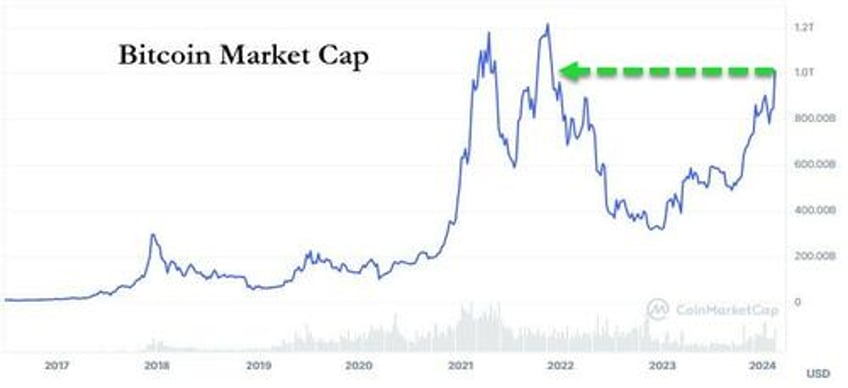

The total market value of Bitcoin's circulating supply crossed $1 trillion today for the first time since November 2021...

Source: CoinMarketCap

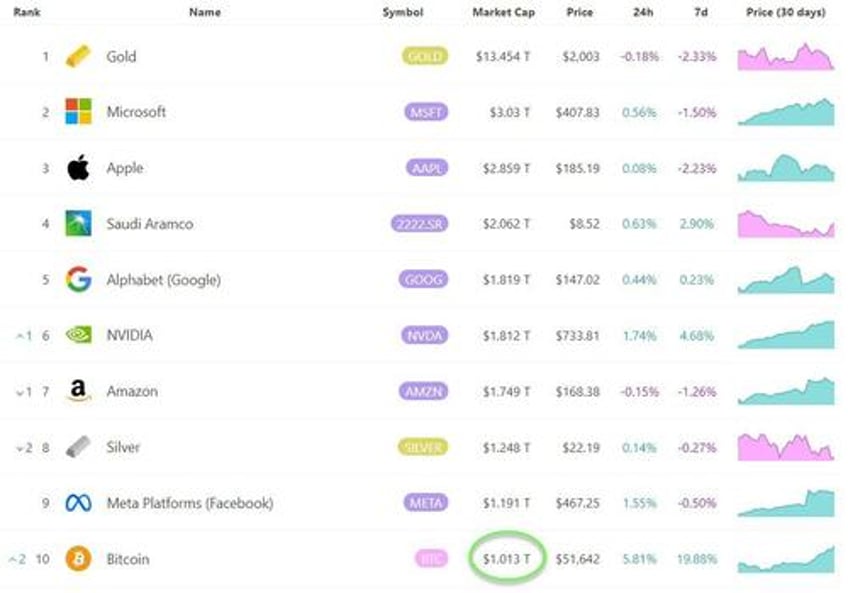

While all eyes have been focused on NVDA's rise, Bitcoin has quietly surpassed Tesla, TSMC, Eli Lilly, and today it overtook Berkshire Hathaway to become the 10th most valuable asset in the world...

