Long Bitcoin / Short Miners Is The Mid-Curve Trade of the Year

I’ve never understood the hedgies’ penchant for pair trades: long this / short that is supposed to be some kind of big brain move that either outperforms something or hedges out the risk – like I said, I don’t always grok them, maybe because I don’t have an MBA in finance.

To be clear, when I see one I usually do understand the overall thesis – what I don’t understand is the way they seem to put an upside ceiling on returns if you’re right. It probably makes sense to do this when you manage other people’s money.

But a TradFi firm called Kerrisdale Capital has a pair trade on that, may seem counter-intuitive at first glance.

It’s long Bitcoin, and short miners – specifically RIOT Blockchain (Nasdaq: RIOT).

They have a separate trade on that’s short MicroStrategy (Nasdaq: MSTR), also long Bitcoin.

The long Bitcoin half of each trade, according to their pinned tweet, is a hedge. The short side is against MicroStrategy for being an inferior proxy to Bitcoin, especially now that ETFs are here, and in Riot’s case? Well they’ve declared war on Bitcoin mining:

“Our investment thesis is that this sector is not going to be around in five years. Bitcoin mining is one of the stupidest business models we’ve come across in our time short selling over the past 15 years.”

— Kerrisdale Capital CIO Sahm Andrangi

Today, we launch a war against bitcoin miners, an industry of snake oil salesmen that are incinerating both investor capital and the environment and should be banished from America much like the Chinese RTO frauds that we helped kick out a decade ago (1/10)

— Kerrisdale Capital (TradFi) (@KerrisdaleCap) June 5, 2024

One of the cornerstones of Kerrisdale’s short thesis is that MSTR (and the miners) go up more than Bitcoin when there is no reason for them to. Especially now that the spot ETFs are here, both the miners and MSTR are inferior proxies to Bitcoin.

If they’re right – miners go to zero, so will Bitcoin – I assume they make more money on the RIOT (and MSTR) shorts than they lose on the Bitcoin.

If they’re wrong – and the miners and MSTR continue to outperform Bitcoin, they will get destroyed on their shorts, while the upside from their hedge – Bitcoin, by their own thesis, is going to lag (this is the part of the pair trade I’m having issues understanding, unless maybe they’re levering up?).

I think what’s confusing me is that the side of their pair trade that means they’re right already has limited upside. Shorts can only go to zero, your upside is capped at 100%, unless you’re using leverage to enhance that – in which case you’re risk is even higher.

What makes more sense to me is that if you’re going to put on a pair trade, you do it with unlimited upside on being right and with the hedge for being wrong on the downside. Kerrisdale seems to have it backwards, especially because we’re dealing with Bitcoin – the highest performing asset in history.

Bitcoin mining is one of the worst biz models we have ever seen: capital intensive, extremely competitive, a pure commodity product & now drawing intense regulatory scrutiny. With bitcoin ETFs abundant, there’s no reason to own these dismal businesses as bitcoin proxies 4/10

— Kerrisdale Capital (TradFi) (@KerrisdaleCap) June 5, 2024

They’re not wrong.

Even Saifedean Ammous – author of seminal book The Bitcoin Standard has said that Bitcoin mining has got to be one of the worst businesses out there (and points out that the same has always applied to gold miners).

So why would anybody in their right mind hold shares in a Bitcoin miner?

Three Ways Bitcoin Miners Fund Their Operations

There are three ways for mining companies to fund themselves and make a return for shareholder:

#1) Sell the Bitcoin as you mine it.

Especially in a bull cycle when the price is constantly going up – and knowing that the block rewards are going to halve within four years, makes a certain amount of sense.

Core Scientific (Nasdaq:CORZ) is an example of a public miner that does this.

Most miners don’t do that however (unless circumstances force them too), especially among the publicly traded miners – the name of the game is HODL! Stack those sats and pile up as many as possible.

If you’re HODL-ing your BTC and it takes operations like this:

…in order to mine them.

That must mean you are looking further down the road than next quarter (hold that thought).

