One of the things I frequently point at in the incessantly tiresome debate between the precious metals and cryptocurrency communities is that while each asset offers its own advantages, cryptos afford a level of optionality for capital mobility that simply doesn’t exist for precious metals.

At least until fairly recently.

Gold is heavy – a one kilo bar is slightly smaller than an iPhone. When you see those scenes in “heist” movies where the crooks are lobbing gold bars around, you know they’re using spray painted styrofoam. A real gold brick would just drop straight to the floor, probably crushing the guy’s foot into mush.

I don’t think so. (Plus you’d need a forklift to move that box).

So no matter how superior one might think gold is as a store of value and a monetary metal – if you have anything beyond a small physical amount in your possession and you need to move locations in a hurry, you have a big problem.

Even traveling with coins or small bars can be an issue if you have to get out of a heavily militarized zone or an area where civil order has broken down. It’s difficult to conceal, and a magnate for trouble if you’re flashing any around to buy passage or refuge.

With cryptos, you can literally hide your wealth in your mind. It’s called a “brain wallet“: you memorize the seed phrase for your private keys (12 or 24 words), and from there on out you can focus on the task at hand – getting yourself and your family out of whatever “hot zone” you’re in.

Whether its a war torn fiefdom in the (so-called) Third World, or a near-future People’s Republic of Canada after the Prime Minister seizes your bank account for running a natural gas furnace in the winter, with a brain wallet you just need to get out of dodge, and then you can reestablish yourself, and a chunk of your wealth, from a safe distance.

Online Vaulted Gold Is Not a Viable Defense From Capital Controls

One option that has come to the fore that gives people the ability to hold gold at a distance, is vaulted gold. These are non-bank custodial vaults – often contracting with the likes of Brinks or other companies – that hold precious metals on behalf of their clients. Bullionvault – domiciled in London, UK, is among the largest of these, with $4.1 billion USD under custody on behalf of over 100,000 clients.

Goldmoney is another one, founded by James Turk – later acquired by Bitgold and now publicly traded on the Toronto Stock Exchange (TSX:XAU). The original Bitgold value-prop was to provide Bitcoin-to-gold convertability – where one could deposit BTC, covert into gold – and even redeem the precious metals. I did this a couple times in 2018 and it was a byzantine nightmare of delays – all regulatory. They eventually suspended the Bitcoin aspect of the operations and reverted to being a straight up gold and silver vaulting platform under the original Goldmoney brand. (In the interests of disclosure, I hold Goldmoney shares).

There is also the US based GoldSilverVault which offers fully segregated holdings – I’ve had a few conversations with its founder and CEO Bob Coleman about the ins-and-outs of all this and he is beyond a doubt, one of the most knowledgeable in the industry.

For a good overview on vaulted gold options, you can check out TrustableGold, although it’s a more Euro-centric (they don’t cover some of the US options like GoldSilverVault).

Vaulted gold provides a good way to store some of your wealth away in an offshore jurisdiction, and you have a decent level of liquidity. Once your account is set up, you can move from fiat to precious metals – and between precious metals… and even between vaults (e.g Singapore, London, Toronto, etc) easily. It’s frictionless, from a user perspective.

But there are limitations and caveats to having gold stored within these platforms. Here are the big weaknesses of vaulted gold platforms:

You cannot spend gold between accounts or users – this used to be a feature of the early Digital Gold Currencies like e-gold, pecunix and the original Goldmoney (before its current incarnation). That’s what actually sunk the former and the latter had to move away from being a transaction platform to a straight store-of-value platform – for regulatory reasons (there’s that word again).

You can only cash out to the same bank account you funded through – as with any centralized exchange or financial platform, setting up your account involves undergoing KYC (Know Your Customer), uploading government issued photo ID, proof-of-residence and finally linking your bank account. Once you’ve done so, you can only fund through your linked accounts, you can only cash out through those accounts.If you’re holding some of your wealth in an online vault like this, and in a crisis you find yourself as a refugee, in exile or otherwise nomadic – you cannot easily redeem your vaulted holdings out into some other bank account in another jurisdiction. You’re going to have to jump through a lot of hoops – and it will take time.

