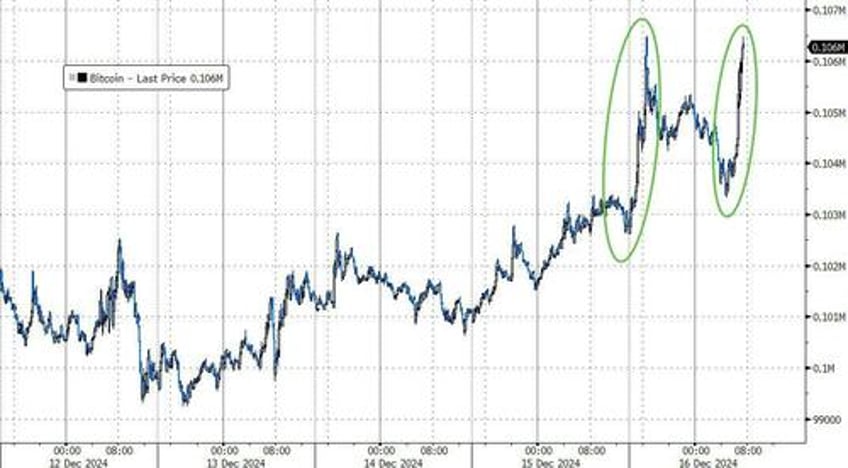

Bitcoin’s price rallied almost 5% over the weekend to set a new all-time high above $106,000 amid speculation that it may become a United States reserve asset.

CK Zheng, chief investment officer of ZK Square, told Cointelegraph that Bitcoin has likely entered “Santa Claus mode,” as many investors fear missing out and look to allocate more capital into the asset class.

He predicted a Bitcoin price tag of $125,000 in early 2025 but warned a possible 30% correction could follow as most of the bullish news from the incoming Trump administration has been “priced in.”

A 30% correction from $125,000 would see Bitcoin retrace to around $87,500.

From a liquidity perspective, we should not be surprised that bitcoin continues to charge higher (but the new year may bring some weakness)...

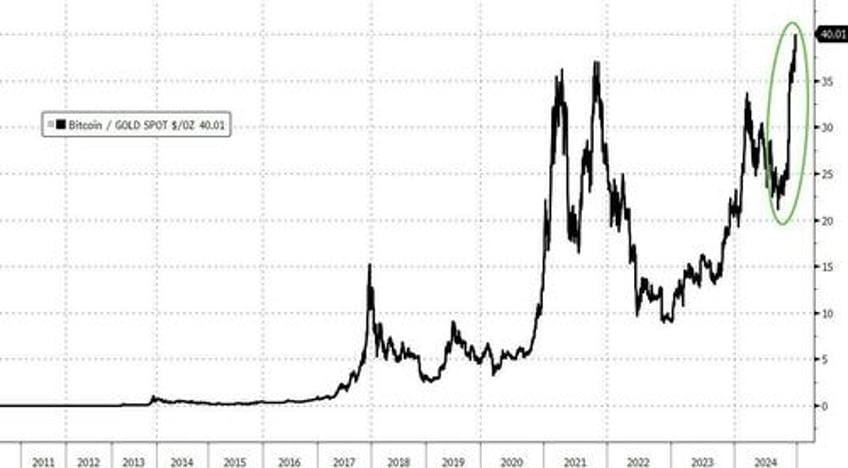

Bitcoin has also reached a new record relative to gold (1 BTC can now buy 40 oz of gold).

Gracy Chen, CEO of Bitget, writes that while the Santa Claus rally is a well-documented phenomenon in traditional stock markets, its presence in cryptocurrency is less clear.

Cryptocurrencies, known for their volatility and 24/7 trading, don’t always follow equities’ seasonal patterns. A second trend can be applied to this model that has empirically proven a powerful predictor of a Santa Claus rally occurring in Cryptoland: whether or not the market is in a bull run.

It’s safe to say that crypto firmly checks that box right now, thus making a compelling case for a severe rally coming together as the year draws close. In late 2017, for example, BTC rallied by 68% over the two weeks spanning the New Year. Subsequent years have been more muted, in line with the prevailing market mood at the time. But then there’s 2024, which has already broken all crypto records. One wouldn’t bet against it closing out the year on a tear just to complete the clean sweep.

If traders buy into the Santa Claus rally thesis, they don’t need to create a prediction market to speculate on the likelihood — although nothing is stopping them. In crypto, financial freedom comes as a standard. A more intelligent strategy is filling one’s conviction bags before the year-end. Load up on the assets you believe in the most, and then sit back and let the prophecy unfold.

As 2024 closes out, the financial landscape presents a mix of optimism and caution. The global economy has shown resilience, with many sectors rebounding from previous downturns. Consumer spending during the holiday season is expected to be robust, bolstering market sentiment. The only potential dampener could be the escalation of global tensions in the Middle East or Ukraine. Still, barring a major macro event, there’s every reason to expect the current bull market to remain intact.

Even if the Santa Claus rally proves to be a damp squib on this occasion, it’s no biggie: The bags investors have accumulated now are likely to stand them in good stead next year as the crypto market continues to grind higher. They don’t have to leave a glass of milk and some cookies out, but there’s no excuse for not being ready for Santa this Christmas.

It comes as Strike founder and CEO Jack Mallers said US President-Elect Donald Trump could potentially issue an executive order designating Bitcoin as a reserve asset on his first day in office on Jan. 20.

“There’s potential to use a day-one executive order to purchase Bitcoin,” Mallers stated, adding:

“It wouldn't be the size and scale of 1 million coins but it would be a significant position."

Meanwhile, Satoshi Action Fund CEO Dennis Porter said a third Bitcoin reserve bill is in the works at the state level, though he didn’t say which state might follow Texas and Pennsylvania’s lead.

“We had Pennsylvania, and we had Texas. And now we have another state coming on board. And they sent me the draft. So I know it’s real,” he said during a Dec. 15 X Spaces.

Porter added he expects at least 10 states to introduce a Bitcoin reserve bill in total.

"Its not going to stop. We're going to see more and more of these bills come. At least 10, in my opinion."

Financial analysts are also tipping a 0.25% interest rate cut from the US Federal Reserve on Dec. 18, which could lift Bitcoin’s price even further in the coming months.

Another catalyst behind Bitcoin’s price surge may be one of the new rules by the Financial Accounting Standards Board, which enables institutions to record the value of their crypto assets more realistically. The rule will apply to fiscal years beginning after Dec. 15.

However, bitcoin’s market sentiment is currently in the “Extreme Greed” zone at a score of 83 out of 100, according to the Crypto Fear and Greed Index.

Crypto Fear and Greed Index score for Dec. 16. Source: Alternative.me

It hasn’t been higher since Dec. 5, when Bitcoin broke through the $100,000 milestone.