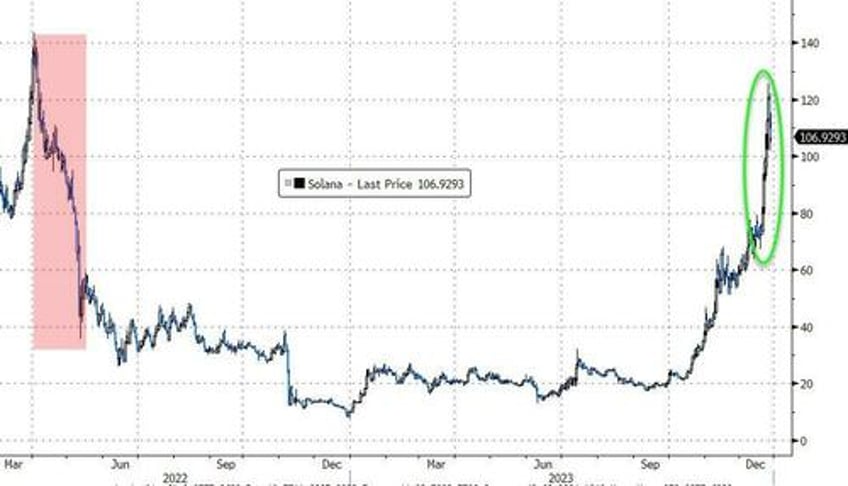

After a remarkable recovery from the depths of the FTX collapse crisis, with Solana soaring above $100 over the weekend for the first time since April 2022 (to $125 at its highs), supported by increased network activity and meme coin re-engagement...

Source: Bloomberg

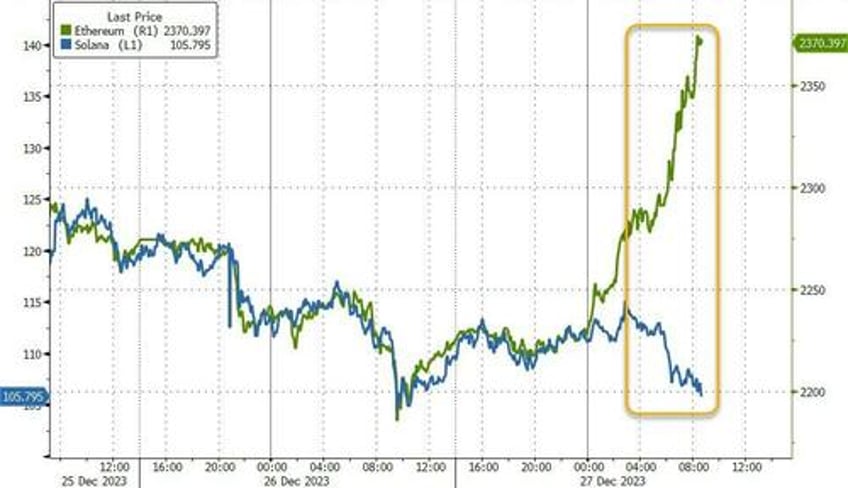

...the fourth largest cryptocurrency has stalled since, and it appears that has prompted a rotation into Ethereum...

Source: Bloomberg

Who could have seen that coming?

When that turns reverse parabolic, guess where the fund flows will go

— zerohedge (@zerohedge) December 24, 2023

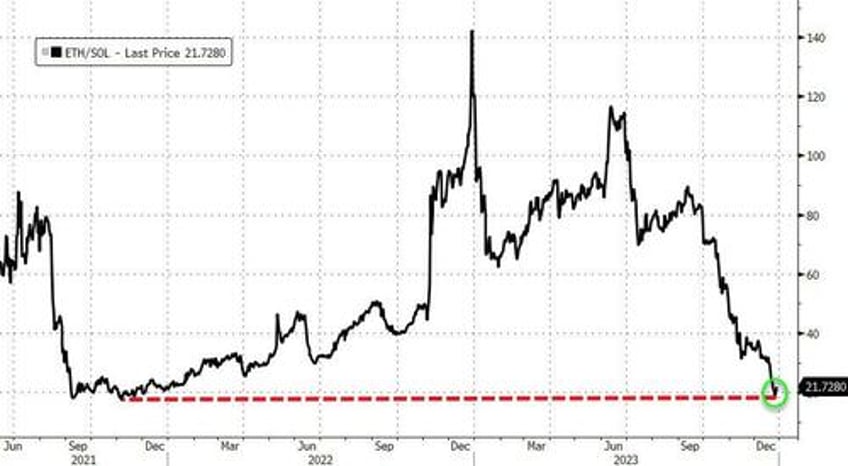

The ETH/SOL pair reversed at a very interesting level...

