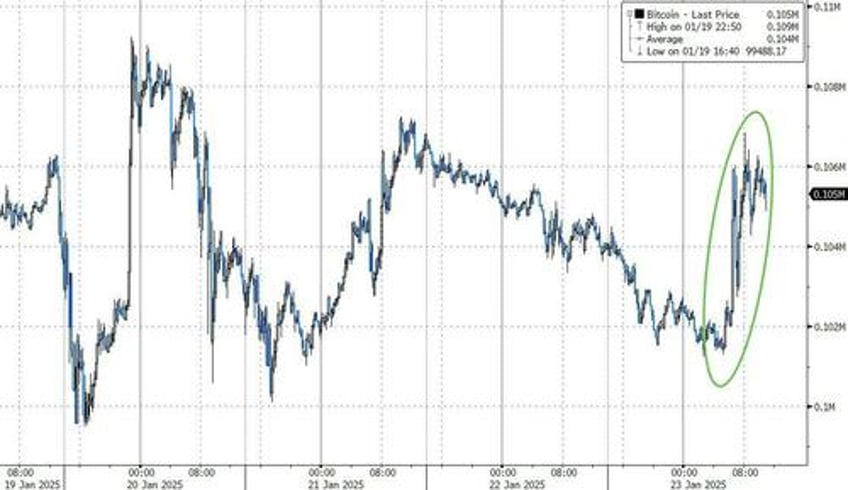

Bitcoin surged higher this morning following news that Senator Cynthia Lummis has been appointed by Senator Rick Scott, the head of the Senate Banking Committee, to chair the Senate Banking Subcommittee on Digital Assets.

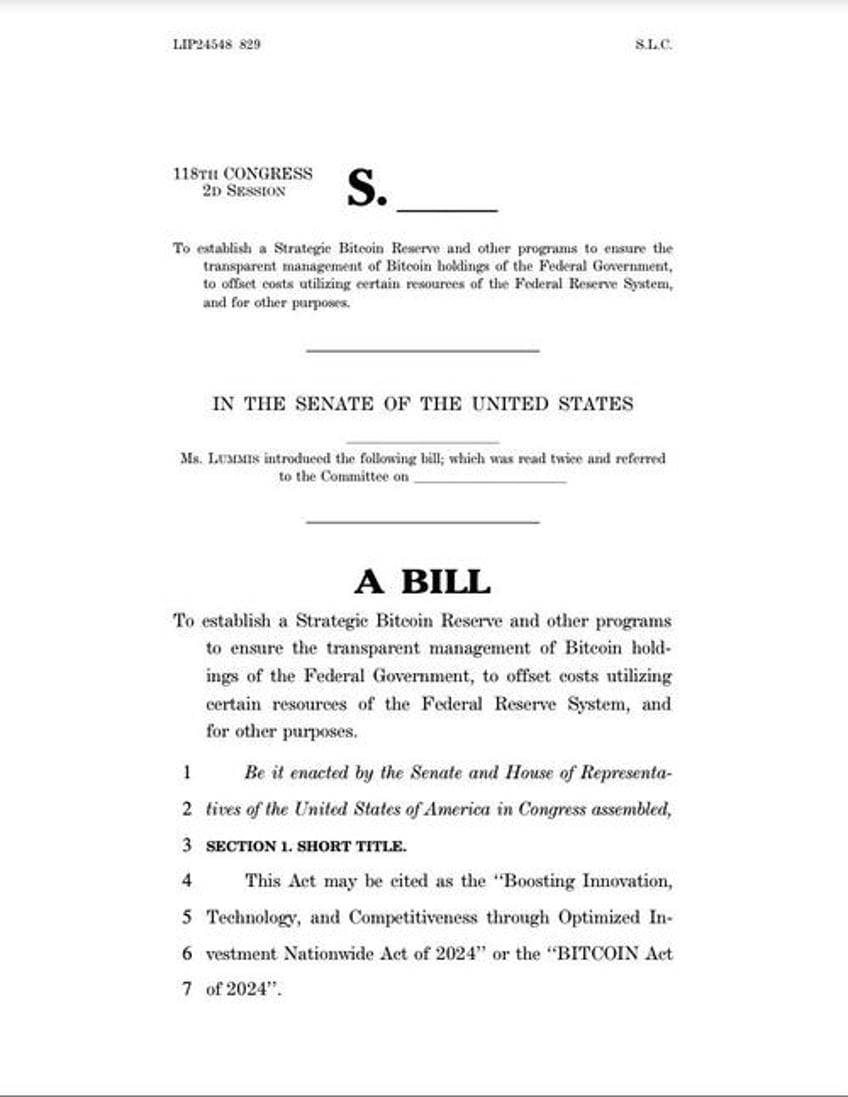

As Vince Quill reports for CoinTelegraph.com, the Wyoming senator introduced the Strategic Bitcoin Reserve Act to the US Senate in July 2024, following the Bitcoin 2024 conference.

According to Lummis, the subcommittee has two primary objectives:

to pass comprehensive digital asset legislation, and,

to conduct federal oversight over regulatory agencies to protect against overreach.

Lummis said the digital asset legislation would include a market structure bill, clear stablecoin regulations and provisions for a Bitcoin strategic reserve.

Lummis wrote:

“If the United States wants to remain a global leader in financial innovation, Congress needs to urgently pass bipartisan legislation establishing a comprehensive legal framework for digital assets that strengthens the US dollar with a strategic Bitcoin reserve.”

Lummis’ announcement sparked rumors and hopes that a Bitcoin strategic reserve would be announced, sending Bitcoin back above $106,000...

Former Binance CEO Changpeng Zhao said that the appointment of Lummis signals that a US Bitcoin strategic reserve is “pretty much confirmed.”

US Strategic Bitcoin Reserve, pretty much confirmed.

— CZ 🔶 BNB (@cz_binance) January 23, 2025

Crypto moving at crypto speed again. https://t.co/8qWlt65ARE

Bitcoin strategic reserve gains momentum, but doubts remain

Several US states have already introduced Bitcoin strategic reserve legislation, including Pennsylvania, Texas, Ohio, New Hampshire and Senator Lummis’ home state, Wyoming.

Senator Lummis’ Bitcoin strategic reserve bill. Source: Cynthia Lummis

Coinbase CEO Brian Armstrong recently called on nation-states to establish Bitcoin strategic reserves in a Jan. 17 blog post.

“The next global arms race will be in the digital economy, not space. Bitcoin could be as foundational to the global economy as gold,” the CEO wrote.

During the digital asset panel at the World Economic Forum conference in Davos, Switzerland, Cointelegraph editor Gareth Jenkinson asked Armstrong about the possibility of a Bitcoin strategic reserve in the US.

The Coinbase CEO responded that the idea is still “alive and well” despite the recent narrative attention captured by memecoins and social tokens.

Coinbase CEO Brian Armstrong at the World Economic Forum’s cryptocurrency panel. Source: Gareth Jenkinson

CryptoQuant CEO and market analyst Ki Young Ju took a different stance in December 2024, arguing that the likelihood of a Bitcoin strategic reserve in the US depends on US economic standing.

The analyst said that President Donald Trump’s pro-Bitcoin stance may clash with promises to strengthen the US dollar and the US in international trade.

A position of economic strength would make it unlikely for the president of the United States to adopt a Bitcoin strategic reserve, Ju wrote.

Additionally, President Trump may backtrack on his pro-crypto rhetoric if the US dollar continues to gain strength against other fiat currencies in global markets.