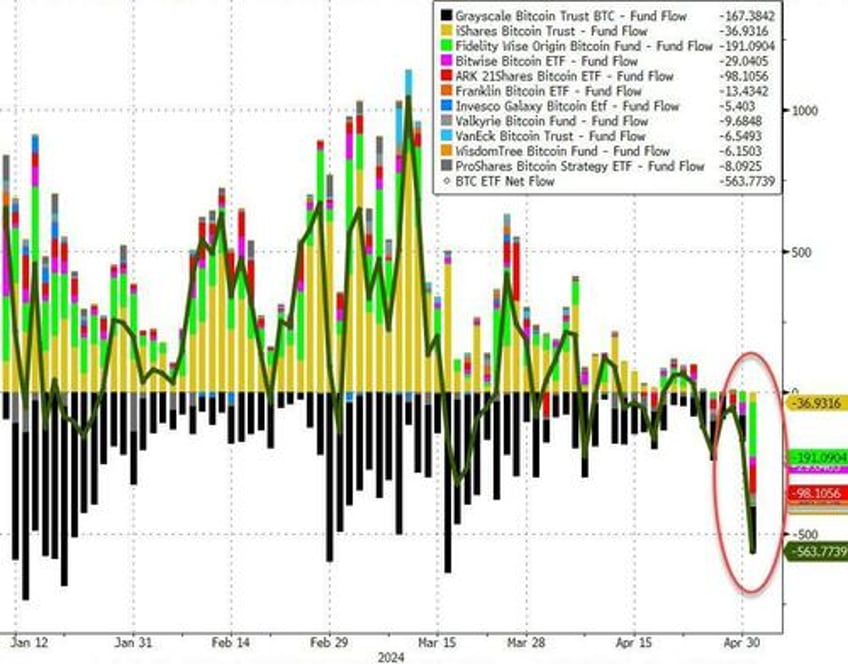

Despite the lack of total carnage in spot bitcoin prices, yesterday was an ugly (nay the ugliest) day for the newly minted ETFs (although bitcoin is down over 10% this week).

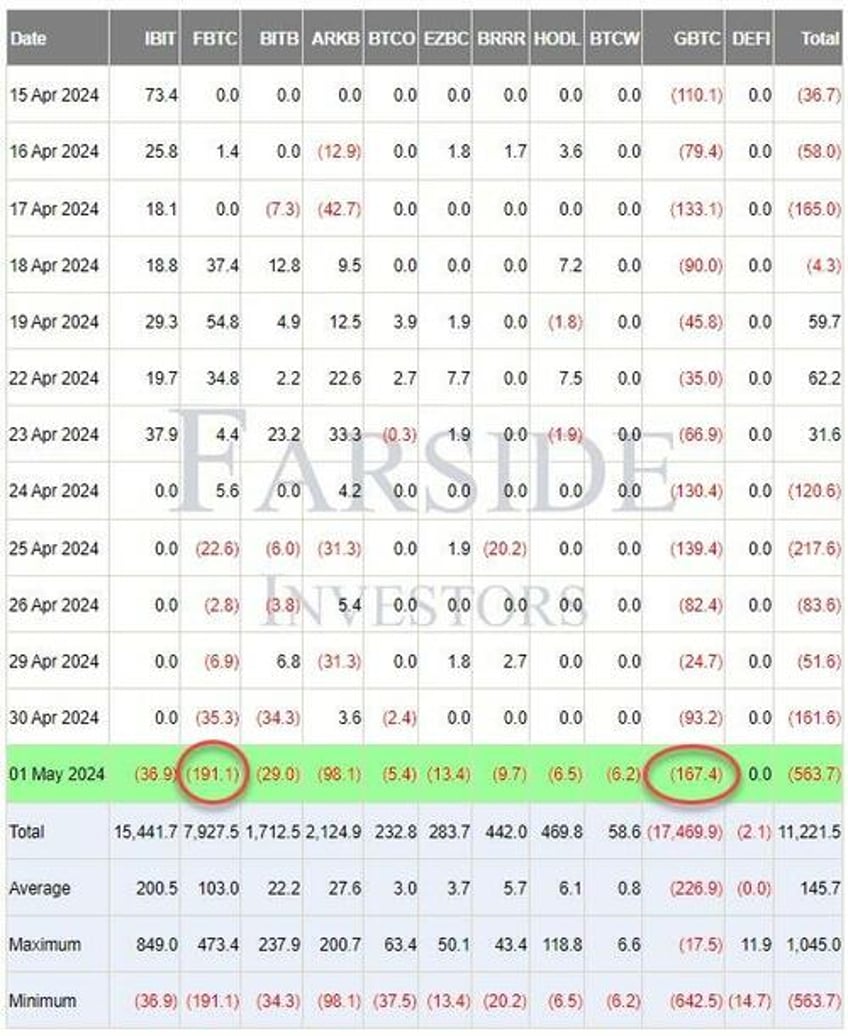

Most notably, BlackRock’s ETF saw around $37 million in outflows for the first time, while the remaining spot Bitcoin ETFs collectively notched over $526.8 million in outflows.

