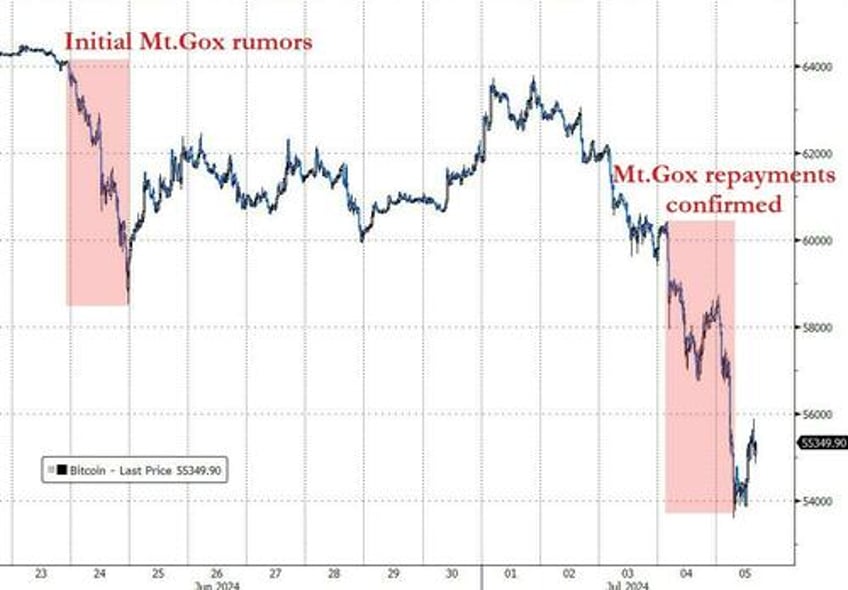

Just over a week after initial rumors - and wallet movements - sent bitcoin prices lower, Mt. Gox - the collapsed crypto exchange - officially began repaying its debts yesterday (on one of the most illiquid days of the year, of course) in Bitcoin and Bitcoin Cash.

This overhang sparked a major wave of selling pressure across the crypto space (after German and US authorities 'simultaneously' moved the ill-gotten-gains on to exchanges - not coordinated on timing to hit July 4th though we are sure, as that would be conspiracy-theory-talk)...

Source: Bloomberg

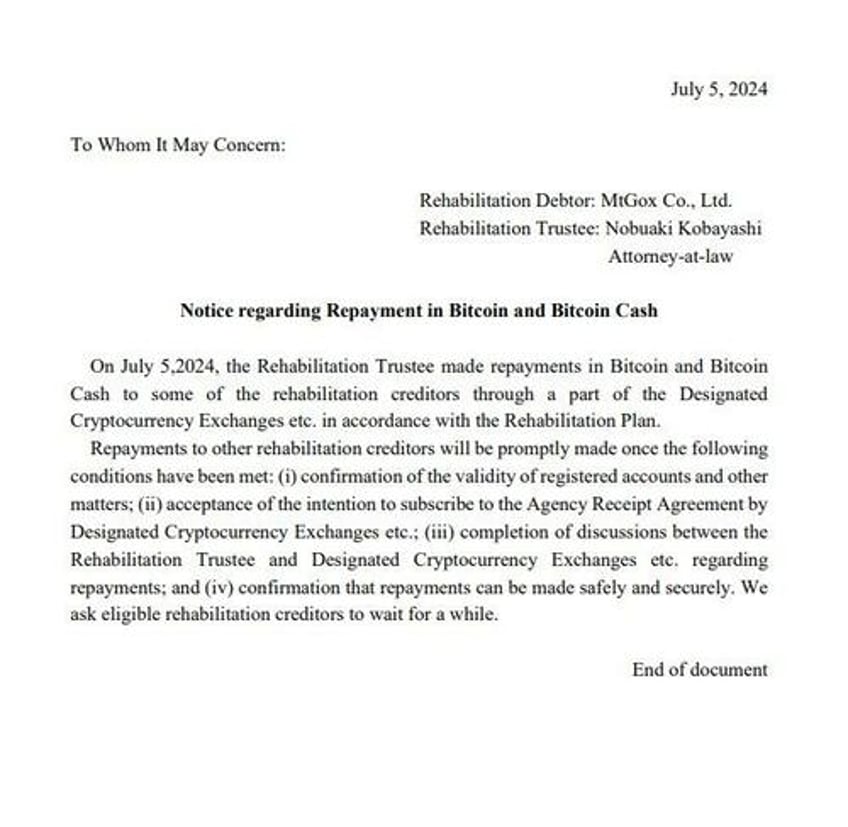

Repayments are being made to some creditors via designated crypto exchanges per its rehabilitation plan.

According to an X post by the MtGoxBalanceBot account, the total Bitcoin balance on all known addresses of the Mt. Gox Trustee is 94,457 BTC, with 47,288 BTC being moved from these addresses since.

As CoinTelegraph reports, the repayments to the remaining rehabilitation creditors will be “promptly made” after multiple conditions have been met.