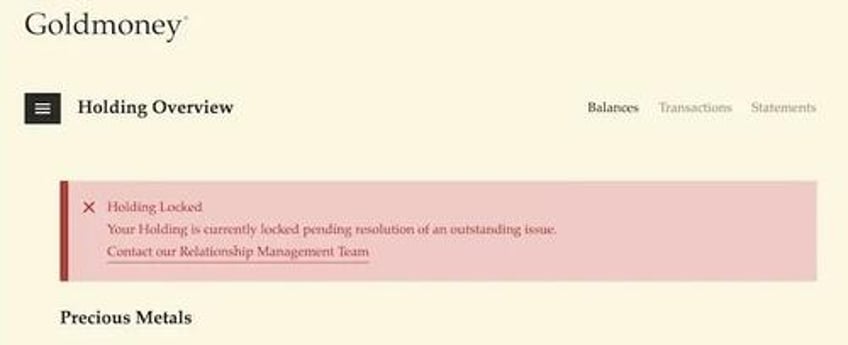

The vaulted gold platforms are centralized and require trust – you deposit your money, they hold your gold and you basically have to trust them to do that and to give you access to it when you want it, which is typically when you need it the most.As someone who over on the crypto side never leaves anything on the exchange, I had an unpleasant reminder of the “not your keys = not your coins” mantra when I recently logged into my Goldmoney account…I hadn’t logged into my account in years and it got straightened out in short order – but the entire point of these vaults is they’re supposed to be a place where you can safely custody some previous metals and then forget about it. For years on end. But in this era of increasingly high demands on providers for regular KYC audits on their client base – you can almost guarantee that if you’ve simply left your deposits for any length of time, they’ll probably be locked up the next time you want to access them.

Vaulted gold is still a viable solution for diversification – from both an asset and geographical standpoint, provided the system is operating and the rule of law has not been mangled by ever increasingly despotic governments.

Not good.

But in the event of nationalizations or catastrophic system collapse – your gold will likely either be stuck inside the vault for the duration of the crisis or you will be barred from accessing your holdings because the only financial egress point (the bank accounts linked to your profile) has been seized or frozen.

Gold-backed cryptocurrencies: The Best of Both Worlds

It is still early in the gold-backed crypto space. This site’s founder, John Rubino covered these early initiatives in 2018, and there were a fair number of comments there pointing out still more options (one unique approach was a DAO – Decentralized Autonomous Organization – that owned a gold mine in Ethiopia, alas the project now seems defunct).

While we are not there yet – the projects and companies pioneering this space today are closer than ever. As noted in our new gold-backed crypto monitor section, the impediments to trustless store-of-value of precious metals and perfectly frictionless capital mobility are not technological, they’re regulatory.

We’re going to make it our business to follow the ones we feel have a shot at achieving escape velocity.

One of the front-runners in my mind is Lode.one. On a call with the Lode team earlier this month I was impressed at how their business continuity plans included provisions for their smart contracts to function independently of themselves, even if the Lode organization ceased to exist:

The smart contracts were running on a blockchain (in this case Avalanche – AVAX), – they are open source and published on their Github – and they would continue to collect custodial fees from the holdings and use those to pay their vaulting contracts – completely automated in the event that an asteroid hit them.

Holders of the AUG and AUX tokens could then redeem their holdings even after the business ceased to exist. It may sound very cyberpunk, but it is the state of the technology today.

Eventually I expect technological advancement to overcome the regulatory headwinds for several reasons:

My base scenario for today’s polycrisis (what I came to call “The Jackpot” back in 2020), is a secular decline in centralized governance structures like nation states

Geopolitical jurisdictions desperate for capital inflows will begin to compete for citizens a la “The Sovereign Individual” thesis

World War Three will be more about populations vs governments than nations vs nations – so the ones that survive will be those who adapt themselves to the highly networked world ultra-mobile capital.

* * *

I cover a lot of these themes in The Bitcoin Capitalist Letter on an ongoing basis, and it’s slightly out-of-scope here (if you’re interested I’d recommend starting with The Crypto Capitalist Manifesto, which you can get free here), but if you were wondering why I predict that gold-backed cryptos will ever overcome the headwinds of industrial age regulations and institutionalized lethargy – that’s why.

Sign up to the DollarCollapse mailing list and receive the simplest, most actionable guide to contrarian investing Nobody Knows Anything, free.

Follow us on Twitter here, or like us on Facebook here.