And... lambos sold out until 2026...

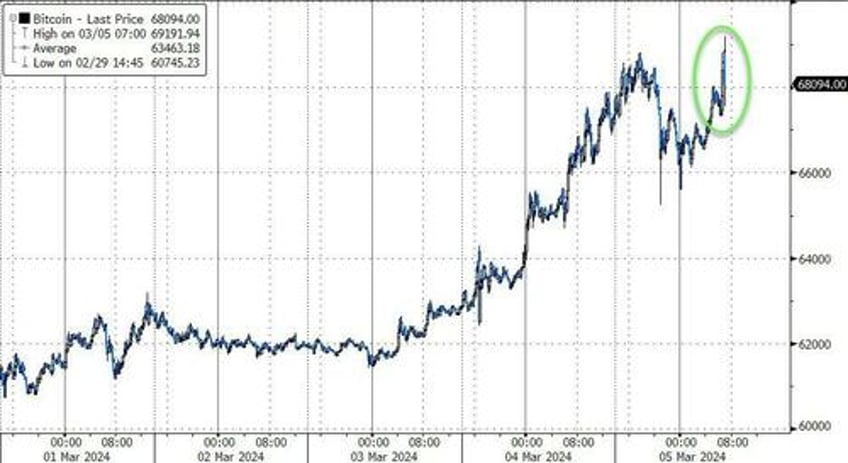

🚨 ‼️ BREAKING: BITCOIN SURPASSES PREVIOUS ALL TIME HIGH OF $69,000 🎉 🎊 pic.twitter.com/WRBR6VQDtL

