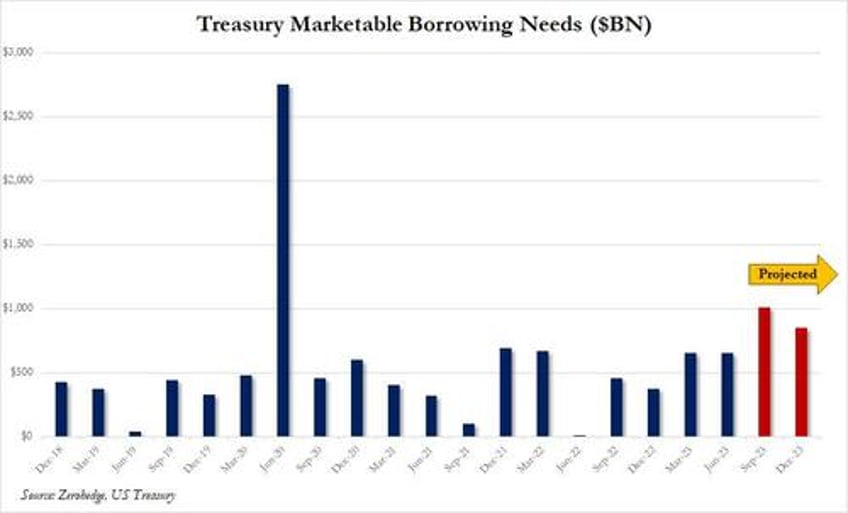

We gave a big picture preview of the debt flood (and fiscal crisis) that is coming to the US this past Monday when, looking at the latest Treasury debt estimates, we showed that the US predicted a near-record $1 trillion in debt sales in the current quarter (up from $$733BN forecast previously) and $852 billion in Oct-Dec quarter, numbers so staggering they are usually associated with economic crises...

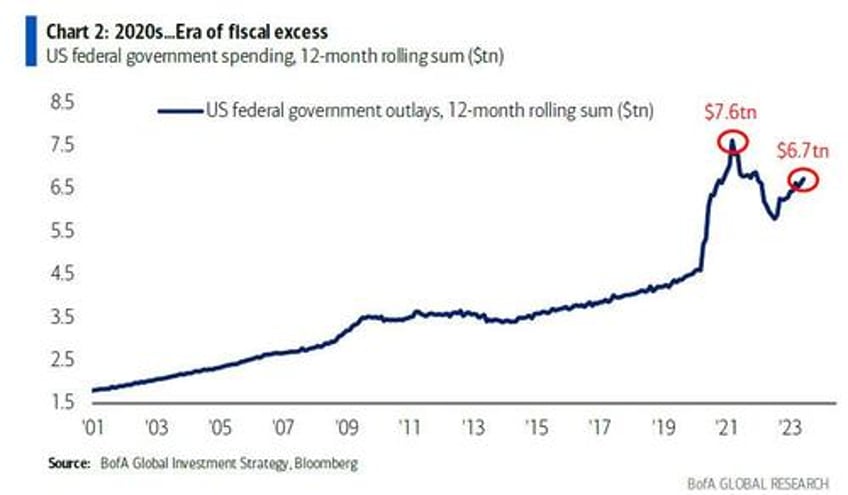

... but in this case a surge in debt issuance meant to sustain the illusion of the deficit-busting Bidenomics, which has managed to keep the US economy from imploding only thanks to massive new debt and deficit spending, or what BofA's Michael Hartnett called "The Era Of Fiscal Excess", something which Fitch finally realized last on Tuesday when it became only the second rating agency in history to downgrade the US AAA rating.

