Bitcoin confuses many people, including prominent investment professionals.

Recently, I debunked the top ten most pervasive misunderstandings.

Today, I’ll continue by debunking another five.

Misconception #11—Bitcoin Is Vulnerable to Nuclear War and Utility Outages

Even if the US and Russia engaged in an all-out nuclear war, destroying most of the Northern Hemisphere, Bitcoin wouldn’t miss a beat in the Southern Hemisphere.

To even have a chance to stop Bitcoin, every government in the world would have to successfully coordinate simultaneously to shut down the entire Internet everywhere and then keep it off.

Even in that improbable scenario, the Bitcoin network can be communicated over radio signals and mesh networks. At the same time, small portable solar panels can power the computers running the network if the regular grid is unavailable.

Further, a network of satellites is constantly beaming the Bitcoin network down to Earth.

In short, all aspects of Bitcoin are genuinely decentralized and robust.

Barring an inescapable, global return to the Stone Age, Bitcoin appears unstoppable.

Misconception #12—Bitcoin 2.0 or a “Better Bitcoin”

As a practical matter, anyone can try to make a “better Bitcoin” whenever they want.

All you have to do is take the open-source code—available to anyone—and make your desired changes.

But that doesn’t mean anyone will follow your lead or value your new cryptocurrency.

For example, I can easily make a new Bitcoin that adds some bells and whistles and tout it using the latest buzzword. Let’s call it Bitcoin 2.0.

But that doesn’t mean I can inherit the superior monetary properties of the original Bitcoin, which depends on its supply’s credibility, which depends on its extreme resistance to change, which I’ve just undermined by adding some bells and whistles and thus demonstrating that someone can change it.

That’s why the market is unlikely to assign any value to Bitcoin 2.0.

Here’s another way to think of it.

Imagine someone wanting to change the rules of chess so pawns could move backward. Let’s call it Chess 2.0.

Of course, anyone could do so anytime, but that doesn’t mean Chess 2.0 will gain traction.

Remember, anyone can make a cryptocurrency in minutes.

That’s the easy part.

Making one that nobody controls is the hard part.

Simply put, no other cryptocurrency comes even close to challenging Bitcoin’s immutability, decentralization, resistance to debasement, liquidity, economic incentives, network effects, and, most importantly, the credibility of its supply.

But suppose a new cryptocurrency came along that was a genuine competitor to Bitcoin.

To disrupt Bitcoin’s established dominance as a monetary network, it would have to be not just a little bit better, but orders of magnitude better.

According to renowned author Jeff Booth, a new competitor to an established network must be at least 10x better to convince enough people to leave the existing one and join the new network.

There have been dubious claims of a “better Bitcoin” for many years, usually from people who simply don’t understand Bitcoin or disreputable altcoin promoters.

I am not inclined to believe such claims until there is solid evidence that something could potentially have much better monetary properties than Bitcoin.

So far, nothing has come close.

Misconception #13—The SEC Will Go After Bitcoin

Given their statements, it’s clear that the Securities and Exchange Commission (SEC) views almost all cryptocurrencies as unregistered securities, making them vulnerable to enforcement actions.

That has led many to incorrectly believe that the SEC will go after Bitcoin.

The reality is that Bitcoin is the only cryptocurrency unambiguously NOT a security.

The US government has been clear that it views Bitcoin—and only Bitcoin—as a commodity under the purview of the Commodity Futures Trading Commission (CFTC) and the Commodity Exchange Act.

Bitcoin is a commodity because it is an asset without an issuer.

Similarly, gold, silver, copper, wheat, corn, and other commodities have producers, but they do not have issuers.

Every other cryptocurrency other than Bitcoin has an issuer. They also have identifiable founders, central foundations, marketing teams, and insiders who can exercise undue control.

On the other hand, Bitcoin has none of these things—just as copper or nickel has no marketing department or founder.

The SEC couldn’t go after Bitcoin even if it wanted to because there’s nobody to go after. There’s no Bitcoin headquarters. Bitcoin has no CEO, no marketing department, and no employees.

But presuming the SEC could go after Bitcoin, they won’t because even they admit Bitcoin is not a security and thus not under their purview.

Misconception #14—Breaking Bitcoin’s Cryptography

Bitcoin’s cryptography is not a risk today.

If Bitcoin’s cryptography were at risk of being broken, it would also be an existential problem for every bank, brokerage, central bank, email provider, and every aspect of modern digital life.

I would put this risk in the same category as an alien invasion—something theoretically possible but irrelevant to investment decisions today.

But let’s suppose a hypothetical problem of quantum computing—or some new technology—posing a threat to Bitcoin’s cryptography.

A hypothetical solution exists.

It would be possible to upgrade Bitcoin’s cryptography by gaining the consensus of the full nodes to make it resistant to quantum computing or whatever new technology is an existential threat to it.

Misconception #15—Bitcoin Is Too Volatile To Be Money

It’s essential first to clarify that while the Bitcoin price is volatile, the Bitcoin protocol is the most stable, predictable, and reliable thing I know of in finance.

Ever since Bitcoin’s inception in 2009, the 21 million total supply has not changed, the network has never stopped, miners have continued to create a new block every 10 minutes on average, and anyone has always been able to use Bitcoin to send value to anyone, anywhere, without needing a third party.