— Autism Capital 🧩 (@AutismCapital) March 5, 2024

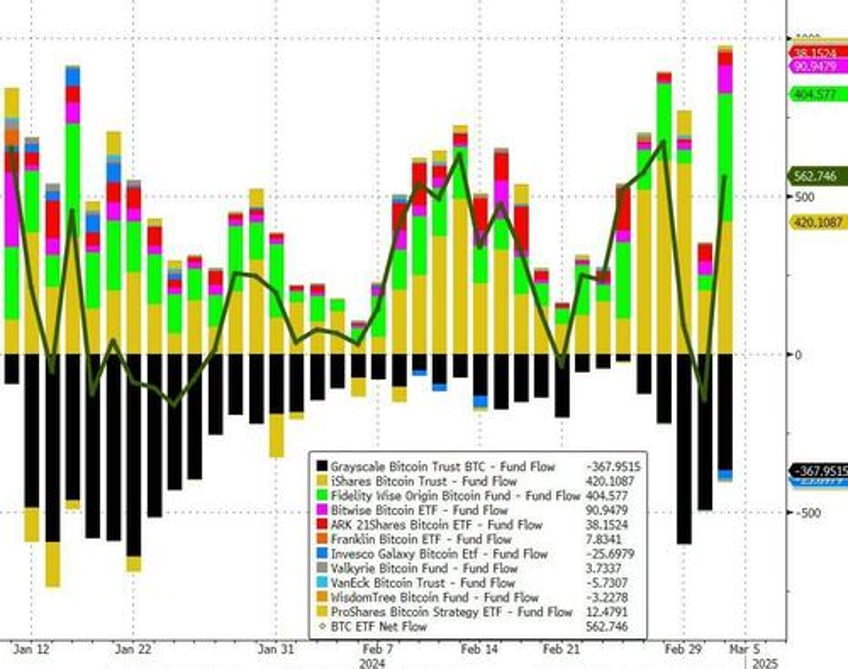

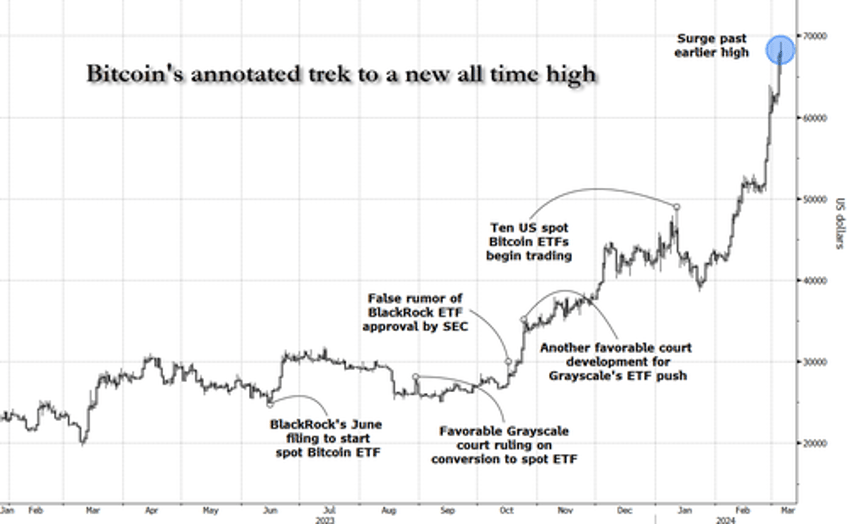

Following yesterday's resurgence in net inflows (+$562 million) into spot bitcoin ETFs...

Source: Bloomberg

“The excitement and hype around the ETFs has ended up being far beyond anyone’s expectations,” said Jad Comair, founder of digital asset investor Melanion Capital.

Spot bitcoin ETFs give investors the ability to gain direct exposure to the cryptocurrency without the risks associated with largely unregulated crypto exchanges.

Bitcoin prices have topped $69,000...

Source: Bloomberg

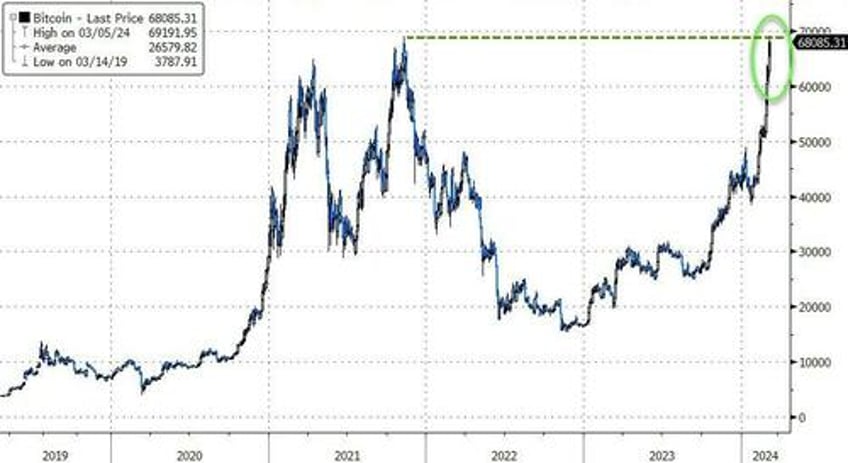

Taking out November 2021's record high...

Source: Bloomberg

However, as @AutismCapital noted on X:

"Reminder that the autistic (correct) ATH adjusted for inflation is $79,000 so make sure to celebrate then as well because at that number your purchasing power will be what it was at the previous ATH."

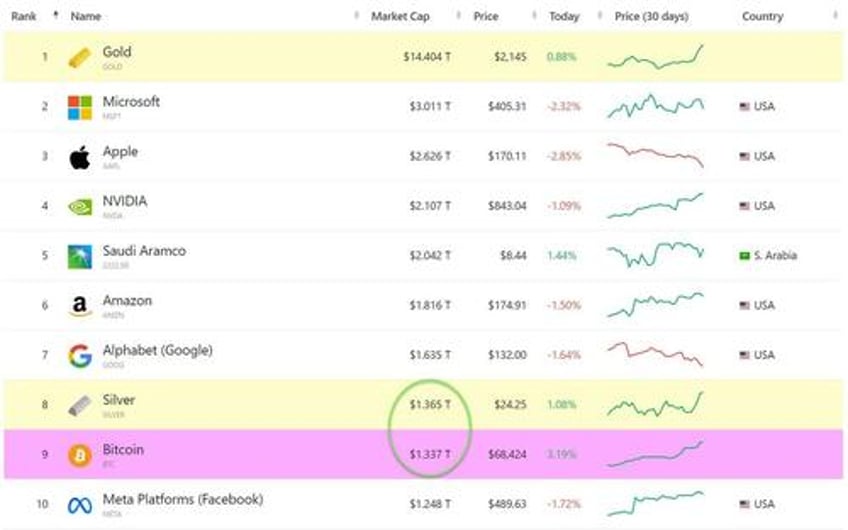

CoinTelegraph reports that following the new high, Bitcoin briefly became the eighth-largest asset in the world after its market capitalization briefly overtook the $1.347 trillion market capitalization of silver, the second-largest precious metal in the world, according to CompaniesMarketCap data.