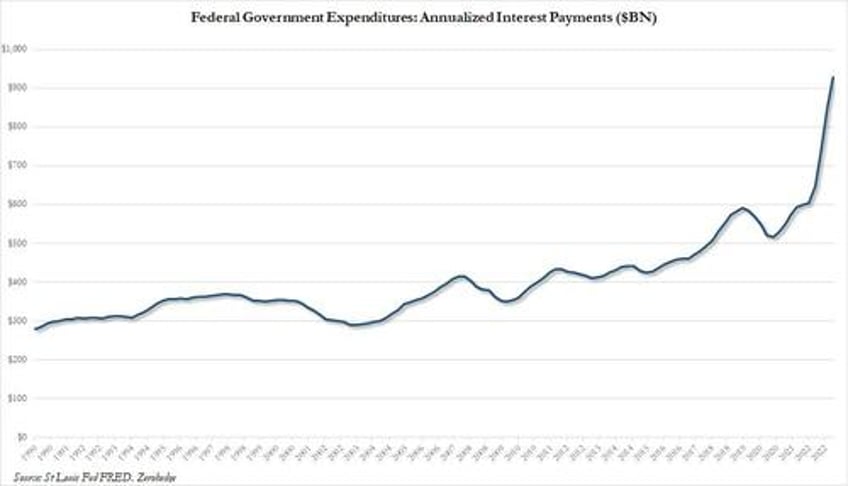

And while the endgame here is the first ever $1+ trillion in US interest payments which we expect will hit within the next 2 quarters...

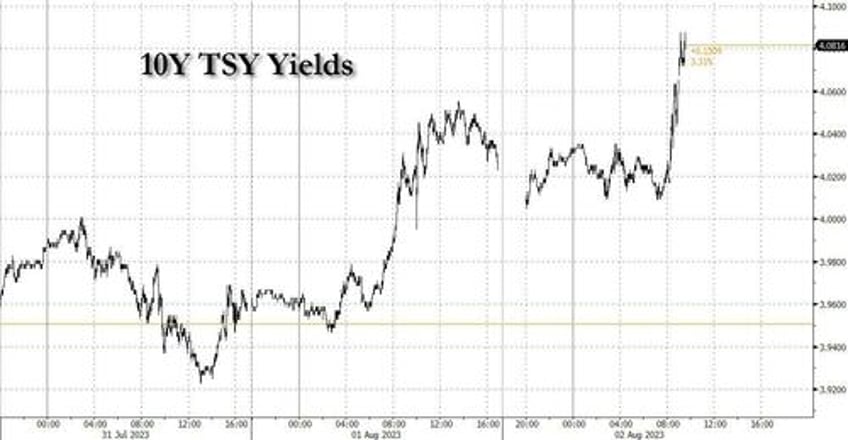

... this morning we got a more granular preview of how we get there, when the Treasury published its quarter refunding statement, in which the US boosted the size of its quarterly sale of longer-term debt for the first time in over 2 1/2 years, testing buyers' appetites amid an increase in government borrowing needs so alarming it helped spur Fitch Ratings to cut the US sovereign rating from AAA (and judging by the surge in yields this morning, the appetite may be lacking).

The Treasury said it will sell $103 billion of longer-term securities at its so-called quarterly refunding auctions next week, which span 3-, 10- and 30-year Treasuries, and will refund approximately $84 billion of maturing Treasury notes and bonds, raising about $19 billion in new cash. That’s a big jump from a $96 billion in gross issuance last quarter, and larger than most dealers had expected.

Specifically, for next week’s refunding auctions, they break down as follows:

- $42 billion of 3-year notes on Aug. 8, up from $40 billion at the May refunding and at the last auction in July

- $38 billion of 10-year notes on Aug. 9, compared with $35 billion last quarter

- $23 billion of 30-year bonds on Aug. 10, versus $21 billion in May

Issuance plans for TIPS, were held steady except for the 5-year maturity, where October’s new-issue auction will go up by $1 billion. Floating-rate note auction sizes were increased by $2 billion.

The table below presents, in billions of dollars, the actual auction sizes for the May to July 2023 quarter and the anticipated auction sizes for the August to October 2023 quarter:

"Over the next three months, Treasury anticipates incrementally increasing auction sizes across benchmark tenors" the TSY said in a statement, adding that it "plans to increase auctions sizes by slightly larger amounts in certain tenors in order to maintain the structural balance of supply and demand across tenors. Treasury will evaluate whether similar relative adjustments are appropriate when determining auction size changes in future quarters."