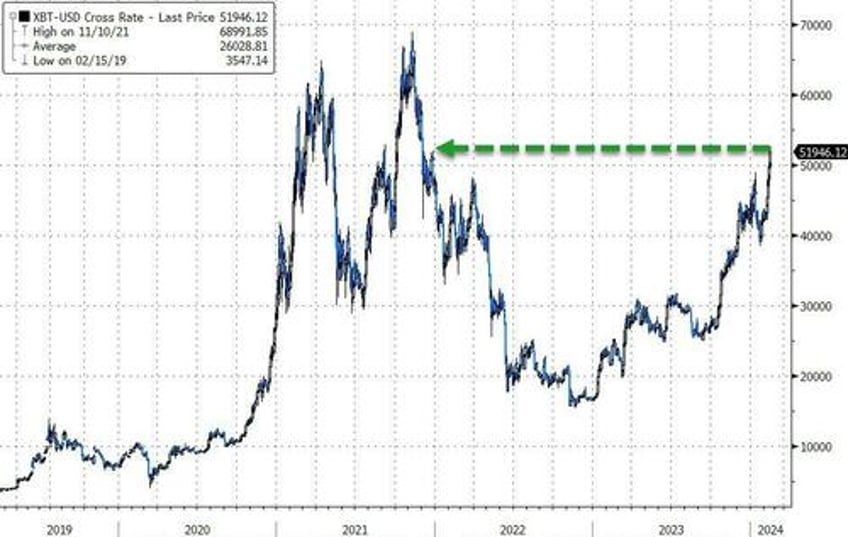

Thanks to the recent resurgence in the largest cryptocurrency's price, which topped $52,000 today for the first time since December 2021...

Source: Bloomberg

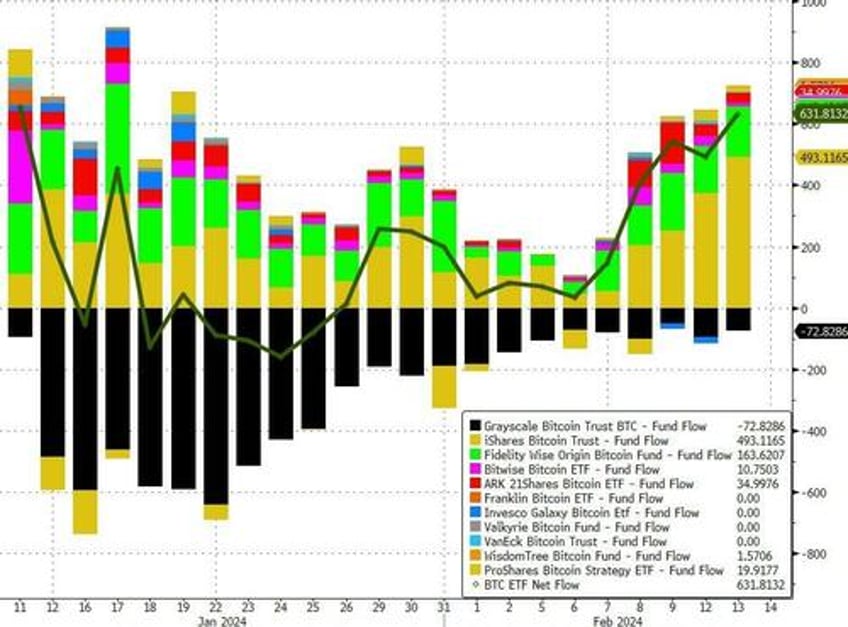

The recent renaissance in crypto has been fueled in large part by the inflows to Bitcoin Spot ETFs, which have very recently started to accelerate. Yesterday saw the largest net inflow into the ETFs since inception...

Source: Bloomberg

In fact, excluding Grayscale's Bitcoin Trust (GBTC), the ETFs have accumulated over $11 billion worth of the largest cryptocurrency by market cap.

Outflows from GBTC appear to have gradually eased, reducing selling pressure according to some analysts and buoying bullish sentiment.