Source: Bloomberg

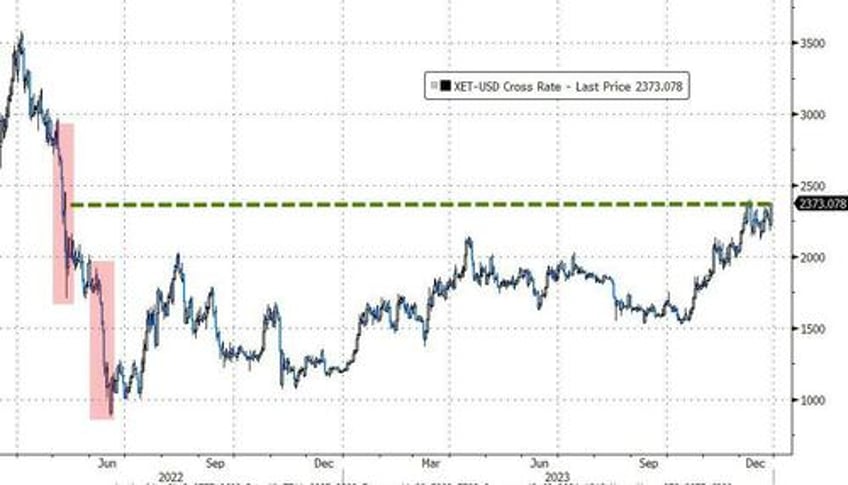

Ethereum is up near its $2403 highs from early December - the highest since the crypto crisis declines in 2022...

Source: Bloomberg

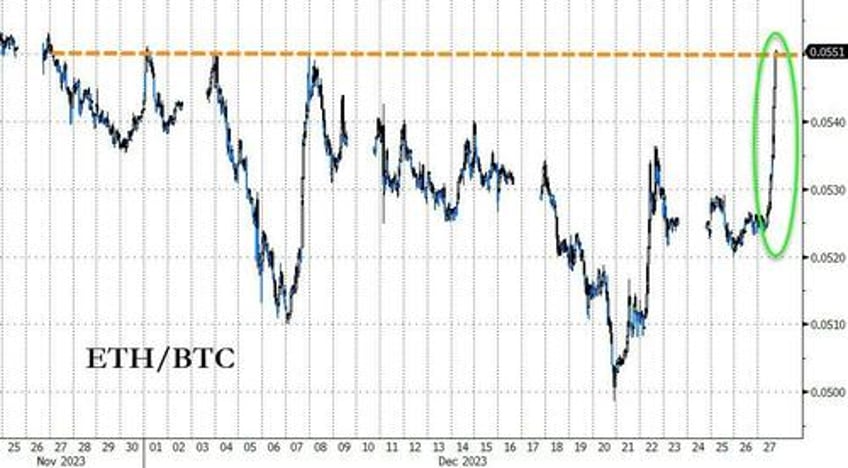

The rally in Ethereum has dramatically outpaced Bitcoin, taking ETH/BTC back up to 0.055 - a recent key resistance level...

Source: Bloomberg

Will it break through this time?

As CoinTelegraph's Marcel Pechman writes, this time, investors are gaining confidence in surpassing this level, venturing into territory not seen since May 2022, before the collapse of the Terra ecosystem.

While the spotlight is on the exchange-traded fund (ETF) narrative as the primary driver of recent cryptocurrency gains, there are several reasons supporting Ether’s price surge that could potentially push it above $2,500 before the expected ETF approval in mid-January, although the United States Securities and Exchange Commission (SEC) might take until March.

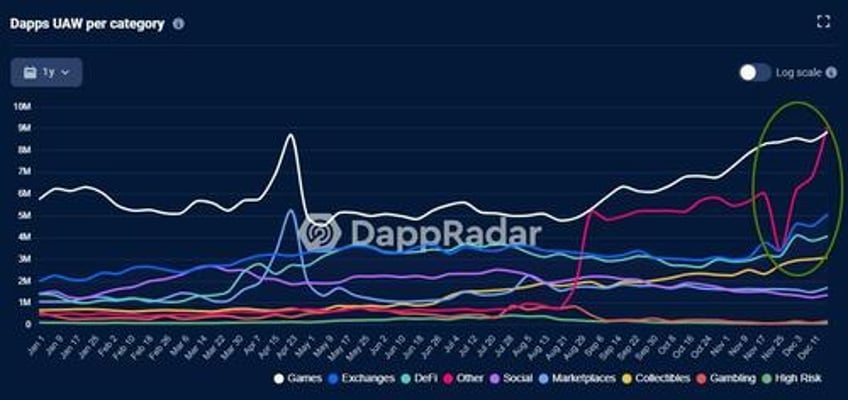

Ethereum network DApp volumes and protocol fees

Rather than attempting to predict the future, which is a challenging task in the fast-paced cryptocurrency industry, it’s more prudent to analyze recent trends influencing the demand for Ether using decentralized applications (DApps) activity as an indicator. One can start by examining DApp volumes, as some sectors do not require a large total value locked (TVL), such as nonfungible token marketplaces, games, layer-2 bridges and social networks.

