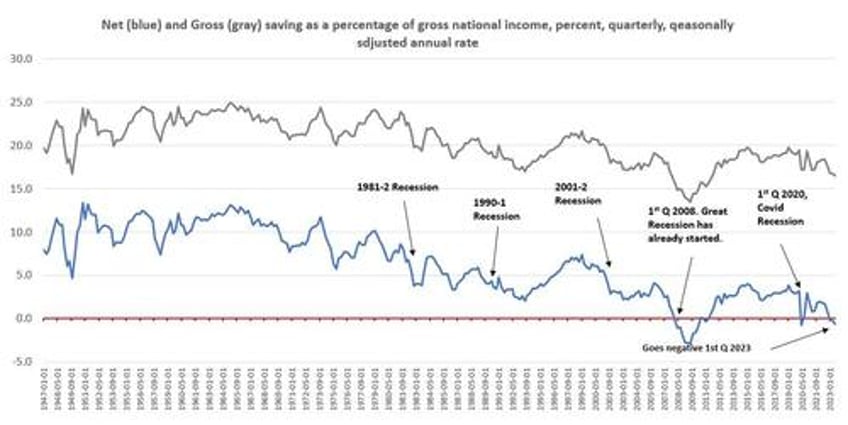

Net saving as a percentage of gross national income has been negative since the first quarter of 2023.

The current period of negative net savings is only the third time that net saving has gone negative in more than 75 years.

Looking back to the late 1940s, we find that the overall trend in net saving increased during the post-war period of economic retrenchment in the 1950s and early 60s.

With the Guns and Butter era of the late 1960s, however, net saving went into decline, and the general downward trend has continued ever since, following a similar trend to mounting federal deficits.

The only other times net saving has gone negative is in the lead-up to the great recession, and during the covid recession.

In general, net saving tends to fall steeply in the early periods of recessions, and this can be seen in the graph, going back several cycles. (A similar trend exists for gross saving as a percent of GNI.) This likely reflects a few different trends, one being the fact that the federal government continues to go more deeply into the red when tax revenues are weak as they are now.

But one thing is clear: net saving has worsened rapidly since the fourth quarter of 2020, dropping from 2.9 percent in that quarter to -0.7 percent in the third quarter of last year.

Such a rapid drop virtually always indicates the US has either entered a recession or will soon enter one.