Treasury plans to increase the auction sizes of the 2- and 5-year by $3 billion per month, the 3-year by $2 billion per month, and the 7-year by $1 billion per month. As a result, the auction sizes of the 2-, 3-, 5-, and 7-year will increase by $9 billion, $6 billion, $9 billion, and $3 billion, respectively, by the end of October 2023.

Treasury plans to increase both the new issue and the reopening auction size of the 10-year note by $3 billion, the 30-year bond by $2 billion, and the $20-year bond by $1 billion.

Treasury plans to increase the August and September reopening auction size of the 2-year FRN by $2 billion and the October new issue auction size by $2 billion.

The bigger than expected jump in issuance showcases the rising borrowing needs that contributed to Tuesday’s decision by Fitch Ratings to lower the sovereign US credit rating by one level, to AA+. Fitch said it expects US finances to deteriorate over the next three years, and that's using old and outdated assumptions: the current reality is much worse.

Ahead of the announcement, dealers had laid out expectations for stepped-up issuance of other securities, and for the boosts in sales to stretch into 2024, which the Treasury confirmed on Wednesday.

“While these changes will make substantial progress towards aligning auction sizes with intermediate- to long-term borrowing needs, further gradual increases will likely be necessary in future quarters” the department said in a statement.

Since the suspension of the debt limit in early June, Treasury has increased bill issuance to continue to finance the government and to gradually rebuild the cash balance over time to a level more consistent with its cash balance policy. As previously noted, Treasury anticipates that the cash balance will approach levels consistent with its policy by the end of September. Accordingly, Treasury anticipates further moderate increases in Treasury bill auction sizes in the coming days. Treasury also intends to continue issuing the regular weekly 6-week CMB, at least through the end of this calendar year.

* * *

Separately, the Treasury said on Monday it is also targeting an increase in its cash balance to $750 billion at year-end, which according to Barclays strategist Joseph Abate, would push T-bills to exceed the 20% ceiling of overall debt suggested by the Treasury Borrowing Advisory Committee (or TBAC, the committee that quietly runs the world's biggest bond market).

Indeed, in the refunding statement, the Treasury said that it anticipates "further moderate increases in Treasury bill auction sizes in the coming days. Treasury also intends to continue issuing the regular weekly 6-week CMB, at least through the end of this calendar year. " In a separate statement released Wednesday, the TBAC indicated that exceeding the recommended share of bills for a time wouldn’t pose a problem.

“The committee expressed comfort with the possibility that the Treasury bill share as percentage of total marketable debt outstanding might temporarily rise above their recommended range, given robust demand for bills,” the panel said.

US debt managers also detailed plans over coming months to lift sales of nominal Treasuries of all other maturities, in differing amounts depending on the security.

Separately, the TBAC also presented on important considerations for Treasury when determining which coupon sectors and tenors to increase.

The presenting member discussed a variety of considerations based on the committee’s Optimal Treasury Debt Structure Model, investor demand, and market functioning and liquidity. The presenting member also highlighted that recent bill issuance has been absorbed well and suggested that money market fund demand would provide significant capacity for additional bill issuance.

Outlined were several potential issuance scenarios and concluded that Treasury should increase issuance across the curve, given strong demand across all tenors, with marginally smaller increases for the 7- and 20-year tenors. The TBAC also thought the market could absorb modest increases in TIPS auction sizes, which would be helpful for maintaining the TIPS share as a percentage of total marketable debt outstanding

Additionally, there was a “robust discussion” on the different assumptions used in the model, particularly with regard to term premia, and how those assumptions may influence the Model’s conclusions. It was noted that the model is one of many useful inputs that Treasury should consider when determining issuance size changes

Also, the TBAC anticipated that increases in coupon issuance would likely occur over several quarters, but this would depend on how the borrowing outlook evolves. It recommended that increases occur across tenors, but with smaller increases in the 7- and 20-year tenors. Also recommended increases to FRN and TIPS auction sizes, and the committee expressed comfort with the possibility that the Treasury bill share as percentage of total marketable debt outstanding might temporarily rise above their recommended range, given robust demand for bills

Separately, debt manager Kyle Lee presented Treasury’s current views on the operational design parameters of the regular buyback program. Treasury plans to conduct liquidity support and cash management buybacks in 9 buckets based on maturity sectors across the curve for nominal coupon securities and TIPS.