7-day DApp volumes per blockchain in U.S. dollars. Source: DappRadar

Ethereum DApp volumes reached $27.8 billion in the last seven days, marking a 14.2% increase on the previous week. This growth was driven by a 21% gain in Uniswap and a 52% gain in Balancer volumes. In contrast, BNB Chain’s volumes for the same period stood at $4.5 billion, while Arbitrum amassed another $5 billion. Most notably, Ethereum was the only blockchain among the top six to experience a volume increase in the past seven days.

To provide some perspective, Solana would need to increase by 12 times to reach half of Ethereum DApps’ current transaction volume. In general, 20% of users account for 80% of the volume, which holds for DApps.

Given Ethereum’s first-mover advantage and substantial treasury for ecosystem development support, the odds do not favor a flipping in the short to medium term.

Furthermore, no other blockchain can match Ethereum’s protocol, which generated $95.4 million in fees in the last seven days, excluding Bitcoin, which is not a direct competitor in the DApp ecosystem.

Aside from incentivizing network security, this data indicates significant potential for increased activity following future updates, including ’DenCun’ scheduled for January, which aims to enhance processing capacity and reduce costs.

Ethereum spot ETF approval is not priced in according to derivatives markets

The eventual approval of the Ether spot ETF will set Ether apart from other cryptocurrencies in terms of regulation.

Competitors have only been nominally mentioned by regulators in recent court cases against exchanges, which face charges for offering securities brokerage and services without proper registration.

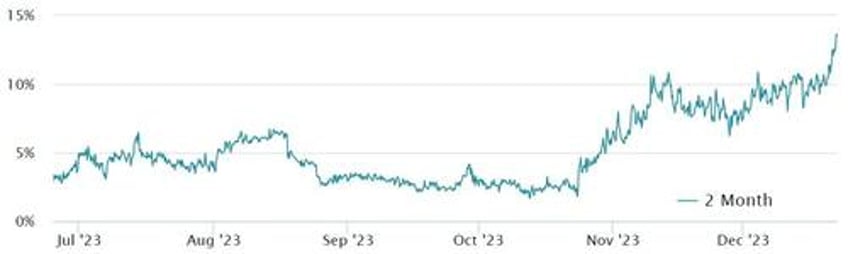

Finally, investors should assess the positioning of Ether derivatives traders, especially large investors and market makers. The Ether futures premium, measuring the difference between two-month contracts and the spot price, has reached its highest level in over a year. In a healthy market, the annualized premium, or basis rate, typically falls within the 5% to 10% range.

Ether two-month futures premium vs. spot markets. Source: Laevitas.ch

The current 13.5% Ether futures annualized premium suggests that traders are not taking the spot Ether ETF approval for granted.

During widespread excitement, this indicator tends to exceed 20%, driven by increased demand for leveraged long positions, causing price distortions relative to the spot market.

This data implies the potential for a positive price impact in case of approval, whether in January or March.

Based on Ethereum’s network activity, Ether investors should not yield to the pressure from contenders gaining momentum, at least not until these contenders pose a genuine threat in terms of volumes and deposits.

Furthermore, the ETH derivatives indicator provides clear guidance that professional traders are bullish despite Ether’s price nearing its highest level since May 2022.

This suggests that investors are confident in Ether’s ability to break above $2,500.

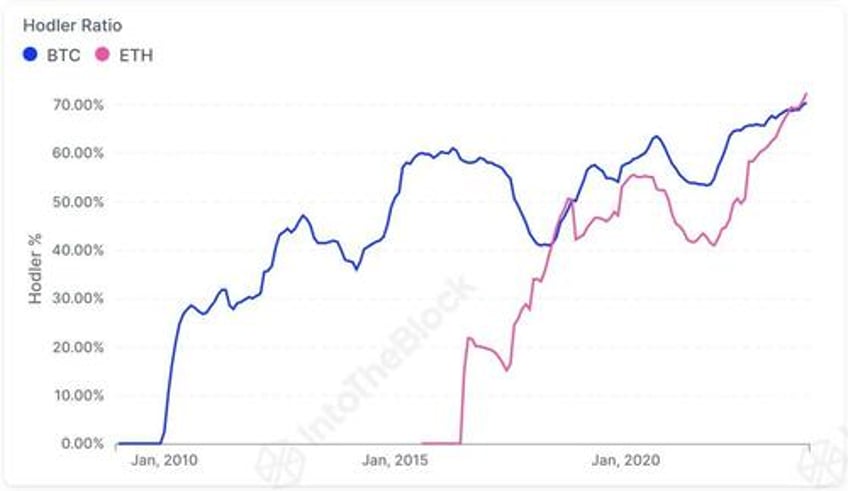

Finally, according to data from the market intelligence platform IntoTheBlock, the total amount of supply owned by the ETH long-term holders has reached a new all-time high.

As Bitcoinist reports, it would appear that despite these holders carrying some very substantial profits by now thanks to this year’s rally, they are still not interested in selling, as the HODLer ratio has only gone up for both Ethereum and Bitcoin.