By Brayden Lindrea of CoinTelegraph

BlackRock’s income and bond-focused funds have bought shares of the asset manager’s own spot Bitcoin exchange-traded fund (ETF) in the first quarter, regulatory filings show.

BlackRock’s Strategic Income Opportunities Fund (BSIIX) snapped up $3.56 million worth of the iShares Bitcoin Trust (IBIT) while its Strategic Global Bond Fund (MAWIX) made a $485,000 purchase, according to May 28 Securities and Exchange Commission filings.

The IBIT shares are a fraction of BSIIX and MAWIX’s investment portfolios, respectively worth $37.4 billion and 776.4 million.

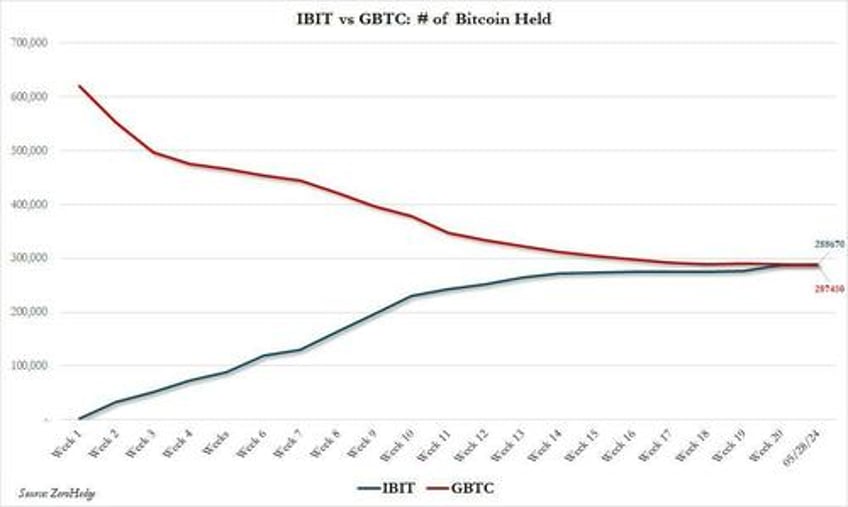

As we detailed last night, IBIT is now the largest ETF holder of Bitcoin, currently holds 288,670 Bitcoin, according to BlackRock data from May 28, having overtaken the converted Grayscale Bitcoin Trust (GBTC), which holds 287,450 Bitcoin as of May 28, Grayscale data shows.

Spot Bitcoin ETFs globally now hold over 1 million Bitcoin worth over $68 billion - equating to nearly 5.10% of its over 19.7 million BTC circulating supply according to CoinGecko.

More than 600 United States investment firms have bought spot Bitcoin ETFs since they launched in January, recent SEC filings revealed. Morgan Stanley, JPMorgan, Wells Fargo, Royal Bank of Canada, BNP Paribas, UBS and hedge funds including Millennium Management and Schonfeld Strategic Advisors were some of the firm’s buying up Bitcoin funds.

Millennium is the largest spot Bitcoin ETF accumulator, with $1.9 billion invested, including $844.2 million into IBIT and $806.7 million into the Fidelity Wise Origin Bitcoin (see "52% Of Top US Hedge Funds Own Bitcoin ETFs").

On May 23, BlackRock was one of eight firms to have its spot Ether ETF bid approved in the U.S. but the SEC must approve the firm’s Form S-1 filings for the products to start trading.