The Chicago Mercantile Exchange (CME), the world's largest futures exchange, is planning to offer spot bitcoin trading on its platform, according to a Financial Times report.

This move would provide major hedge funds and institutional traders with a regulated venue to trade Bitcoin.

As Vivek Sun reports via Bitcoin Magazine, CME is already the global leader in Bitcoin futures trading. By adding spot bitcoin, it can offer clients an integrated platform that includes both spot and derivatives markets.

This enables complex trading strategies like arbitrage and basis trading that leverage price differences between the two.

Currently, most spot bitcoin trading occurs on offshore exchanges like Binance.

CME, providing a regulated alternative, targets institutional investors who require strict due diligence and compliance standards.

The exchange has reportedly held talks with traders expressing strong interest in trading bitcoin in a regulated environment.

The move comes as Wall Street ramps up its Bitcoin offerings amid surging demand. Several firms already provide access to SEC-approved Bitcoin ETFs earlier this year. CME would differentiate itself by allowing sophisticated trading strategies beyond simple directional bets.

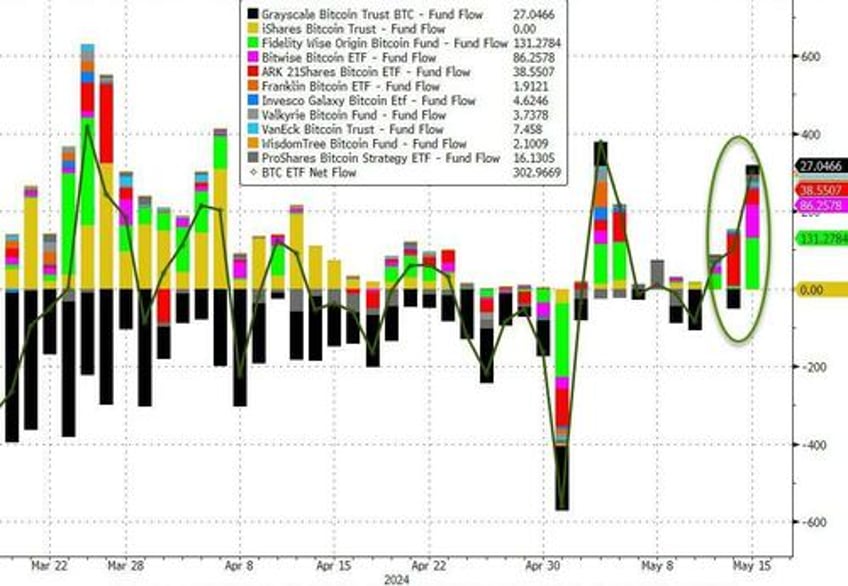

Yesterday saw the largest daily rise in bitcoin price in 14 months and a large net inflow to BTC ETFs...

Institutional funds are more inclined to use CME than platforms like Coinbase due to existing relationships. The transparency and trust in CME's decades-long track record outweigh its lack of Bitcoin specialization.

By tapping into extraordinary demand from institutional clients, CME can significantly boost its Bitcoin exposure, helping satisfy the appetite of hedge funds, family offices, pension funds and more for regulated and familiar avenues to access Bitcoin.