Bitcoin prices plunged overnight after now-defunct Bitcoin exchange Mt. Gox said it would begin distributing assets stolen from clients in a 2014 hack starting in July, after years of postponed deadlines.

"The Rehabilitation Trustee has been preparing to make repayments in Bitcoin and Bitcoin Cash under the Rehabilitation Plan," trustee Nobuaki Kobayashi said in a statement posted on the Mt. Gox website today.

"The repayments will be made from the beginning of July 2024," Kobayashi added, noting due diligence and safety steps are still required.

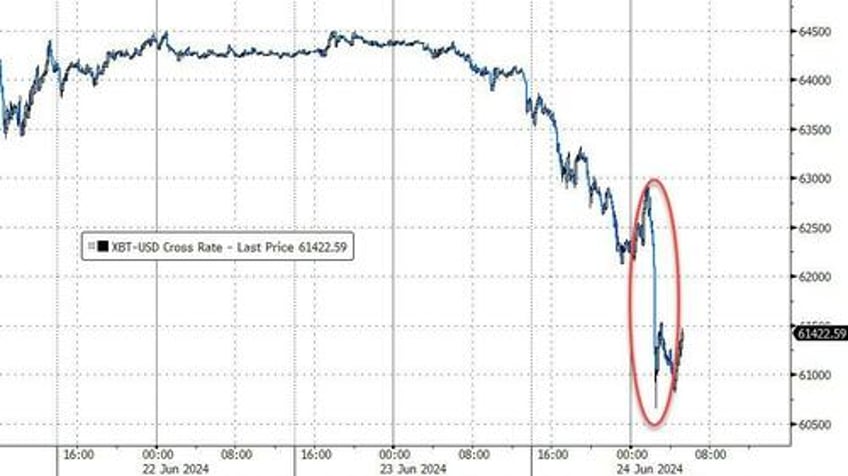

The statement sent BTC down to a $60,000 handle as market participants fear the release - after ten years - of the proceeds will lead to an imminent sell-off in BTC and BCH...

Source: Bloomberg

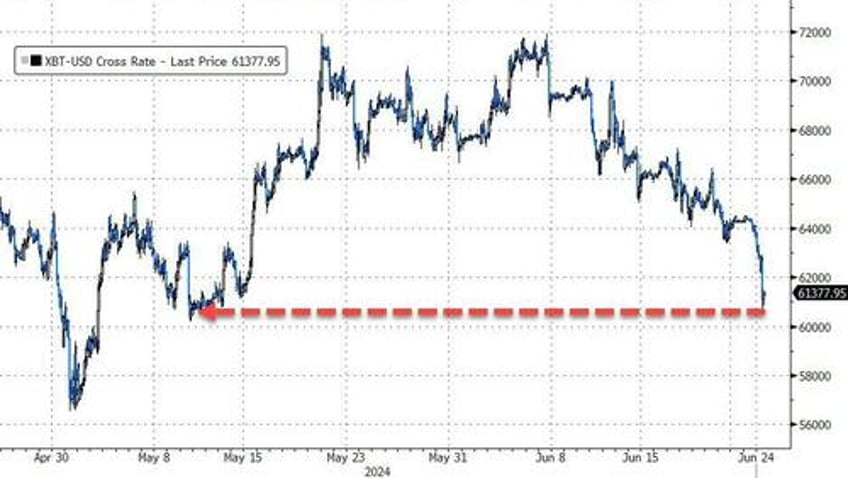

...its lowest in six weeks...

Source: Bloomberg

As BitcoinMagazine.com reminds readers, Mt. Gox was once the world's largest Bitcoin exchange, handling over 70% of all Bitcoin transactions in its early years.

In 2014, hackers stole around 740,000 bitcoin, worth $15 billion today, in one of many attacks on the exchange from 2010-2013.

After declaring bankruptcy in 2014, Mt. Gox has faced numerous delays in repaying victims.

Last year, the Tokyo court set an October 2024 deadline for the exchange's civil rehabilitation plan.

In May, Mt. Gox moved over 140,000 BTC, worth around $9 billion, from cold wallets for the first time in five years. The transactions were likely preparations for repayments.

Additionally, last year, as Decrypt reports, it was revealed that the deadline to repay investors had been pushed back to October 2024.

This means the entire reimbursement process can potentially take up to 4 months.