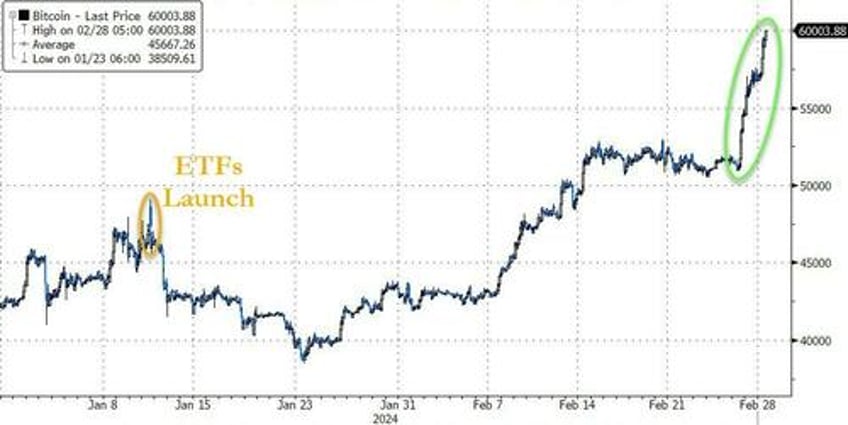

Bitcoin breached $60,000 for the first time in two years and three months after rising over almost 20% in the last three days...

Source: Bloomberg

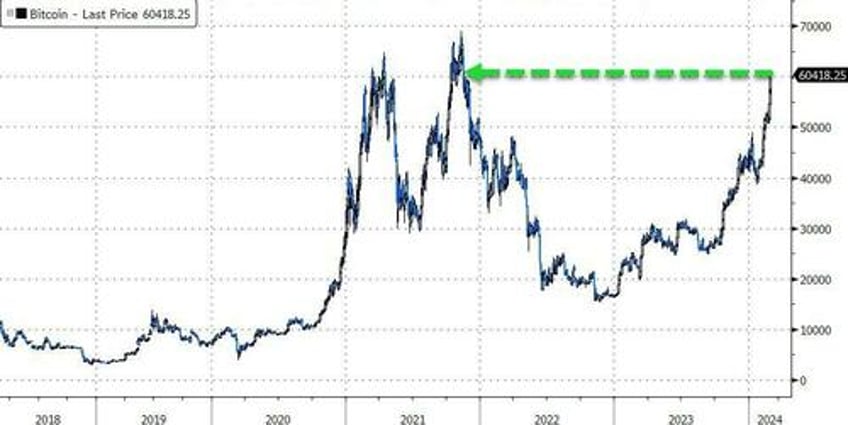

The last time Bitcoin traded above $60,000 was on Nov. 12, 2021, when Bitcoin started its reversal, falling over 67% to the macro low of $19,297 at the beginning of April 2022.

Source: Bloomberg

Ethereum has also been on a strong run recently, topping $3300 for the first time since April 2022...

Source: Bloomberg

Additionally, over the past few days, BTC has hit ATH’s price against the Japanese yen, Malaysian ringgit, Indian rupee, Taiwan dollar, South Korean won, Chilean peso, Australian dollar, Chinese yuan, South African rand, Norwegian krone and Turkish lira.

“It’s pretty nuts,” said Ryan Kim, head of derivatives at digital-asset prime brokerage FalconX.

The new BTC ATH against these currencies indicates a declining market value for the fiat currencies.

CoinTelegraph reports that Bitcoin’s price performance can largely be attributed to the market anticipation surrounding the upcoming halving event, which historically leads to increased buying activity, according to Bryan Legend, investor and CEO of Hectic Labs. He told Cointelegraph:

“Investors expect a reduction in supply to drive up prices. This is better known as the ‘Pre-Halving rally’ which contributes to a new bull market with a refreshed bullish sentiment. This is exactly what we are seeing today.”

Yet, according to pseudonymous crypto analyst Rekt Capital, a “pre-halving retracement” could still be on the table. The pseudonymous analyst added that the upcoming Bitcoin halving isn’t priced in by the market, based on historical market data that saw Bitcoin’s major movements occur after previous halvings, not before, Rekt Capital shared in a Feb. 28 X post.

