The German and United States governments have drawn significant attention after transferring millions of dollars of crypto holdings.

As Josh O'Sullivan reports at CoinTelegraph.com, the German government has made substantial Bitcoin transfers, while the U.S. government has transferred Ether from seized funds.

On July 1, the German government moved 1,500 BTC worth roughly $95 million to multiple crypto exchanges, while the U.S. government moved 3,375 ETH worth $11.75 million to an unknown address.

German government BTC transfers

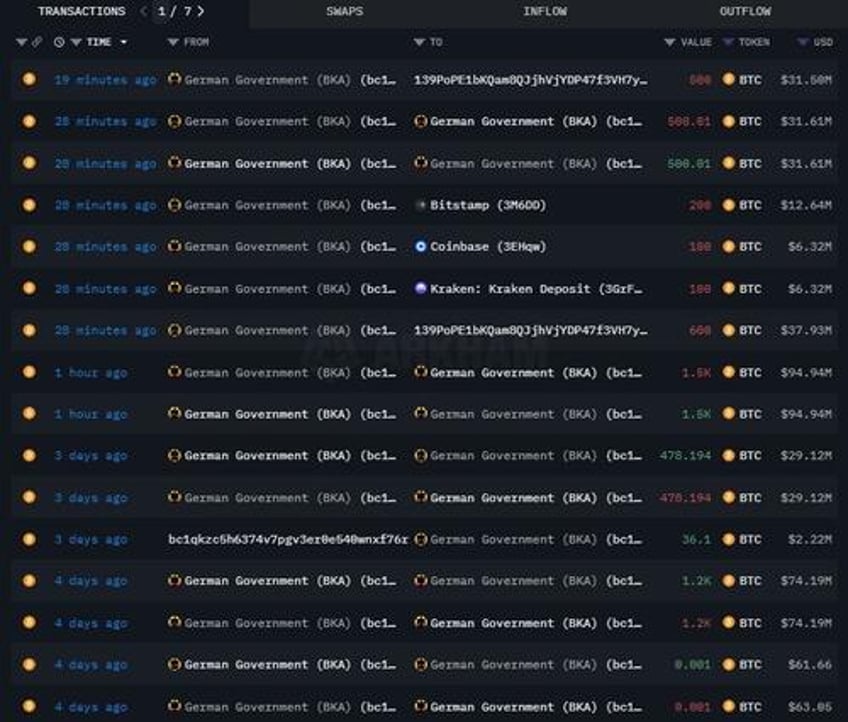

According to data from the onchain analytics platform Arkham Intelligence, the German government has transferred 2,700 BTC to multiple exchanges over the last two weeks.

The exchanges include Bitstamp, Coinbase and Kraken. The German government currently holds 44,692 BTC worth approximately $2.82 billion.

In its latest transfers, 400 of the 1,500 BTC transferred were sent to the aforementioned major crypto exchanges, while 750 BTC was transferred on June 26 — 250 of that to Bitstamp and Kraken.

Arkham Intelligence data of German government crypto movements over the last four days. Source: Arkham Intelligence

U.S. government ETH transfers

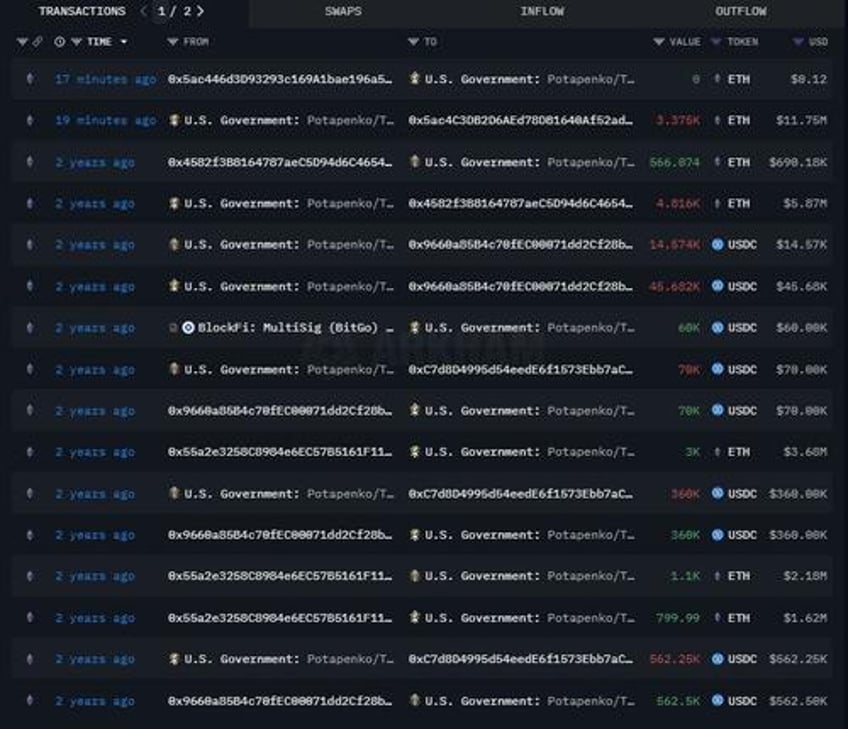

According to Arkham intelligence data, the U.S. government has made large transactions, specifically the address holding funds seized from Estonian crypto entrepreneurs Sergei Potapenko and Ivan Turogin.

Previously moving 11.84 BTC worth around $743,000 on June 30 from another seized funds address, the U.S. government has since moved its entire $11.75 million in ETH holdings to a previously unassociated address.

Arkham Intelligence data of U.S. government crypto movements over the last two years. Source: Arkham Intelligence

Analysis and impact

These frequent recent transfers by both governments suggest strategic management of the held funds, with Germany potentially looking to liquidate its holdings on major exchanges.

The U.S. government’s movement of funds to an unknown wallet could suggest a general shift in ETH fund management.

The Markets in Crypto-Assets Regulation (MiCA) recently adopted by the European Union could influence Germany’s crypto transfers.

Set to affect stablecoins and crypto asset services alike, MiCA is expected to shake up the crypto market substantially.

The question many are asking is the tactical timing of the potential government liquidations comes at a time when Bitcoin has seen historical seasonal strength.

As Tom Mitchelhill reports, the price of Bitcoin historically averaged a slump of 0.35% in June, according to data from Coinglass, which tracks the monthly returns of Bitcoin beginning in 2013.

The data shows that in previous years, whenever June ended in a downtrend, the following month saw a roaring comeback, with Bitcoin gaining an average of 7.42% historically.

Historically, Bitcoin has performed strongly in July when June ended in a decline. Source: CoinGlass

Overall, BTC has posted minimum monthly gains of 8% for seven of the last 11 July trading periods.

Memecoin analyst Murad also highlighted this in a post to their 103,000 followers on X, pointing to the swift historical rebounds beginning in July.

Murad noted that Bitcoin had posted minimum gains of 28% in the first few weeks of every July for the last six consecutive years.

Source: Murad

However, despite the overhang of US/German govt unwinds, several analysts believe the impact of these repayments may not be as dire as many investors expect, with only $4 billion set to hit the spot BTC market.

Jonathan de Wet, chief investment officer at digital asset trading firm ZeroCap, told Cointelegraph in a recent interview that Bitcoin had been trading strongly in a low to mid $60,000 range despite headwinds.

He said he expects the asset to hold around this level but said it could fall to its “key support” level at around $57,000 in the coming weeks as Mt. Gox creditor repayments hit the market.

Historically, Bitcoin’s best monthly performance tends to arrive in November, with an average monthly gain of 46.81% since 2013.