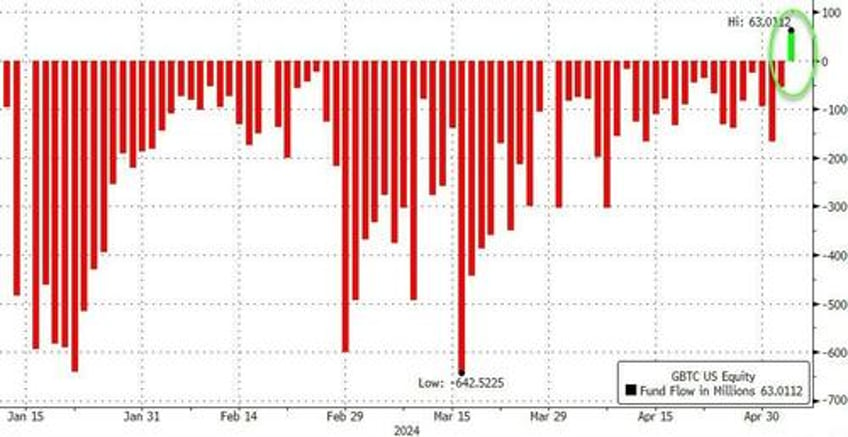

For the first time since spot bitcoin ETFs were launched, Grayscale's Bitcoin Trust ETF (GBTC) saw a daily net inflow on Friday (of $63 million)...

Source: Bloomberg

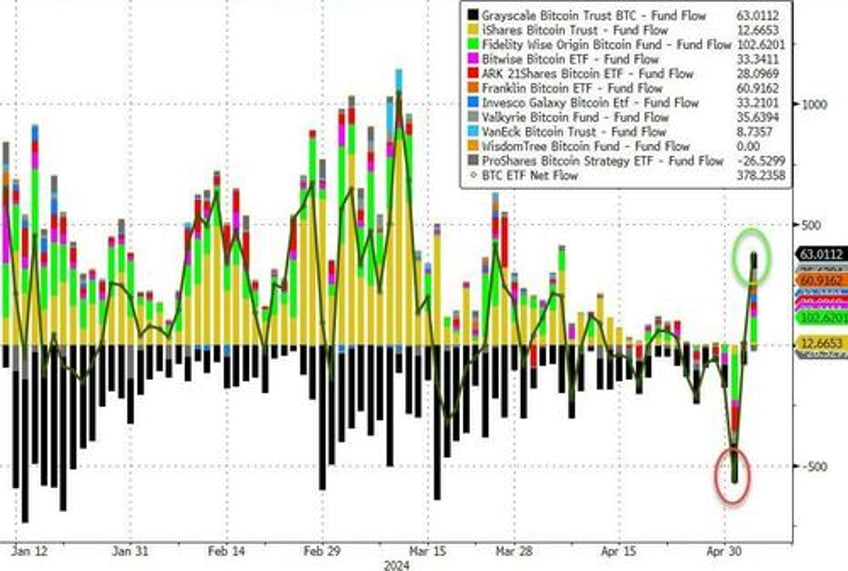

GBTC has dominated the outflows since inception (adding up to around $17.5 billion) since the 11 spot ETFs were launched on Jan 11. The inflow coincided with a sudden surge in aggregate net inflows to ETFs overall of $378 million on Friday (which came two days after a record net outflow of $563 million)...

Source: Bloomberg

CoinTelegraph's Ciaran Lyons reports that pseudonymous crypto investor DivXman told his followers that the GBTC was the “primary source” of sell pressure across all spot Bitcoin ETFs, but “the tides” could be turning.

“That effectively means a significant decrease in sell pressure and additional increase in demand while ETFs collectively are buying more BTC than miners can create,” he explained to his 20,800 X followers in a May 3 post.

Crypto trader Jelle predicted to his 80,300 X followers on the same day that Bitcoin’s new all-time high is on the horizon.

“60 million dollars worth of inflows for Grayscale’s ETF. The halving chop will come to an end, and 6-figure Bitcoin will follow shortly after.”

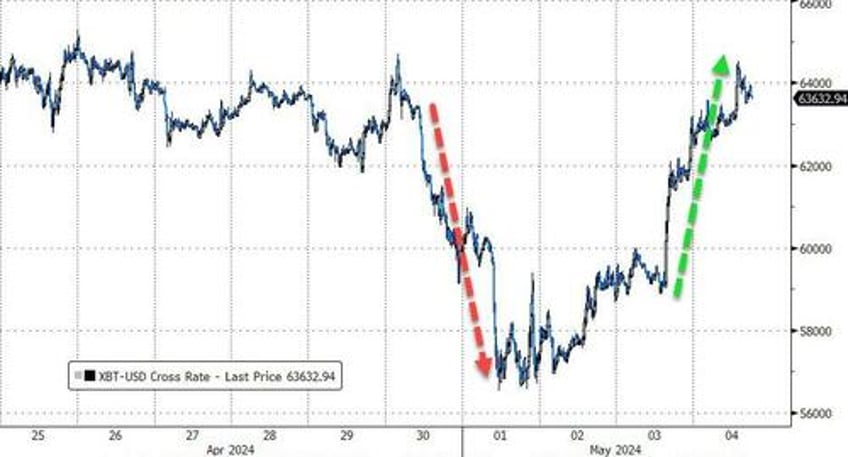

Bitcoin's price responded to this sudden inflow surprise and rallied back above $64,000, erasing the outflow-driven plunge from last week...