“Breaking all-time highs, with the current momentum in spot ETFs as well as the upcoming halving narrative, would likely awaken true FOMO — fear of missing out — among participants currently watching markets from the sidelines,” said Stefan von Haenisch, head of trading at OSL SG Pte.

And so where from here?

As CoinTelegraph's Zoltan Vardai reports, while Bitcoin’s pre-halving rallies are historically profitable for investors, analysts expect the biggest gains to come after the halving, with some eyeing $130,000 to $180,000 by the end of 2025.

Bitcoin’s 4-year halving cycles are widely associated with the subsequent crypto market bull runs that generally lead to new Bitcoin all-time highs. But is the much-awaited halving the right time to invest in the world’s largest cryptocurrency?

Based on historical Bitcoin price data, the halvings could be a great time to buy for investors with longer time horizons, according to Vetle Lunde, a senior analyst at K33 Research. Lunde told Cointelegraph:

“While the immediate post-halving performance has tended to be sluggish, each halving has proven to be a solid point to enter the market. 150-400 days after the halving tends to be the sweet spot where the compounding effects of subdued miner selling pressure impact BTC positively directionally.”

Bitcoin breached the $60,000 mark for the first time in over two years on Feb. 28, 47 days before the halving, and the world’s first cryptocurrency is up 30% over the past week.

The Bitcoin halving halves the rate at which new BTC are issued into circulation every four years. The network will stop producing new Bitcoin once 21 million coins are created by the year 2140, which will be the year of the last Bitcoin halving.

According to Bryan Legend, investor and CEO of Hectic Labs, the pre-halving period can be a profitable time to hold Bitcoin. He told Cointelegraph:

“The pre-Halving leading up to the actual Halving event is a great time to realize gains. The pre-Halving rally turns investor sentiment into a new bull cycle but timing the market to know when to get out at the top is extremely challenging.”

Bitcoin’s pre-halving rally to the $67,611 mark was largely assisted by record inflows in the 10 new spot Bitcoin exchange-traded funds (ETFs) in the United States.

According to CoinShares analyst James Butterfill,

“Total assets under management (AuM), after recent price rises, are now very close to the all-time high at US $82.6bn, just shy of the US $86bn peak set early November.”

According to the report, Bitcoin accounted for “94% of the inflows” at $1.72 billion, as U.S.-based funds continued to dominate with net inflows totaling $1.88 billion.

Sergei Gorev, a risk manager at fintech platform YouHodler, said that Bitcoin ETF inflows are a significant part of the current rally, along with the pre-halving anticipation. He told Cointelegraph:

“Spot Bitcoin ETFs buy 10 times more Bitcoin daily than miners produce each day."

Can Bitcoin price reach $120,000 by the end of 2024?

Bitcoin price typically rallies into the halving but sees a consolidation immediately after the halving, according to K33 Research’s Lunde. He said:

“The pre-halving rally stems from a combination of traders buying in advance and miners holding onto a larger portion of its rewards. In the direct aftermath of the halving, hashrate tends to plunge, block production stalls from 10 to 15-25 minutes, leading uncertainty to grow.”

However, Lunde only expects a brief correction, before Bitcoin resumes its price rally to new all-time highs.

“Based purely on data from past performance and the diminishing impact of halving rallies, Bitcoin could see a 130-150% rally in the year following the halving, which would lead to a peak in the range of $125,000 - $150,000 in 2025.”

All-time Bitcoin chart, incl. Halvings. Source: Bitbo

Bitcoin’s end-of-year price could reach around $80,000 to $85,000 in the worst case and $120,000 to $130,000 in the bullish case, according to Hectic Labs’ CEO, Bryan Legend. He told Cointelegraph that this will mainly depend on macroeconomic conditions:

“ [The 2025 bull market] will be dependent on the state of financial markets and the fundamental outlook on the world... If the bull market does carry through into 2025, we may indeed see higher prices with a BTC top of $180,000 - $200,000.”

