Back at the start of August, when 10Y TSYs were trading just around 4.00%, Bill Ackman sparked a modest selloff in rates when, without telling the world something it didn't already know, he tweeted he was shorting 30Y due to "higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining power of workers" the bond market could "reprice the long end of the curve in a matter of weeks, and this seems like one of those times."

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining…

— Bill Ackman (@BillAckman) August 3, 2023

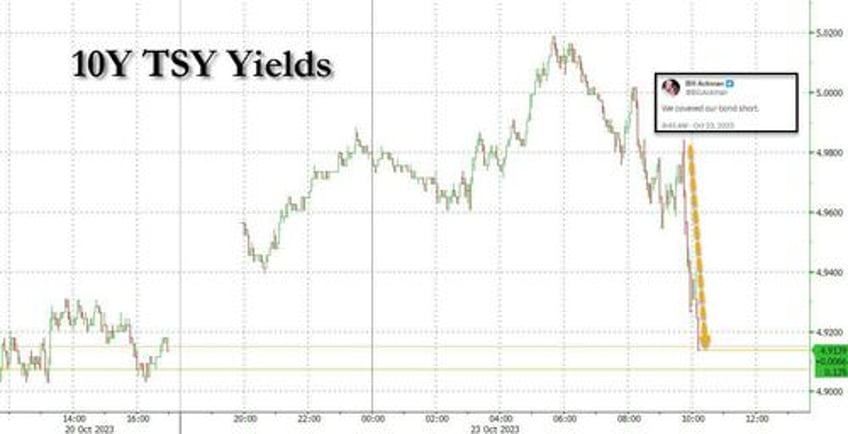

Just under three months later, the predicted repricing has indeed taken place - largely thanks to an out of control fiscal situation which has seen the US add $600 billion in new debt in the past month - and moments ago Ackman said that he was closing his bond short as "there is too much risk in the world to remain short bonds at current long-term rates"...

We covered our bond short.

— Bill Ackman (@BillAckman) October 23, 2023

... and in a slap to the face of Biden's Department of goalseeking strong data which is then revised much lower one month later, the billionaire hedge fund manager said that "The economy is slowing faster than recent data suggests."

The economy is slowing faster than recent data suggests.

— Bill Ackman (@BillAckman) October 23, 2023

The market reaction was instantaneous, with 10Y yields - after earlier breaching 5.00% for the first time since 2007 - certifying that they now trade as pennystocks, and tumbling more than 7bps on Ackman's tweet alone, down to 4.91%.