One day after a stellar, record-breaking 2Y auction, moments ago the Treasury dumped a clunker in the form of $70 billion in 5Y bonds which tailed badly and which saw a drop in foreign demand. Here are the details.

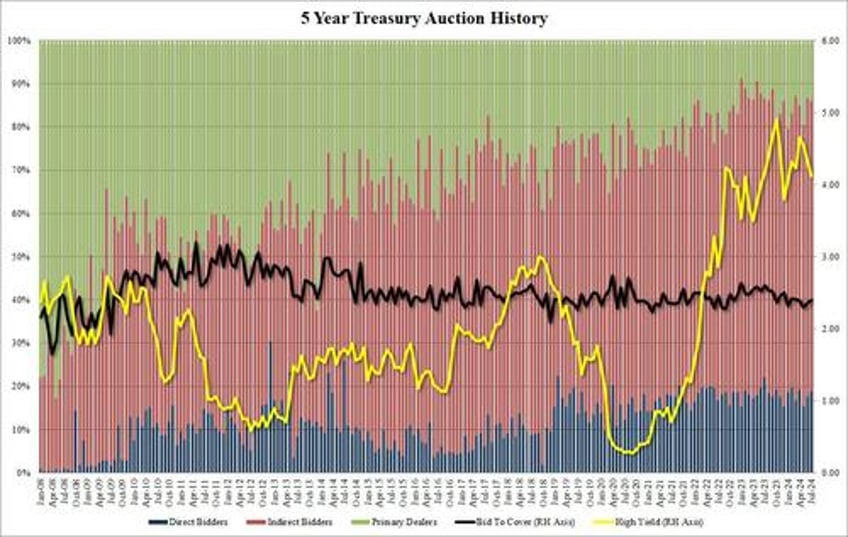

The high yield of 4.121% was below last month's 4.335% but tailed the 4.110% When Issued by 1.1bps. In fact, it was the 4th consecutive tailing 5Y auction and 6 of the past 7.

The Bid to Cover was 2.40, up from 2.35 and above the six-auction average of 2.36.

The internals were average, with Indirects taking down 67.3%, down from 68.9% in June but above the 65.8% recent average. And with Directs taking down 18.8%, above the recent average of 17.9%, Dealers were left holding 14.0%, just below the 6-auction average of 16.3%.

Overall, this was a mixed auction, one where demand was superficially low due to the 4th consecutive tail in a row, even though the internals were in line, if not just above, recent prints with foreign demand clearly on the upper end of the recent range.

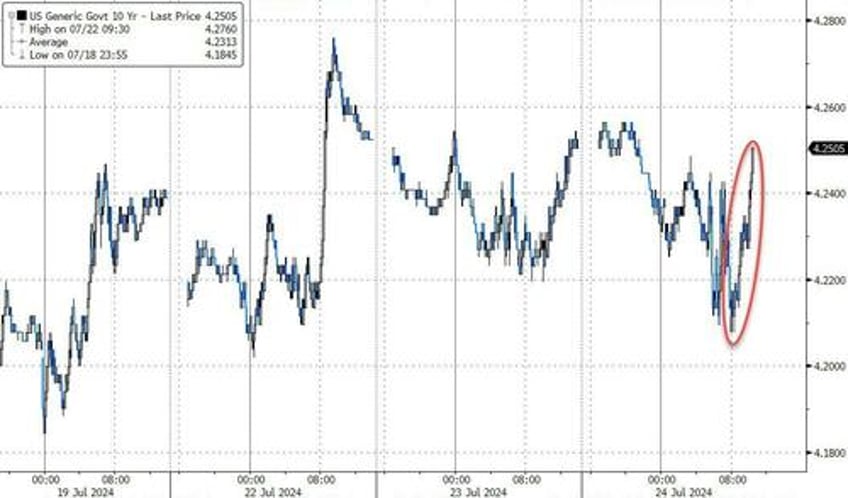

And with the market desperate for soundbites, it is not surprising that the focus was on the latter, with 10Y yields jumping to session highs, last trading at 4.25% after dropping as low as 4.21% moments ahead of the auction.