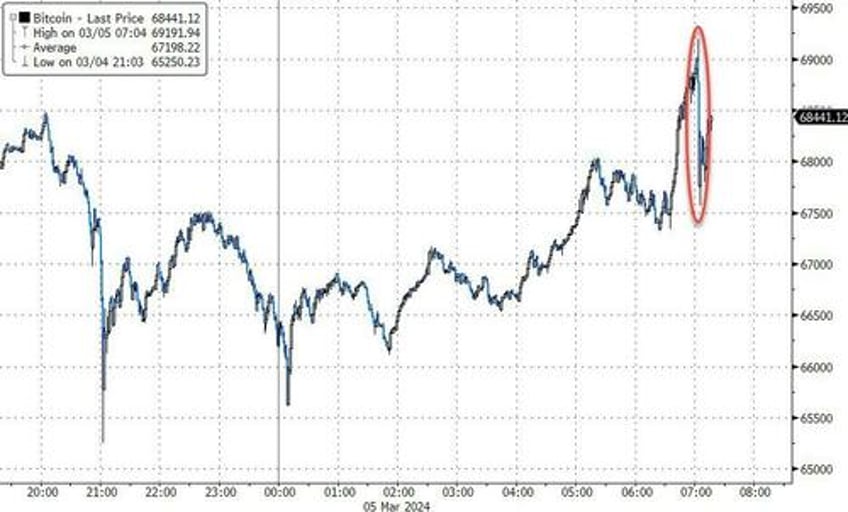

Finally, we note that a big sell order hit right as Bitcoin took out the record highs...

Which prompted some mockery...

LOL at this bozo selling the ATH right now. Imagine being a literal top buyer and suffering for years in agony only to sell it all to break even right before you miss out on the actual bull run. You get to feel like an idiot twice. Good job 👏🏼

— Autism Capital 🧩 (@AutismCapital) March 5, 2024

To the moon?

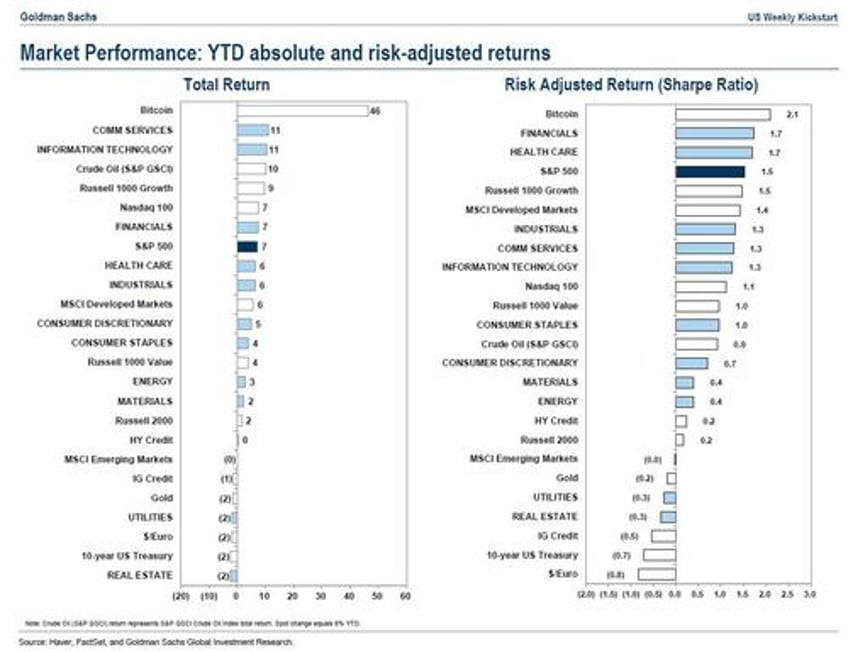

Not only is it best performing asset, up 62% YTD, it also has the highest sharpe ratio of any asset class...

We now have to wait with baited breath to hear what Jim Cramer thinks, but here's JPMorgan:

“The current backdrop looks similar to the exuberant backdrop of 2021 when retail investors were driving both a crypto and equity market rally simultaneously on momentum,” said JPMorgan analyst Nikolaos Panigirtzoglou, who cautioned that there was a “high risk of profit-taking” ahead of next month’s bitcoin halving event.

But, SMCI up 250% in a month is not at all like the dotcom bubble, right?