The largest outflow for the day was the Fidelity Wise Origin Bitcoin Fund, which saw $191.1 million in net outflows. The Grayscale Bitcoin Trust took the second spot with outflows of $167.4 million.

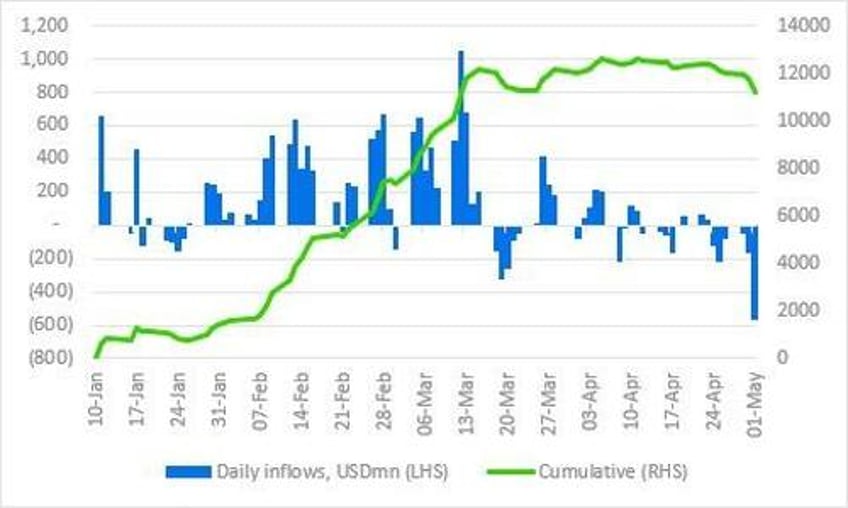

This means the total net inflow since inception has fallen to USD11.2bn.

