Bitcoin is extending its tumble from record highs this morning, touching a $92,000 handle before bouncing back a little.

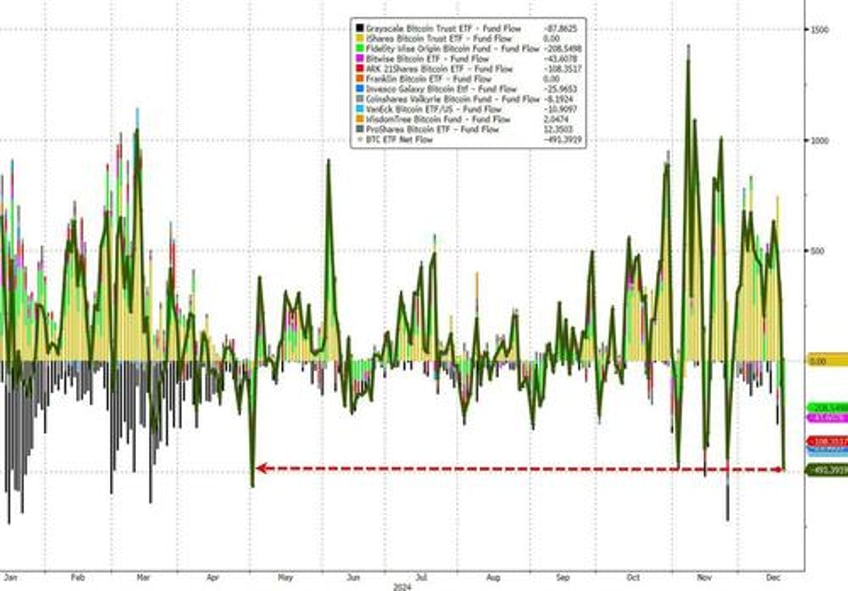

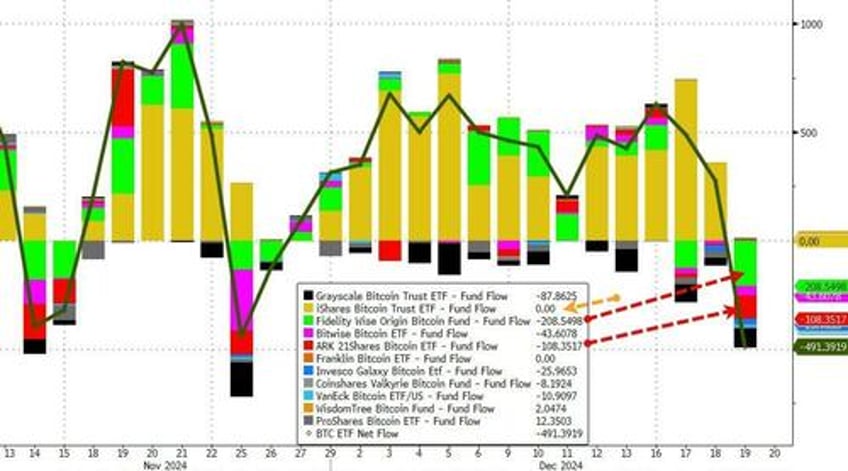

The downward momentum saw massive net outflows from ETFs (second largest daily net outflow on record)...

Source: Bloomberg

But while the net outflows were huge, we point out that IBIT (BlackRock's market dominating ETF) saw ZERO outflows in BTC or ETH)...

BTC ETF flows were dominated by ARK and Fidelity...

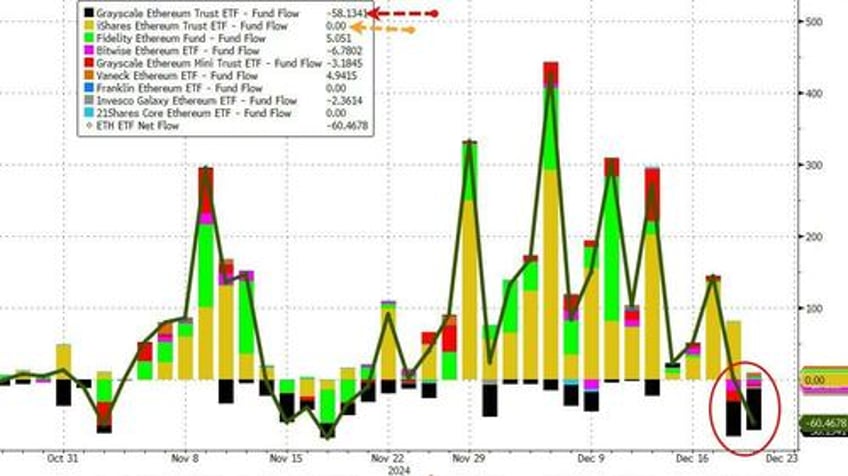

ETH ETF flows...

But, amid the collapse, CoinTelegraph reports that the proportion of social posts about buying the crypto dip has surged to its highest level since April, as Bitcoin fell below the psychological $100,000 price level, according to recent data.

“With Bitcoin falling as low as $95.5K today, the ratio of crypto discussions that are about buying crypto’s dip has reached its highest level in over 8 months,” crypto analysis firm Santiment said in a Dec. 19 X post.

Highest social dominance score in 8 months

The social dominance score - mentions of “buying the dip” across social media platforms - hit 0.061 on Dec. 19, as Bitcoin had remained below $100,000 for about 12 hours at the time of publication.

It was the highest social dominance score since April 12, when Bitcoin’s price dropped below the $70,000 mark to just above $67,000, before falling to about $63,000 the following day.

It almost retested this score on Aug. 4, when Bitcoin dropped below $60,000 and slid toward $53,000 within the following 24 hours.

It may not be the perfect time to BTFD quite yet though as global liquidity is signaling a retracement in BTC prices in the short-term...

Meanwhile, data shows that search interest for the term “crypto” remains high but has dropped since the start of December.

According to Google Trends data from the past 12 months, global searches for “crypto” are at a score of 75 over the past seven days, down 25 points from a score of 100 at the beginning of December.

Finally, there are some buyers still as CoinTelegraph reports that El Salvador bought $1 million worth of Bitcoin a day after striking a $1.4 billion deal with the International Monetary Fund that stipulated limits on dealing with the cryptocurrency.

The country’s National Bitcoin Office wrote in a Dec. 19 X post that it had “transferred over a million dollars worth of Bitcoin to our Strategic Bitcoin Reserve,” with its website showing it had added 11 Bitcoin to its holdings.

The move broke its streak of adding “one Bitcoin per day” that President Nayib Bukele announced in November 2022 and brought the country’s holdings to 5,980.77 BTC, worth about $580 million with BTC trading at around $97,000.

National Bitcoin Office Director Stacy Herbert said in a Dec. 19 X post that El Salvador “will continue buying Bitcoin (at possibly an accelerated pace).”

On Dec. 18, Bukele’s government struck a financing agreement with the IMF, which asked the country to wind down some of its Bitcoin dealings to receive $1.4 billion from the global lender over the next 40 months.

The IMF said that as part of the deal, El Salvador’s government-led Bitcoin activity, transactions and purchases would “be confined.”

The country also agreed to make private sector acceptance of Bitcoin voluntary, allow taxes to be paid only in US dollars and unwind government involvement in its Chivo crypto wallet.

A Bitcoin Office spokesperson told Cointelegraph at the time that it “will keep buying one Bitcoin a day (likely even more in the future), and we will not sell any of our current holdings,” adding that “Bitcoin continues to be our main strategy.”