Source: Bloomberg

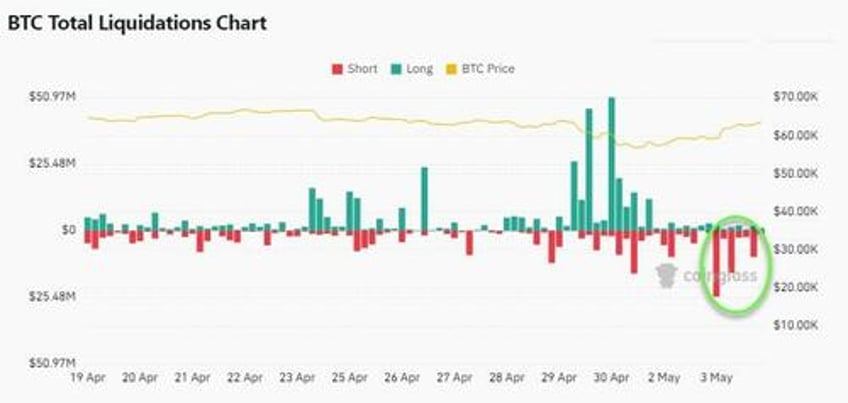

This price rise corresponded to a big short liquidation in the past 24 hours...

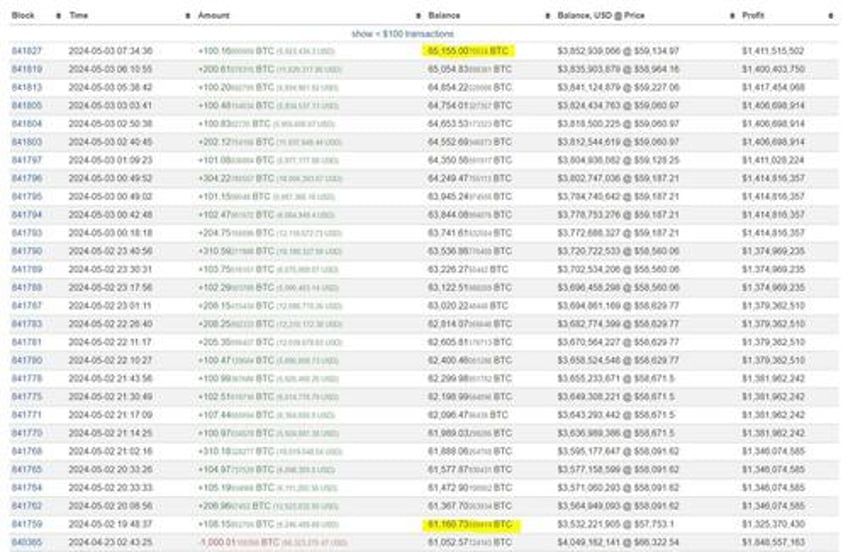

Additionally, CoinTelegraph reports that bitcoin whale entity nicknamed “Mr. 100” has bought the Bitcoin dip for the first time since the Bitcoin halving.

Meanwhile, multiple market analysts suggest that the local Bitcoin bottom may be in as the price bounces from $56,000 lows.

The Mr. 100 whale wallet has added over 4,100 BTC worth over $242 million, around the $58,000 mark, according to on-chain data from Bitinfocharts, as noticed by X user HODL15Capital.

This represents the wallet’s first Bitcoin purchases since April 19, the day before the 2024 Bitcoin halving.

The wallet has been adding at least 100 BTC nearly every day since Feb. 14, except for the post-halving period.

Mr. 100 is currently the 12th-largest Bitcoin holder, with over 65,155 BTC, according to Bitinfocharts data.

Finally, another even-larger 'whale' is Michael Saylor at MicroStrategy, delivered a masterclass on corporate finance and the power of bitcoin to supercharge corporate balance sheets. Saylor made a point to emphasize Bitcoin as the single solution for capital appreciation in an inflationary environment.

The MicroStrategy Executive Chairman noted key differences between Bitcoin and alternative cryptocurrencies like Ethereum, expressing the importance and necessity of proof-of-work-based consensus in creating a digital commodity.

“You could see the writing on the wall when the spot ETF of Bitcoin was approved in January. By the end of May, you'll know that Ethereum is not going to be approved. And when Ethereum is not going to be approved, sometime this summer it'll be very clear to everyone that Ethereum is deemed a crypto asset security, not a commodity. After that, you're going to see that [for] Ethereum, BNB, Solana, Ripple, Cardano – everything down the stack.”

Saylor’s conviction and use of physics-based metaphors were present as ever as he spoke on Bitcoin’s price appreciation and continued monetization.

“It's never declining. The chart's not ever decreasing. It only goes one way. Bitcoin is a capital ratchet. It's a one-way ratchet. Archimedes said, give me a lever long enough and a place to stand and I can move the world. Bitcoin is the place to stand.”

“There's no more powerful idea than the digital transformation of capital… No force on earth can stop an idea whose time has come. This is an idea. Its time has come. It's unstoppable. And so I'm going to end with the observation that Bitcoin is the best. The best what? The best.”

Saylor is an outspoken proponent of BTC and a leading force behind MicroStrategy acquiring the cryptocurrency as a reserve asset. As of April 30, the firm held 214,400 BTC - worth more than $13 billion at the time of publication.