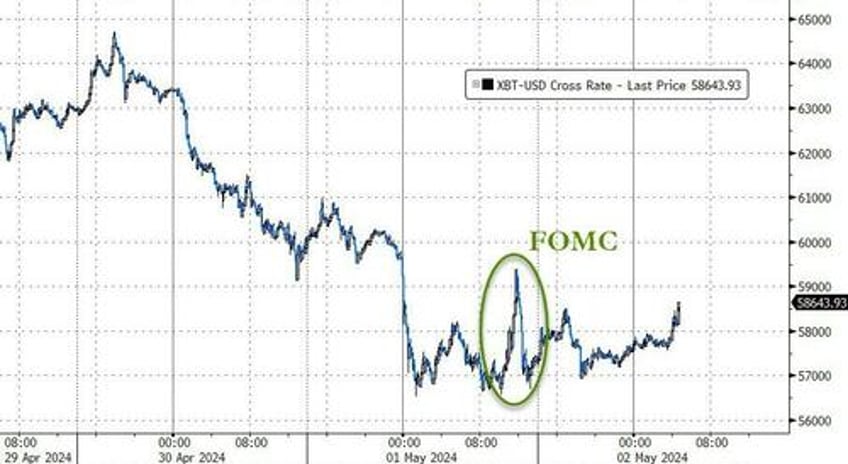

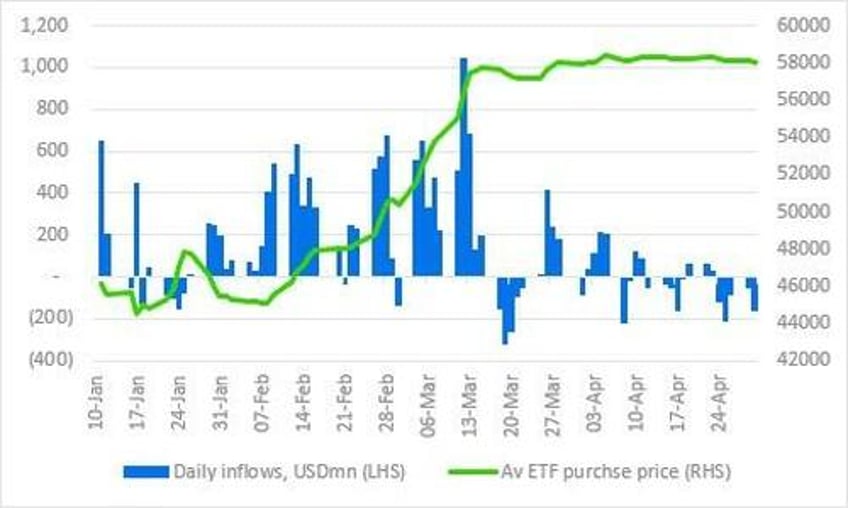

On the crypto-specific we have now had 6 days in a row of outflows from the US spot ETFs and, as importantly, we are now below the average ETF purchase price of around 58k...

Source: Geoffrey Kindrick

Bloomberg ETF analyst James Seyffart noted that the Bitcoin ETFs are still “operating smoothly across the board” and that “inflows and outflows are part of the norm in the life of an ETF.”

Coinglass data shows that there has been around $200mm in 'long liquidations' in the last coupled of days...

“Bitcoin is our favorite canary,” ByteTree Asset Management Chief Investment Officer Charlie Morris wrote in a note.

“It is warning of trouble ahead in financial markets, but we can be confident it’ll bounce back at some point.”

But this is not a time to panic, as CoinTelegraph reports, ETF Store president Nate Geraci pointed out that the iShares Gold ETF and SPDR Gold ETFs have had $1 billion and $3 billion in outflows so far this year.

Yet, gold is up 16% year-to-date, Geraci noted in a May 2 X post.

As CoinDesk reports, the current lull is likely to be followed by a new wave from a different type of investor, said Robert Mitchnick, head of digital assets for BlackRock, the world's largest asset-management company.

The coming months will probably see financial institutions such as sovereign wealth funds, pension funds and endowments start to trade in the spot ETFs, Mitchnick said in an interview. The firm is seeing “a re-initiation of the discussion around bitcoin,” which turns on the topic of allocating to bitcoin (BTC) and how to think about it from a portfolio construction perspective.

“Many of these interested firms – whether we're talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices – are having ongoing diligence and research conversations, and we're playing a role from an education perspective,” Mitchnick said.

And finally, Geoffrey Kendrick - who correctly predicted $4k in ETH few months ago - is sticking with his 150k target for year-end 2024 and 200k for year-end 2025 (with chance of overshoot to 250k).

“The next three to four months will be less bullish and more risk-oriented, with the market closely monitoring inflation, employment and economic data for any unexpected shocks or to gain confidence about potential rate cuts,” said Youwei Yang, chief economist and vice president of crypto miner BIT Mining Ltd.

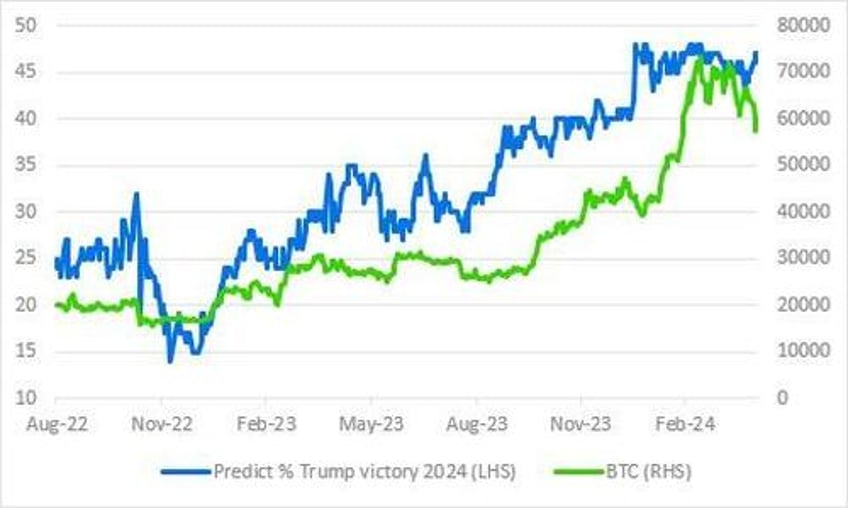

But, Kendrick notes, the next leg higher may take some time and require us to be closer to the US election.

At that time we would expect BTC to rally into year-end, particularly if a Trump presidential election victory becomes more likely, as a Trump administration will be more crypto friendly than a Biden one.