- For liquidity support, Treasury anticipates operating in each bucket around one to two times per quarter, while cash management buybacks would occur in the front-end with operations likely occurring around major tax payment dates

- Lee noted that Treasury plans to announce a maximum amount it is willing to buy back per quarter in each maturity bucket for liquidity support and cash management, and highlighted that Treasury does not plan to establish a fixed minimum amount to buy back in any given operation and that it is possible that Treasury may not buy back any securities during an operation

- He also discussed what securities would generally be excluded from operations and how purchase limits per CUSIP would be approached

- Lee reviewed how Treasury plans to communicate around buyback operations with regard to announcements and results, and he highlighted outstanding issues that Treasury is still considering

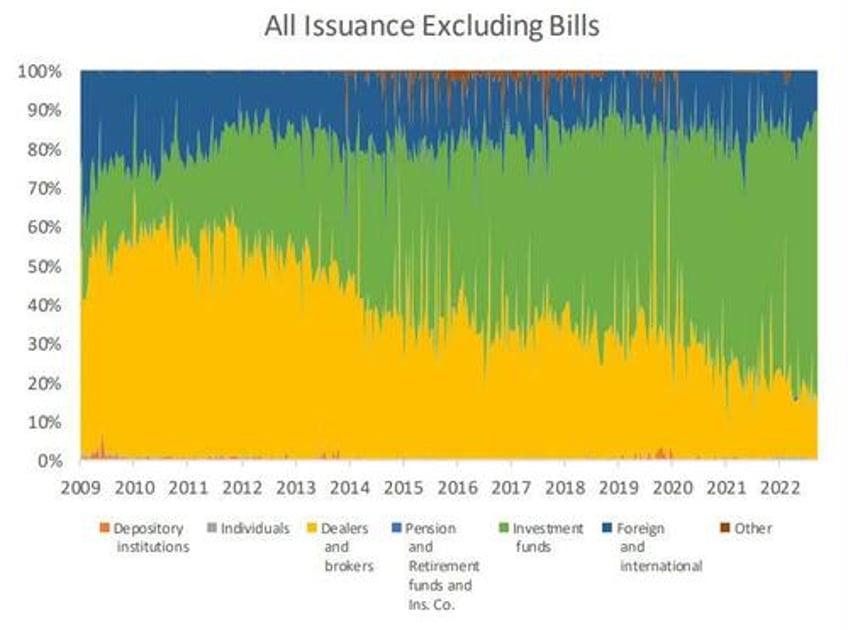

The TBAC also looked at the Auction allotment over time: it found that the dealer participation in issuance has steadily declined over the past decade (thanks to QE), and that increased percentage of supply is being absorbed by investment funds, while foreign participation has remained range bound.

This Increased reliance on investment funds implies:

- Larger tails when those funds are less enthusiastic to provide liquidity

- Stops way through the pre-auction levels when those funds are motivated to buy

Translation: while investment funds have been gobbling up paper - mostly to fund basis trades - the moment the basis trade blows up again, as it did in Sept 2019 and March 2020, the Fed will come running in to backstop everything.

The full must read TBAC presentation on the coming debt-issuance deluge is here.

* * *

Putting it all together, and looking ahead, the message is simple: as Joseph Wang put it, "Bill issuance is heavy next few months, so Treasury will soon be at their 20% recommended level. Then trillions in coupons each year forever."

Here's latest Treasury supply estimates from public and private sector analysts. Bill issuance is heavy next few months, so Treasury will soon be at their 20% recommended level. Then trillions in coupons each year forever

— Joseph Wang (@FedGuy12) August 2, 2023

IMO I can't see anything but structurally higher yields. pic.twitter.com/PzKbwWyHeO

He concluded that he "can't see anything but structurally higher yields." He is right, of course, and it is only a matter of time before the buyer of last resort, the Fed, will be forced to step in with another round of QE. So keep an eye on the next manufactured crisis that will enable the Fed to do just that.

* * *

Following news of the "larger than expected" refunding amounts, Treasuries dropped with benchmark 10-year yields spiking to as high as about 4.08%, a gain of around 5 basis points relative to Tuesday’s close.