Something odd just happened in crypto-land...

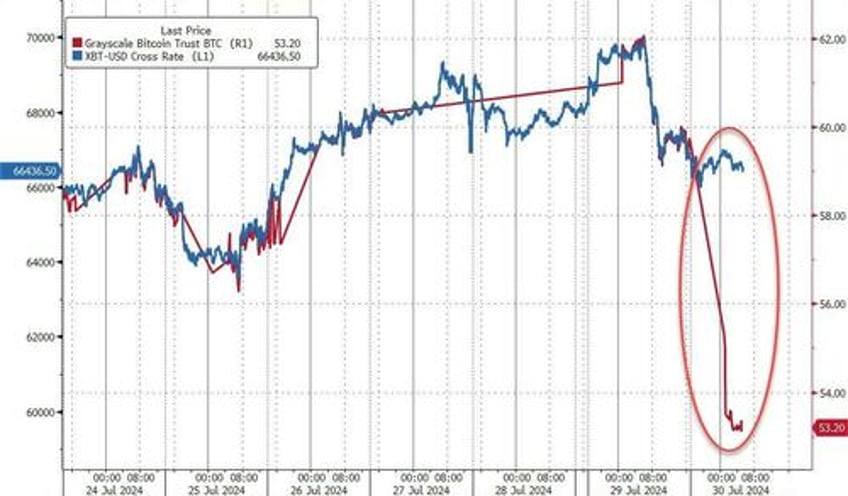

The Grayscale Bitcoin Trust ETF (GBTC) suddenly crashed 11%...

...completely decoupling from the underlying bitcoin price...

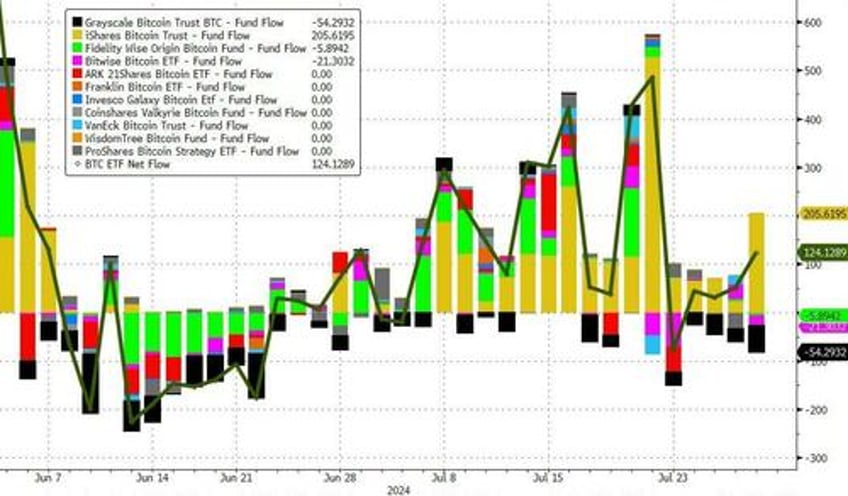

GBTC has seen almost constant serial outflows (while the rest of the ETF patch has seen inflows)...

As CoinTelegraph reports, asset management firm Grayscale Investments has recorded over $20.4 billion in outflows from its spot Bitcoin and Ether exchange-traded funds (ETFs) combined.

The Grayscale Bitcoin Trust ETF (GBTC) has lost an average of approximately $137.7 million daily in almost seven months since its launch on Jan. 11.

As of July 29, GBTC recorded total outflows of $18.86 billion.

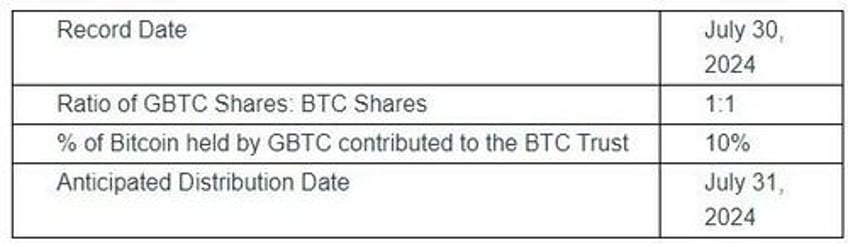

Several traders are pointing to the following press release from Grayscale:

Grayscale Investments®, the world’s largest crypto asset manager*, offering more than 20 crypto investment products, previously announced that it has set a record date of July 30, 2024 (the “Record Date”) for the initial creation and distribution of shares of Grayscale Bitcoin Mini Trust (the “BTC Trust”) to shareholders of Grayscale Bitcoin Trust (Ticker: GBTC) (“GBTC”) (referred to as the “Initial Distribution”).

Grayscale also previously announced an intention to list Grayscale Bitcoin Mini Trust on NYSE Arca, subject to required regulatory approvals, under the ticker symbol “BTC.”Today, Grayscale is confirming that from and after July 30, 2024, anyone who purchases GBTC shares will not be entitled to receive BTC shares in the Initial Distribution.

Additionally, Grayscale currently expects the Initial Distribution Date to be July 31, 2024, following (i) the filing and effectiveness of the BTC Trust’s registration statement on Form 8-A to register the BTC Shares under the Exchange Act, (ii) the effectiveness of the BTC Trust’s registration statement on Form S-1 (Registration No. 333-277837) under the Securities Act, and (iii) the BTC Shares having been approved for listing on NYSE Arca.

No assurance can be given that the Initial Distribution will occur on Grayscale’s anticipated timeline, and Grayscale will update the market to the extent its expectations change.

So it appears Grayscale is seeding its mini-BTC ETF with a distribution from GBTC which would suggest the "10%"-ish decline in GBTC is warranted.