Bitcoin's price trend continues to be dominated by the ETF narrative, and after Friday's re-filings of various ETF applications, SEC Chair Gary Gensler just dropped the biggest hint yet that the Spot ETF approval is imminent.

This follows eleven of the asset managers that have applied for permission to launch a spot Bitcoin ETF filed 19b-4 amendments on Jan. 5.

The filers included BlackRock, Valkyrie, Grayscale, Bitwise, Hashdex, ARK Invest and 21Shares, Invesco and Galaxy, Fidelity, Franklin Templeton, VanEck and WisdomTree.

And, in a three-part post on X, Gensler issues the clearest cover-your-ass narrative yet suggesting the approval is imminent:

A thread 🧵

— Gary Gensler (@GaryGensler) January 8, 2024

Some things to keep in mind if you're considering investing in crypto assets:

1. Those offering crypto asset investments/services may not be complying w/ applicable law, including federal securities laws. Investors in crypto asset securities should understand they may be deprived of key info & other important protections in connection w/ their investment.

2. Investments in crypto assets also can be exceptionally risky & are often volatile. A number of major platforms & crypto assets have become insolvent and/or lost value. Investments in crypto assets continue to be subject to significant risk.

3. Fraudsters continue to exploit the rising popularity of crypto assets to lure retail investors into scams. These investments continue to be replete w/ fraud- bogus coin offerings, Ponzi & pyramid schemes, & outright theft where a project promoter disappears w/ investors’ money.

To which we charitably added a fourth warning:

4️⃣ Unlike banks and the entire western financial system, crypto has never had a central bank bailout. In fact, central banks are actively conspiring against it. And yet its price is fast approaching all time highs having survived countless crises on its own

— zerohedge (@zerohedge) January 8, 2024

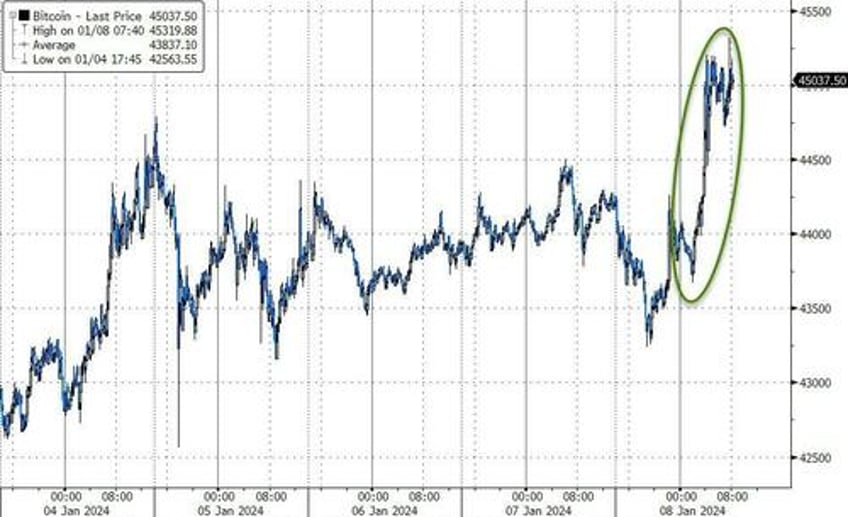

Bitcoin topped $45,000 this morning amid the growing confidence in SEC approval...

Bloomberg Intelligence's ETF analyst Eric Balchunas said he would "probably go with 5% at this point" in reference to the likelihood of the SEC rejecting the spot Bitcoin ETF applications on its desk.

“It’s basically done,” Balchunas tweeted on Jan. 5, noting that the United States Securities and Exchange Commission (SEC) has been “trying to line everyone up for a Jan. 11 launch.”

He stressed, however, that the SEC had not officially confirmed that timeline.

Participants in crypto betting platform Polymarket are more cautious, currently placing the odds at approval of a spot Bitcoin ETF by January 15 at 82%.

Finally, as Decrypt reports, Bitcoin ETF hopefuls have been given until Monday morning to submit last-minute revisions to their applications. The SEC has an open window until January 10 in which it could approve multiple applications simultaneously.

The first stage in approval of a spot Bitcoin ETF would be the SEC signing off on 19b-4 filings by the exchanges planning to list the ETFs, all of which were submitted by 6 p.m. ET on Friday.

The SEC would then need to approve the issuers' S-1 applications; with both approved, the ETFs could technically begin trading the next business day.