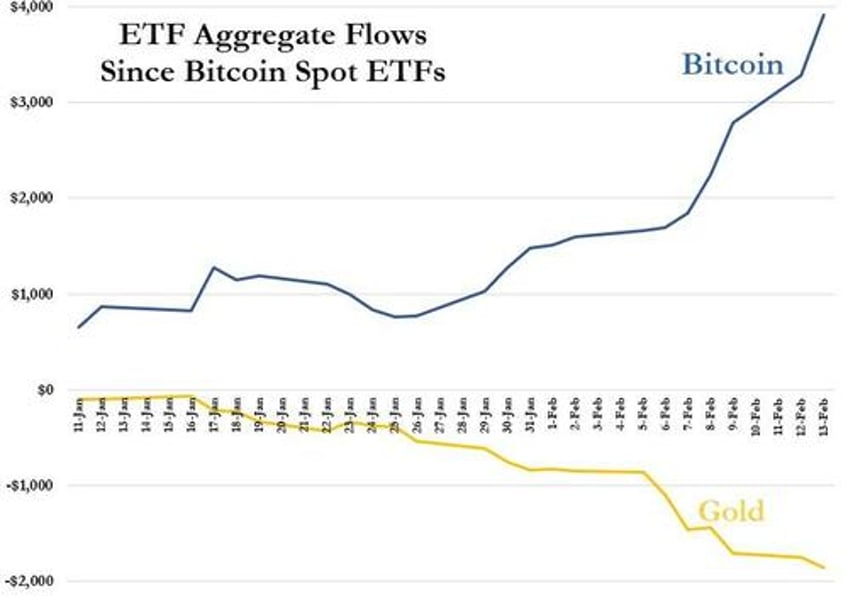

But those inflows for bitcoin appear to have come at the cost of outflows from Gold ETFs, which saw investors redeem $858 million last week ahead of the recent CPI reading, bringing year-to-date outflows out of the metal to $3.2 billion.

Since Spot Bitcoin ETFs were launched, Gold ETFs have in aggregate seen almost $2 billion in net outflows while Bitocin ETFs have seen net inflows of almost $4 billion...

And it doesn't look set to stop anytime soon. As CoinTelegraph reports, the upcoming Bitcoin halving is expected to play a key role in further increasing the market price of Bitcoin. According to a Grayscale analysis, Bitcoin ETFs can fundamentally change the cryptocurrency’s demand-supply ratio, counterbalancing the halving’s sell pressure.

Grayscale’s analysis highlights that the current mining rate of 6.25 Bitcoin per block amounts to approximately $14 billion annually - considering the price at $43,000. In other words, to maintain current prices, $14 billion worth of buy pressure is required over the same period.

“Post-halving, these requirements will decrease by half: with only 3.125 Bitcoin mined per block, that equates to a decrease to $7 billion annually, effectively easing the sell pressure.”

Bitcoin’s price directly impacts the operational costs of the mining community. The upcoming halving event will cut the mining reward in half to 3.125 BTC, which will require BTC to maintain a high market value to make mining a viable business model.

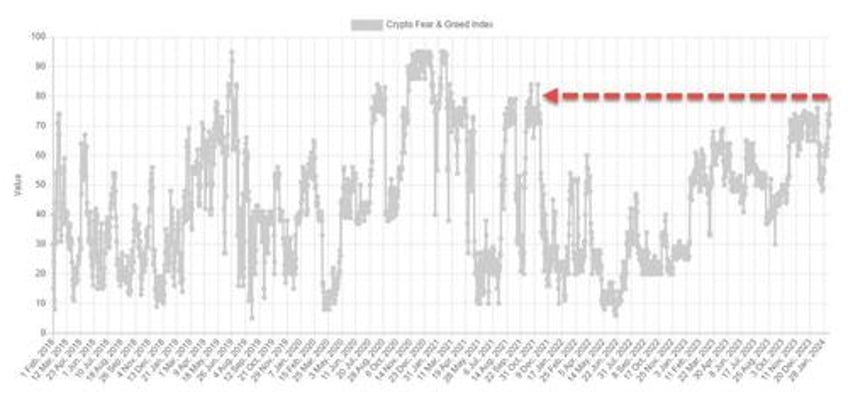

However, one word of warning: the 'Fear & Greed Index' for Bitcoin, which aggregates data on market momentum, volatility, volume and social media, is now at 79 out of 100, its highest score since Bitcoin reached $69,000 in November 2021.

“When investors are getting too greedy, that means the market is due for a correction,” said alternative.me on its website.