US yields are at the margin more exposed to a lower-than-expected payrolls release today after Powell’s pushback on a rate hike this week. Nonetheless, leading indicators are pointing to an inflection higher in payrolls growth in the coming months.

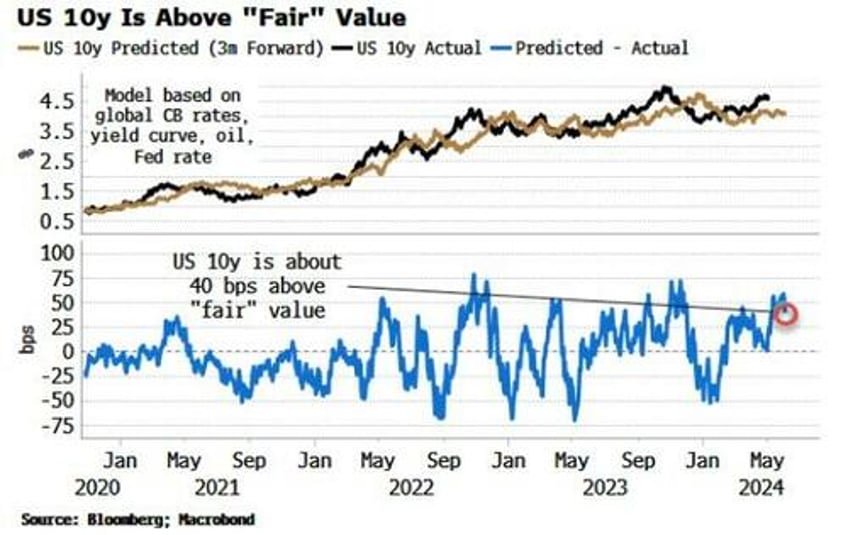

Yields are off their recent highs, but are still prone to falling further if payrolls disappoints. My fair value model for 10-year yields, which uses global central-bank rate policy, the yield curve, oil prices and the Federal Reserve’s policy rate, suggests a 10-year yield ~40 bps lower.

That potential short-term pull to fair value is reinforced by Powell skewing the distribution away from further rate hikes at this week’s Fed meeting. Yields are still set to rise in the medium and longer term (in a yield curve bear steepening), but in the shorter term the risks are tilted to lower yields.

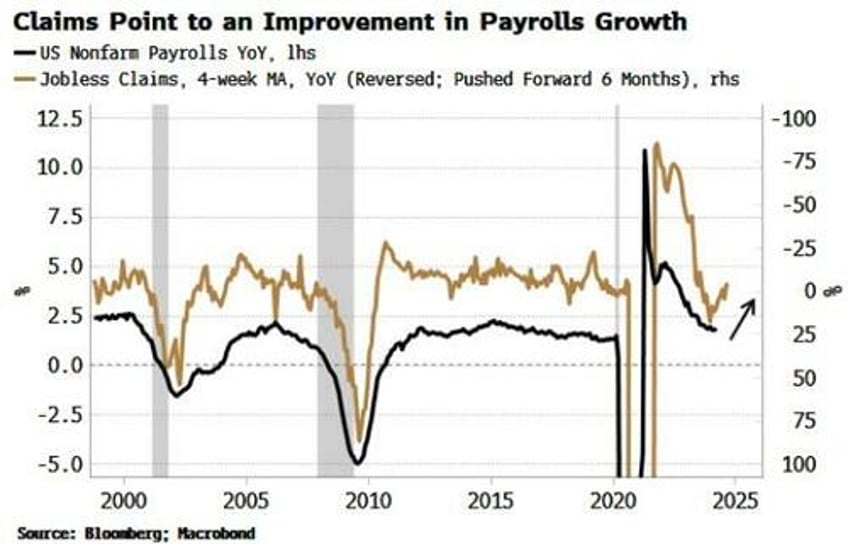

As mentioned, today’s payrolls could be such a catalyst if it is weak. However, it’s worth bearing in mind that the nearer-term outlook for payrolls (the next few months or so) is turning up.

First, temporary-help jobs growth is rising and typically leads annual payrolls growth by about six months.

Second, unemployment claims inflected lower around the end of last year, and this also leads rises in payrolls by about three-to-six months.

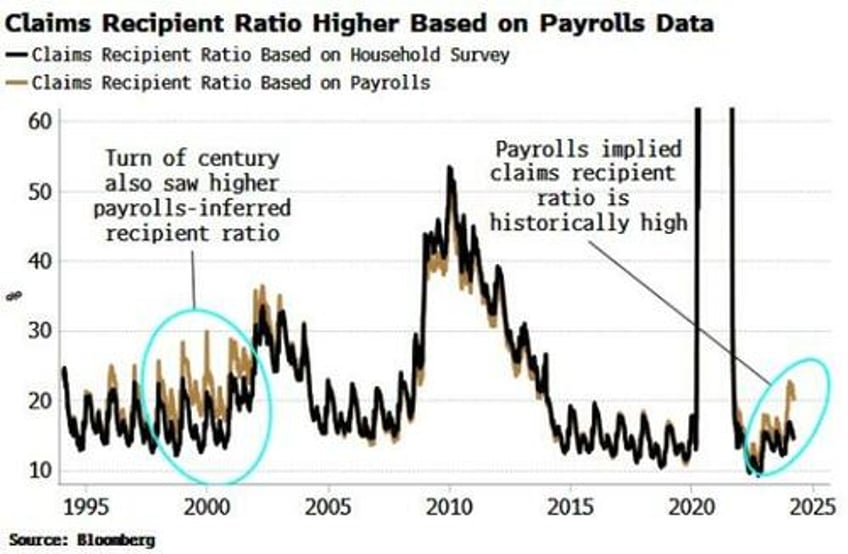

There have been concerns raised about claims data, specifically fewer people taking up the benefit as it is insufficient, or new migrants who are not eligible for it. The ratio of those on claims to the number of unemployed based on the household survey is indeed low.

I have argued that the “truth” of the state of the US labor market probably lies in between the household and establishment (i.e. payrolls) surveys.

If we then also look at the claims recipient ratio based on an approximate estimate for the number of unemployed from the payrolls data, we can see it is higher than the household-survey implied ratio (which also happened in the late 1990s and early 2000s).

So in between the two surveys, the recipient ratio does not look abnormally low.

There may well be (and quite likely is) several issues with the household and establishment surveys and the claims data, but that is what the market is going to trade for now, despite their imperfections. If payrolls growth does start rising and claims stay low, that likely means rising yields again.