Here’s Why the Bitcoin Halving Is NOT Priced In

— Rekt Capital (@rektcapital) February 27, 2024

If you enjoyed this 1-minute summary on #BTC

Checkout the full video here:https://t.co/jxduExhrTu

Enjoy and Subscribe!$BTC #Crypto #Bitcoin pic.twitter.com/UrWxbMA7iK

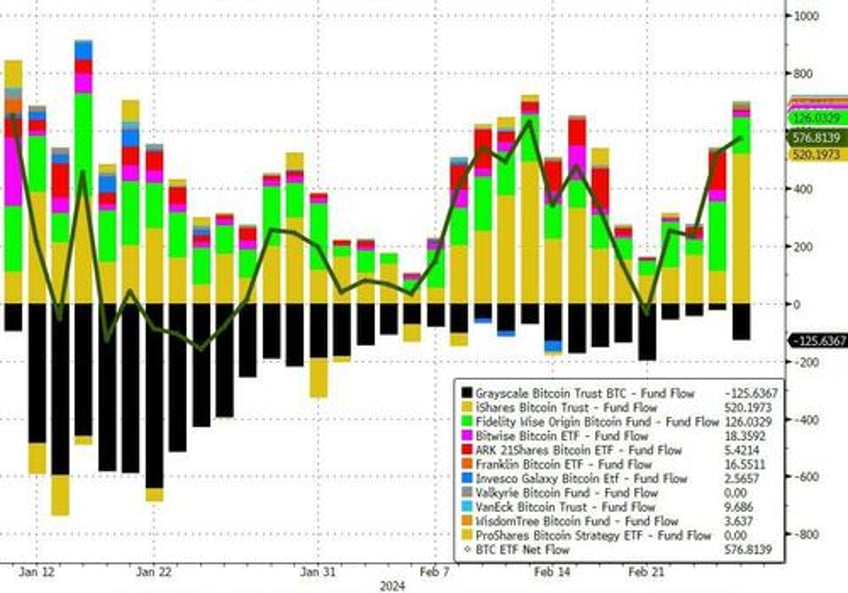

Bitcoin’s bullish momentum comes two days after the spot Bitcoin exchange-traded funds (ETFs) in the United States broke an all-time high of $2.4 billion in daily trading volume on Feb. 26, according to Eric Balchunas, senior ETF analyst at Bloomberg.

Bitcoin ETF Flows. Source: Bloomberg

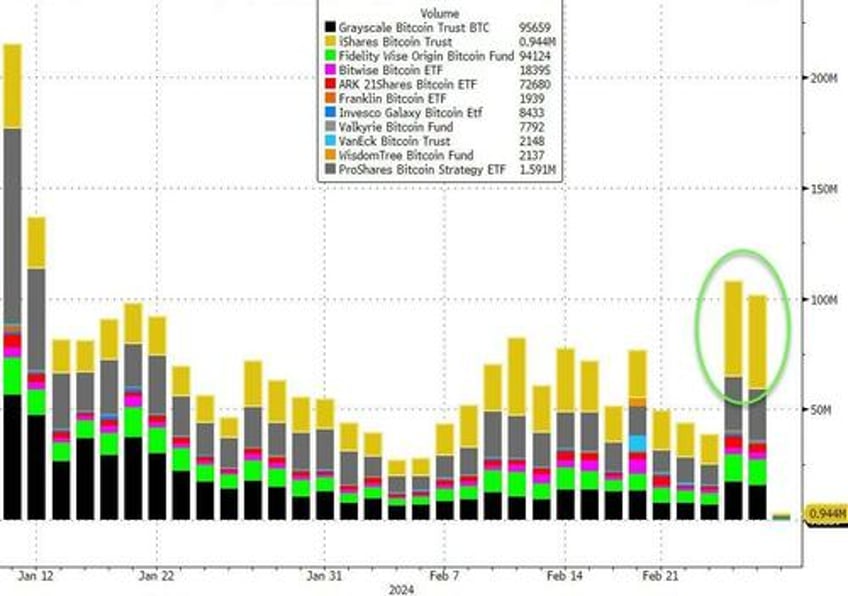

The nine spot Bitcoin ETFs have recorded combined trading volumes of over $2 billion for the second consecutive day on Feb. 28.

Bitcoin ETF Volumes. Source: Bloomberg

BlackRock’s iShares Bitcoin ETF (IBIT) recorded over 100,000 individual trades on Feb. 27, up from around 30,000 to 60,000 average daily trades, according to an X post by Balchunas.

This is wild stat: there were more individual trades yesterday in the bitcoin ETFs than there were in $SPY or $QQQ. And this is before they have options and/or are available on many advisory platforms. Def a big retail component given size of trades. Bigger that I estimated. https://t.co/PHsD4caa4c

— Eric Balchunas (@EricBalchunas) February 28, 2024

An estimated 75% of new Bitcoin investments came from the spot Bitcoin ETFs in the United States, according to a Feb. 14 report by on-chain data analytics firm CryptoQuant.

“This reversal is all the more impressive in the light of central banks signaling they intend to keep rates high a while longer, eroding the theory that the next crypto bull would be driven by dropping interest rates,” said Michael Safai, co-founder at quantitative trading firm Dexterity Capital.