The other two ways:

Funding method #2) Take on debt

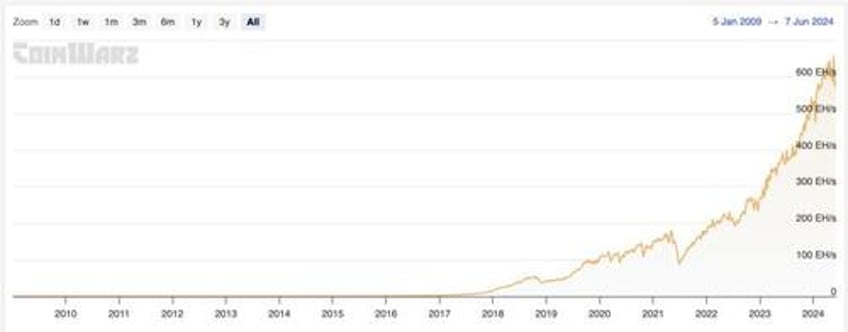

The mining game is a never-ending struggle to grow one’s hashpower at a rate faster than the overall network is growing, and if you thought the price action of Bitcoin was nuts, just try to wrap your head around the hashrate 👇

As I reported previously in The Bitcoin Halving Crash Course, this pencils out to in excess of 600 million trillion computations per second.

That leaves mining outfits competing to acquire: more ASICs (specialty miners that crunch the calculations), power, and datacenters.

And while critics – including Kerrisdale – argue that this is a monumental waste of resources and energy to maintain a decentralized, non-state monetary network…

…it’s actually quite a bit more benevolent, not to mention civilized, compared to the energy and resources it takes to enforce a fiat dollar standard.

Taking on debt works fine in an up cycle, especially when interest rates are squashed through the floor. But when crypto winter hits – look out.

Many of the miners who levered up (BITF, CBIT) had to sell down their HODL in order to survive it – and do so at depressed prices.

Funding method #3: issue shares (dilute, dilute, dilute…)

What may look more appealing than debt, is to issue shares.

You can do that provided Bitcoin is going up faster than your dilution rate.

The miners get an extra boost, because in up cycles, they go up more than Bitcoin.

As does MicroStrategy – and this is one of the main objections Kerrisdale Capital has to all this:

They shouldn’t.

We’ve been hearing a lot of this.

- Bitcoin shouldn’t be outperforming gold — Peter Schiff

- MSTR and miners shouldn’t be acting as leveraged proxies for Bitcoin (Kerrisdale)

Bitcoin ETFs should be bad news for MSTR and even worse news for miners.

Canada has had spot Bitcoin ETFs for years and it didn’t stop Bitfarms (BITF.V) from being the number one performing stock on the TSX-V for 2023, it was number three on the Nasdaq (BITF).

Up 618% on the year, it outpaced Bitcoin’s 162% by nearly 4X while the Canadian ETFs pretty much tracked the spot price (mildly lagging, actually).

Why?

When logic says they “shouldn’t” but in reality they do, there has to be a reason.

Few. pic.twitter.com/5kO0Tyooh2

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) June 7, 2024

Make it make sense

My thesis has always been that the Bitcoin phenomenon isn’t “a trade” – it’s not like finding some hot penny stock that’s going to rocket higher for longer – but at some point it has to peak or at least level off.

Bitcoin is a monetary regime change.

If you’re founding, operating, or investing in any of these monster data centers that mine Bitcoin, it isn’t because you think “number go up” as much as you are anticipating a world of hyper-bitcoinization.

Today we have the money center banks endlessly creating fiat backed by nothing out of thin air. The world looks like this:

In the coming Post Fiat Era, it’ll look more like this:

It sounds crazy now – but so did Bitcoin, back in 2009. Look at the scoreboard.

Our thesis in The Bitcoin Capitalist stock portfolio is that somewhere in there we have an Amazon of crypto, a Berkshire Hathaway of crypto, and a Microsoft of Bitcoin (among others). We don’t second guess why they outperform Bitcoin or ETFs, we just look at where we think they’ll be 10 or 20 years out from a “1000-baggers” framework. Try it out here or sign up for the free list here and get The Crypto Capitalist Manifesto.

Follow me on Twitter, or Nostr (npub: npub1elwpzsul8d9k4tgxqdjuzxp0wa94ysr4zu9xeudrcxe2h3sazqkq5mehan )