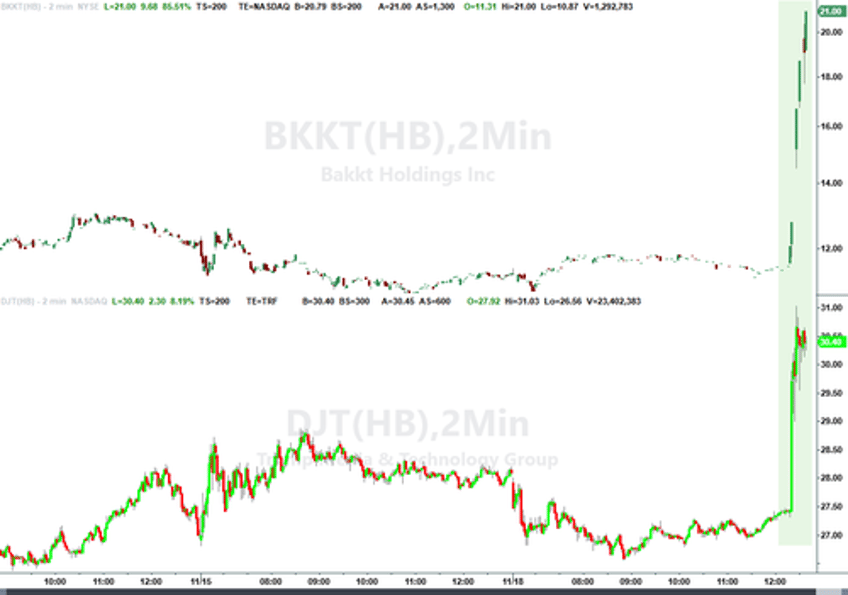

Donald Trump's social media company, DJT, soared 8%, amid reports that it was in advanced talks to buy Bakkt, a cryptocurrency trading venue owned by Intercontinental Exchange, as it pushes to expand beyond online conversation.

The US president-elect’s Trump Media and Technology Group, in which he has pledged to retain his 53% stake, is closing in on an all-share purchase of Bakkt, the FT reported citing two people with knowledge. The valuation under discussion was not immediately clear but Bakkt’s market capitalization stood at just over $150 million on Monday. DJT's market cap was $6 billion before the news hit.

As the FT reports, TMTG, which operates Truth Social, has become one of the most actively traded US stocks since Trump’s election victory as retail investors try to profit on its often-volatile trading moves. What is remarkable is that the company has a $6 billion market cap even though it has reported just $2.6 million in revenues; clearly the stock is extremely overvalued and gives the management a valuable currency with which to buy other companies. Which it is now doing.

A successful deal would deepen Trump’s move into the cryptocurrency market after he began promoting a new crypto venture set up by longtime business partners, World Liberty Financial, from which he stands to earn significant fees. Crypto markets have also soared following his election victory, with bitcoin up more than 30 per cent on speculation that his administration would enact favourable legislation for the industry.

Bakkt, which has also struggled for profitability since its launch, was created by ICE, and the owner of the New York Stock Exchange still holds a 55% economic interest in it. Its stock soared 47% on the news and was promptly halted.

Bakkt’s first chief executive was Kelly Loeffler, a former head of marketing at ICE and a Republican ex-senator for Georgia during Trump’s first presidency. She is co-chair of the committee organising his inauguration in January. She is also married to Jeff Sprecher, ICE’s founder, chair and chief executive.

Bakkt previously said its crypto custody business, which has a regulatory license from New York authorities, is likely to be wound down. The FT noted that it would not be included in the deal.

The crypto business had been set up to hold digital assets such as bitcoin and ether on behalf of customers but failed to gain traction and made operating losses of $27,000 from revenues of $328,000 in the three months to September 30. Bakkt is planning to build a trading platform for institutional investors. Bakkt had faced delisting from NYSE owing to its lowly share price, until it effected a 1 for 25 reverse stock-split in April. Last week its share price rose 15%; the stock soared almost 90% and was halted on the FT news, while DJT stock jumped 8%.

Truth Social remains tiny in terms of its reach, averaging 646,000 daily visits to its website this month, according to Similarweb, compared with 155mn a day for Elon Musk’s X platform. Even so, the president-elect’s stake now accounts for more than half of his $5.7bn wealth, as calculated by Bloomberg.

Separately, the WSJ reported that Trump is meeting with the CEO of Coinbase Monday, according to people familiar with the matter. The duo is expected to discuss personnel appointments for his second administration. The meeting between Trump and Brian Armstrong would mark the first time the two have met since Election Day and comes as Trump continues to fill out his cabinet and other senior posts. Trump, formerly a crypto skeptic, has turned into a vocal supporter of the industry.