Rising inflation is likely to push more traders to go outright short on US Treasuries, supporting yields.

The inflation tide is turning. Disinflation has stalled in the US, core inflation in Japan is stuck at more than 30-year highs, and the global median inflation rate has stopped falling.

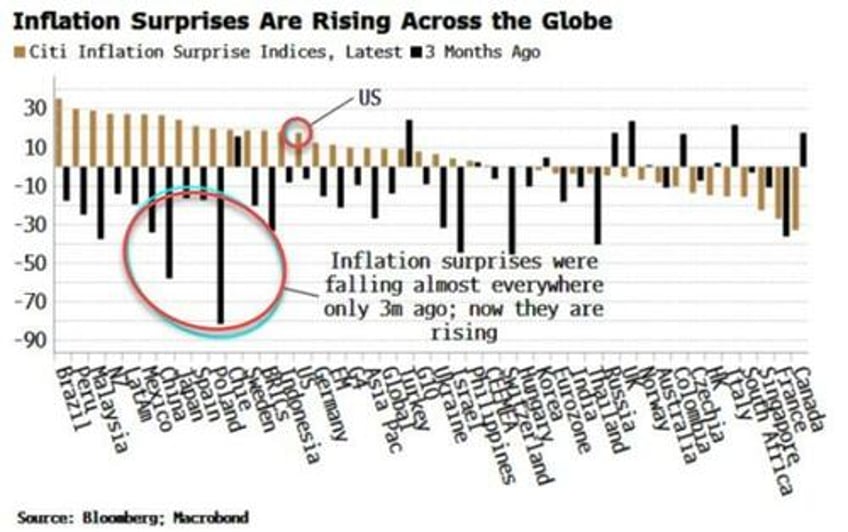

Global disinflation momentum has petered out. The Citi Inflation Surprise indices, which were negative in almost every country only three months ago, are now positive is most countries.

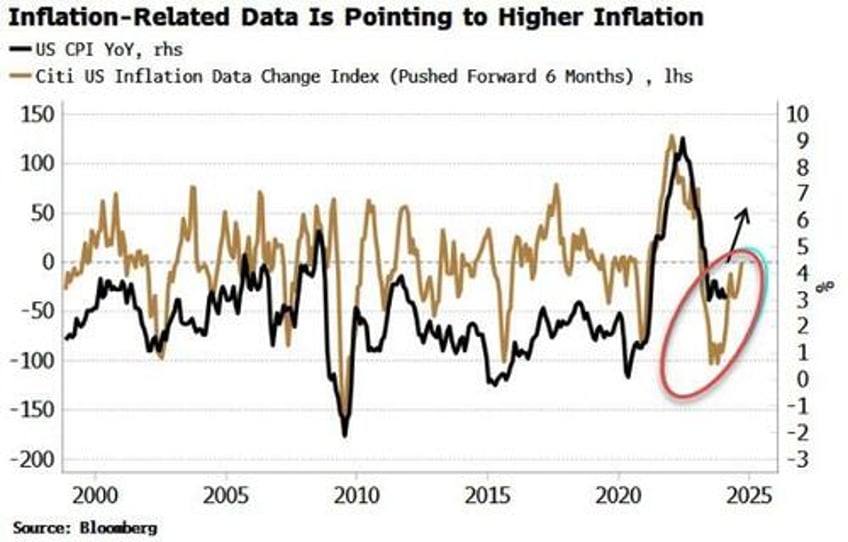

We’ll get updates on inflation this week from several countries in Europe as well as the US. Leading data has been consistently pointing to a re-rise in US inflation.

To add to that, Citi also produces an Inflation Data Change Index for the US, which tracks the cumulative change in inflation-related data. It shows US CPI should soon start rising again.