In short, despite everything that has happened since 2009, the Bitcoin network hasn’t missed a beat.

That said, monetization doesn’t happen overnight, and it’s inherently a volatile process for the Bitcoin price.

While gold is an established money, Bitcoin is an emerging one.

It took gold centuries to achieve monetization. Bitcoin has a good chance of undergoing monetization in a much shorter period—and it’s already well on its way.

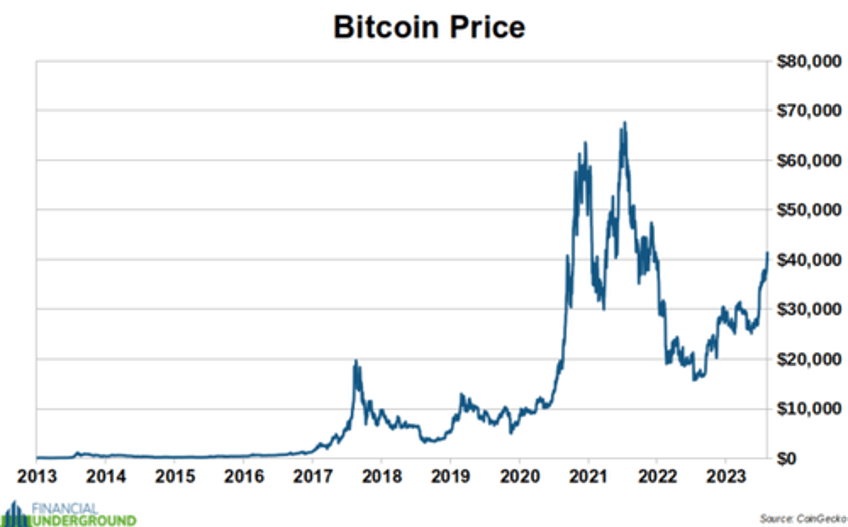

Something doesn’t go from having no value to being significant global money without volatility in its price. For example, Bitcoin went from having no value in 2009 to over $67,000 in 2021 to around $41,600 as of writing.

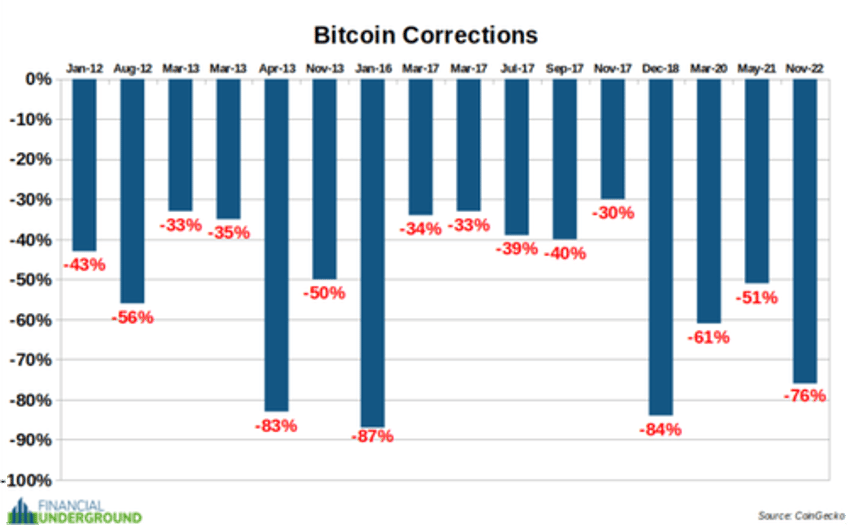

It is not uncommon for Bitcoin to have significant corrections of 50% or more, which has happened eight times. Further, there have been three occasions where Bitcoin has declined 80% or more.

Here is a chart showing Bitcoin’s biggest corrections over the years to put its volatility into perspective.

If you zoom out and look at the Big Picture, the volatility of the Bitcoin price has mainly been to the upside over the long term.

It’s a series of higher highs and higher lows.

Stomaching Bitcoin’s volatility is the price we must pay to earn outsized gains as it undergoes the process of monetization.

It will be a wild ride—like a violent roller coaster—but I believe it will reward patient investors.

There are a couple of ways to help tame the volatility of Bitcoin’s price.

First, instead of buying your desired amount of Bitcoin in one large transaction, use dollar cost averaging (DCA) to spread it out over time.

For example, suppose you’d like to invest $10,000 into Bitcoin. Instead of buying $10,000 at once, make a purchase of around $192 each week for a year.

DCA significantly reduces the risk of buying too much at the top of a cycle and not buying at the bottom.

That’s how DCA can turn Bitcoin’s volatility in your favor.

Second, plan on holding for at least four years—through one halving cycle.

There has rarely been a period in which the Bitcoin price was lower than it was four years ago. But, of course, past performance does not indicate future results.

Third, whenever you see volatility in the Bitcoin price, ask yourself two things:

1) Does Bitcoin still have superior monetary properties (total resistance to debasement and extreme portability)?

2) Is Bitcoin still unstoppable?

If the answer to those two questions is “Yes,” I would not be worried.

As adoption grows and Bitcoin becomes more established as money, the volatility should smooth out—but probably at a much higher price.

That’s why you want to buy Bitcoin—and the best Bitcoin stocks—before the rest of the world figures out its superior monetary properties.

I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.