These conditions include confirming account validity and creditors’ acceptance of the intent to subscribe to the Agency Receipt Agreement by designated crypto exchanges.

In addition to assuring repayments are made safely and securely, discussions regarding repayment procedures between the Rehabilitation Trustee and the exchanges must also be completed.

According to several Reddit posts and users, BTC and Bitcoin Cash have begun to be repaid and credited to exchanges.

“On July 5, 2024, the Rehabilitation Trustee made a blockchain transfer of the BTC/BCH amount repayable to you as the Base Repayment and the Early Lump-Sum Repayment or the Intermediate Repayment.”

The Reddit post details the email received by Mt. Gox, with “MtGox Co., Ltd.” as the Rehabilitation Debtor and Nobuaki Kobayashi, Attorney-at-law, as the Rehabilitation Trustee.

The selling pressure is coming from 'long liquidations' which have soared in the last 48 hours with total crypto liquidations surging $664.5 million over the past 24 hours alone, the highest in two months, according to data from CoinGlass.

The smash-down in Bitcoin forced it back below its 200DMA for the first time since October of last year...

Source: Bloomberg

Other highly traded cryptocurrencies, including Ether and Solana’s, also saw almost 10% drops on the day.

ETH dropped to $2,898, below the key $3,000 level that it held since mid-May, according to Cointelegraph Markets Pro.

Despite the potential selling pressure, the repayments come as a positive for the industry and the exchange’s defunct users, as also highlighted by Mark Karpelès, the former CEO of Mt. Gox. He wrote in a July 5 X post:

“Mt. Gox customers have finally started receiving Bitcoins! After over 10 years I wasn’t sure anymore if it’d finally happen, but here we are finally!! This has been a long journey and I’m happy to see we’re finally getting there, only a bit more.”

More than $9.4 billion worth of Bitcoin is owed to approximately 127,000 Mt. Gox creditors who have been waiting for over 10 years to recover their funds.

CoinTelegraph notes that considering that the Bitcoin price increased by over 8,500% during the past 10 years, the majority of defunct creditors will likely look to lock in some profits.

This is partly why King also expects around 99% of the creditors to sell their BTC. He wrote:

“I’d say 99% of those on Mt. Gox are going to sell their coins the moment they get it. Imagine billions worth of Bitcoin all being dumped gradually over the next several weeks. There is no way to spin this to be bullish, or news that could offset this.”

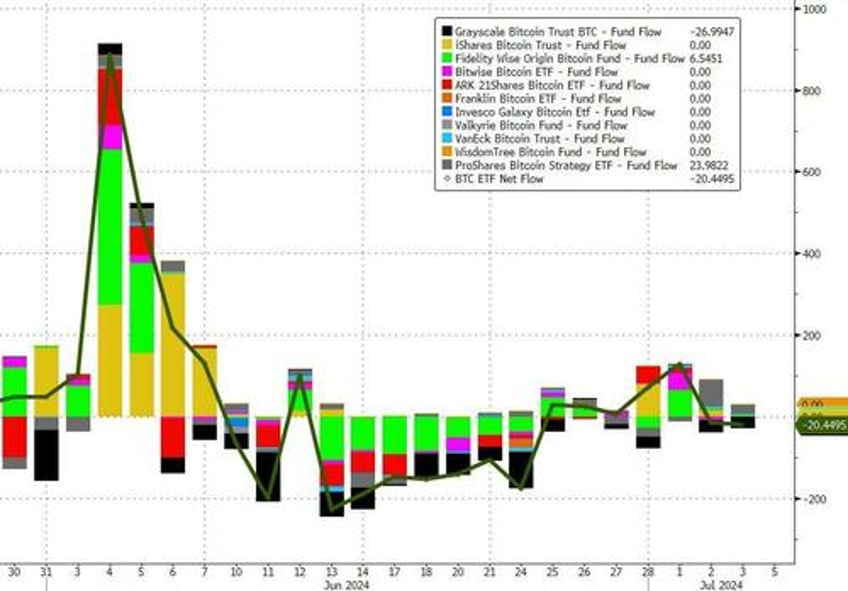

In another significant development, Bitcoin fell below the average realized buying price of the spot Bitcoin ETF buyers, or $57,979 - considered a significant support line for BTC analysts.

Despite the fall, ETF buyers haven’t started panic selling, as there were only $20.5 million worth of net total outflows on July 3. Grayscale’s ETF accounted for the majority, or $27 million worth of outflows...

Source: Bloomberg

However, Willy Chuang, COO of crypto exchange WOO X points out that "it's worth noting that despite these concerns, the long-term impact may be less severe as the market gradually absorbs the selling pressure."

Additionally, Joe Burnett, a former Blockware Solutions analyst and senior product marketing Manager at Unchained, commented on the seemingly coordinated timing of the dump on X: "Announcing a sale of this size is idiotic and creates a reflexive feedback loop."

Idiotic indeed... unless your goal is not economically rational, and instead ideological.