A major Bitcoin correction in the first month of a year after the blockchain sees a halving is historically not unusual, according to analysts who have compared previous cycles.

“Bitcoin dumping in January has historically been a common occurrence in post-halving years,” crypto analyst Axel Bitblaze told his 123,000 X followers on Jan. 12.

“We all know what happened after the 2017 and 2021 dumps.”

Bitcoinhas lost 10% so far this month in a fall from its high of $102,300 on Jan. 7 to just below $92,000 before recovering slightly to now hover around $94,000.

In January 2021, the next most recent post-halving year, Bitcoin fell more than 25% from over $40,000 to just above $30,000 by the end of the month. It then skyrocketed 130% to a new all-time high of $69,000 by November.

In January 2017, the year after the 2016 halving, Bitcoin slumped 30%, falling from $1,130 to $784. It then surged 2,400% that year, culminating in an all-time high of $20,000 by December.

Bitcoin post-halving year January slumps. Source: Axel Bitblaze

Meanwhile, YouTuber and analyst Crypto Rover observed that Bitcoin has consistently dropped in the first half of the month for the past year.

“This is just a small dip compared to what we’ve seen before,” he said.

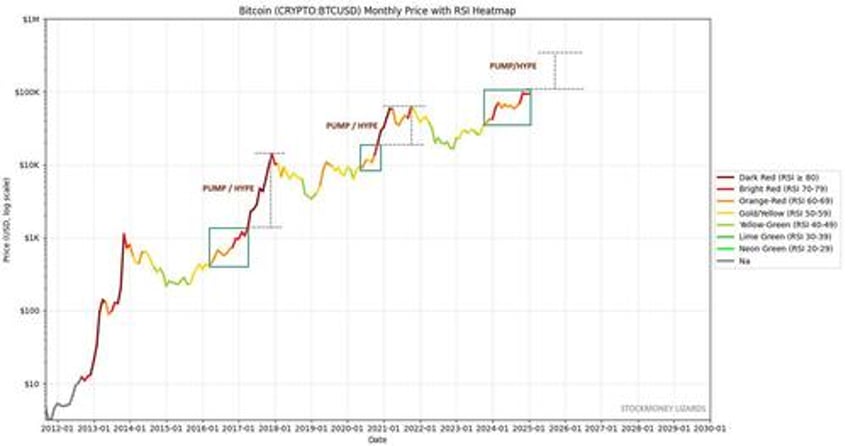

“Bitcoin has NOT reached the ultimate hype/pump phase,” posted the finance analysis Stockmoney Lizards X account on Jan. 12. “This cycle has more fuel in the coming 12 months.”

Bitcoin monthly chart with RSI color coding. Source: Stockmoney Lizards

The analyst acknowledged that things were a bit different in every cycle but added that “with mass adoption, pro-crypto governments worldwide, ETFs, etc. I think it underlines our hypothesis.”

A 130% move similar to that in the peak year of the previous cycle could send BTC prices from current levels to over $200,000 before the end of 2025.

On the flip side, a pullback of the magnitude seen in January of the last two cycles could send prices below $70,000.