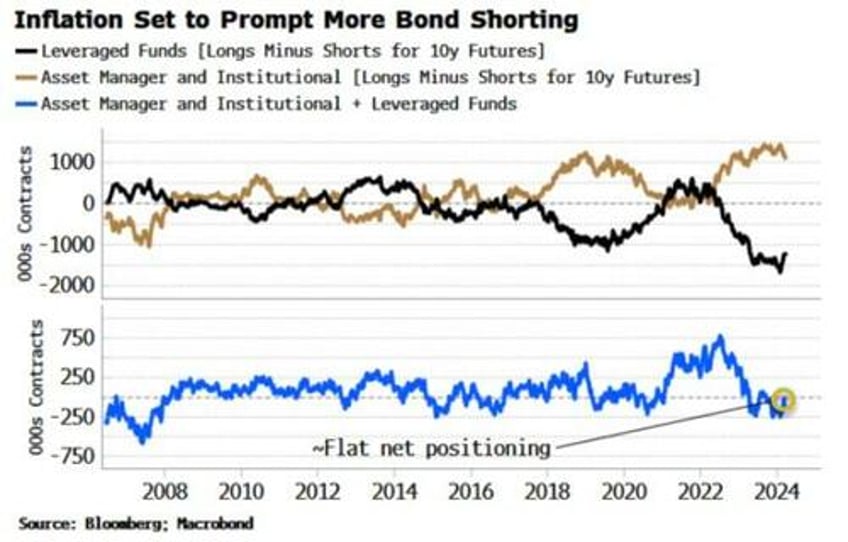

That’s a challenge for bond holders. Speculators’ positioning in USTs in the Commitment of Traders report is very net short, but this data is polluted by the basis trade, i.e. trading the bond future versus the underlying cash bond.

A better way to look at the data to try to account for this is to focus on the positioning of asset managers and leveraged funds. Typically, the second places the trade with the first via the repo market.

If we net the positioning in futures between leveraged funds and asset managers that should eliminate much of the contribution from basis trading. The net position in 10y UST futures is basically flat (orange line in the chart below).

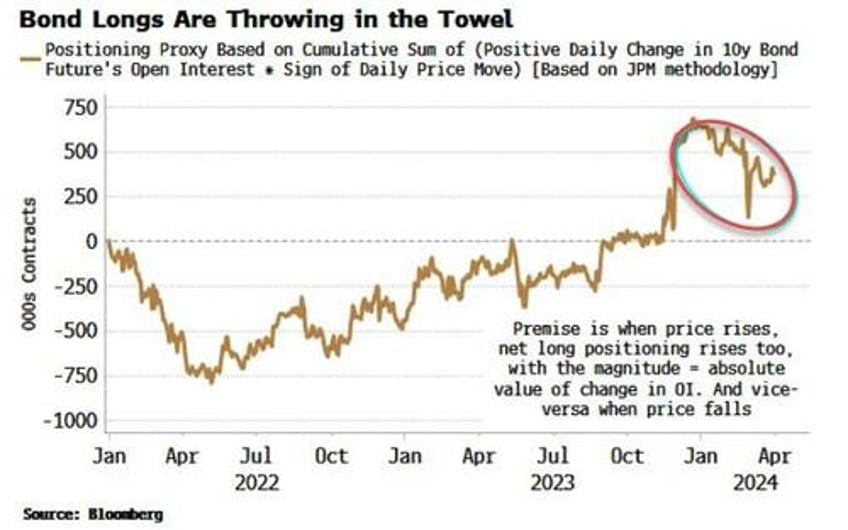

Another proxy for bond positioning shows that longs in 10y notes have been falling quite rapidly from their highs at the end of the last year. Furthermore, JP Morgan’s Client Treasury Survey shows outright shorts at almost series lows.

The overall message is that bond traders have been reducing longs as recession risk has receded, but they have not yet gone net short en masse. However, the inflation picture is likely to soon change that.

This week’s inflation data has a risk tilt, in that a lower-than-expected print is unlikely to prompt a stampede of fresh longs, but data that is above expectations could see any lingering doubts about going short bonds adamantly put to one side.