As CoinTelegraph reports, Bitcoin’s price rally comes two days after the announcement that Michael Saylor’s MicroStrategy had acquired an additional 3,000 BTC for a total of $155 million at an average price of $51,813 between Feb. 15 and 25. With a total of 193,000 BTC acquired for $6.09 billion at an average price of $31,544, MicroStrategy is the world’s largest Bitcoin holder among publicly traded companies.

MicroStrategy has acquired an additional 3,000 BTC for ~$155 million at an average price of $51,813 per #bitcoin. As of 2/25/24, @MicroStrategy now hodls 193,000 $BTC acquired for ~$6.09 billion at an average price of $31,544 per bitcoin. $MSTR https://t.co/micudbYf3P

— Michael Saylor⚡️ (@saylor) February 26, 2024

According to Mikkel Morch, founder of the digital asset investment fund ARK36, MicroStrategy’s recent purchase is the institutional endorsement mainly fueling this rally. Morch wrote in a research note shared with Cointelegraph:

“This rally is not just numbers on a chart; it’s a declaration of the confidence among institutional investors in the transformative potential of cryptocurrencies… Moreover, the green light for Bitcoin-owning ETFs in the United States has injected a fresh wave of optimism, propelling trading volumes and spotlighting crypto-linked firms amidst a broader market fraught with apprehension.”

According to Morch, we could see a new all-time high for both Bitcoin and Ether in the next couple of weeks, driven by the anticipation of the upcoming Bitcoin halving and the potential acceptance of a United States spot Ether ETF.

He wrote:

“The anticipation swirling around the approval of spot Ether ETFs further underscores the maturation of the cryptocurrency market. It recognition of Ethereum’s role not just as a digital currency, but as an infrastructure backbone for a future where finance and technology merge more seamlessly.”

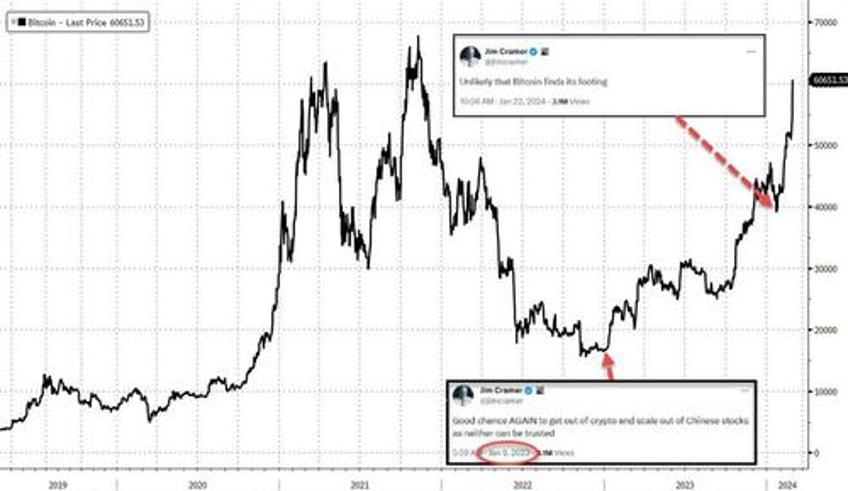

Of course, we could always wait for Jim Cramer's advice as to what will happen next...

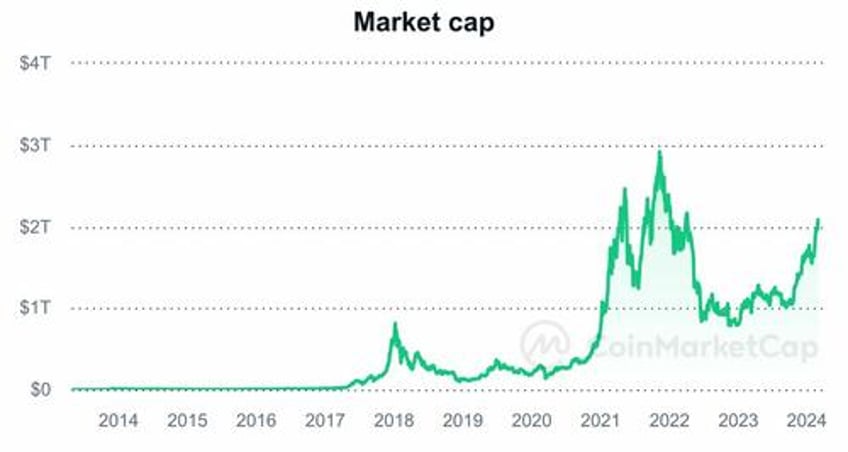

The total crypto market capitalization increased by 2.85% in the past 24 hours to $2.19 trillion.

Ethereum is now larger than Exxon Mobil and Bitcoin overtook Meta in market cap.