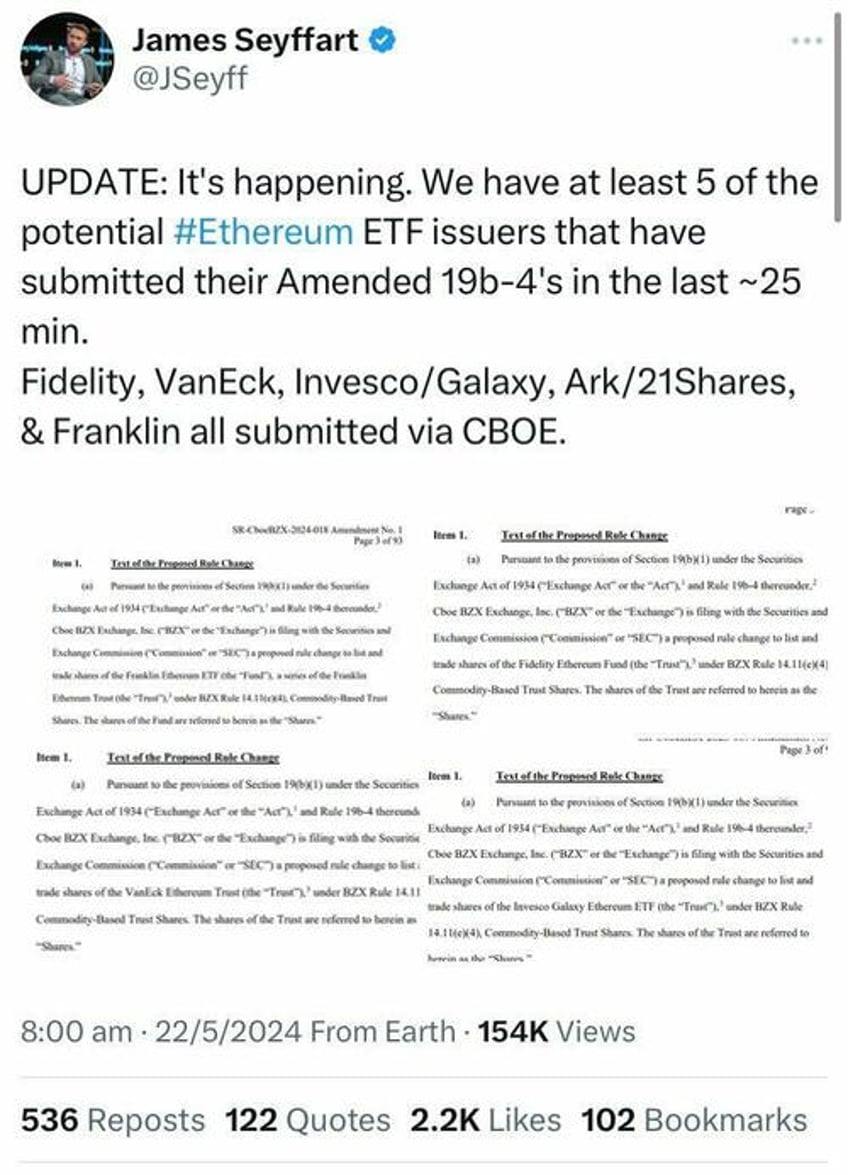

Five potential spot Ether exchange-traded fund (ETF) issuers have submitted amended 19b-4 filings after receiving last-minute feedback from the United States Securities and Exchange Commission (SEC).

Several filings show changes from asset managers Fidelity, VanEck and Franklin Templeton, along with joint applications from Galaxy and Invesco, and ARK Invest and 21Shares.

As Brayden Lindrea reports via CoinTelegraph, the amendments saw Fidelity, Franklin Templeton and ARK 21Shares remove provisions for Ether staking.

“Neither the Trust, nor the Sponsor, nor the Custodian, nor any other person associated with the Trust will, directly or indirectly, engage in action where any portion of the Trust’s ETH becomes subject to the Ethereum proof-of-stake validation or is used to earn additional ETH or generate income or other earnings,” Fidelity’s amended 19b-4 filing read.

The other Chicago Board Options Exchange (CBOE)-sponsored applicants used similar language.

Grayscale also scrapped staking, according to a proxy statement.

However, Adam Cochran, partner at venture capital firm Cinneamhain Ventures, claimed that an approved spot Ether ETF without the staking element would actually boost staking returns.

“ETFs without staking provide the same crucial boost to Ethereum’s legitimacy while avoiding ETF tail risk and diluting my yield,” added Ryan Berckmans, Ethereum community member and investor.

All five CBOE filings came in the 25 minutes between 9:35 pm and 10:00 pm UTC on May 21, according to Bloomberg ETF analyst James Seyffart.

The approved 19b-4 filings will need to be accompanied by signed-off S-1 registration statements for the ETFs to launch, Seyffart iterated.

“Still a potentially long way from a launch. But these filings prove that all of the rumors and speculation and chatter have been accurate,” he added.

Source: James Seyffart

The SEC must decide on VanEck’s application by May 23. However, industry pundits tip the regulator to decide on all or most applicants, similar to how it handled spot Bitcoin ETF applications in January.

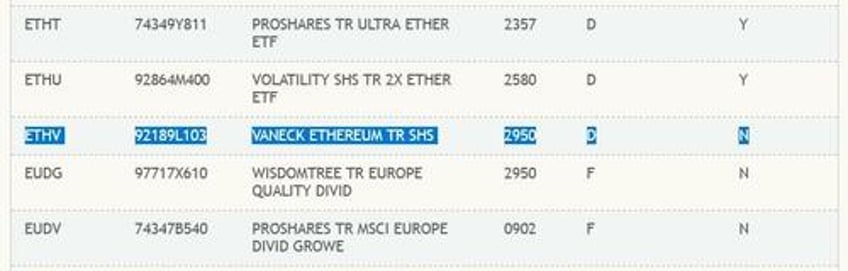

Fox Business reporter Eleanor Terrett noted that VanEck’s Ether ETF bid was added to the Depository Trust and Clearing Corporation’s (DTCC) website.

Listing of VanEck’s spot Ether ETF on DTCC’s website. Source: DTCC

The DTCC website often lists securities eligible for trading and settlement within its systems, including ETFs that have completed particular registration or compliance processes. However, this doesn’t indicate that the securities will be approved by the SEC.

BlackRock and Hashdex are the other two spot Ether ETF applicants vying for SEC approval.

It comes as the SEC reportedly started asking applicants to accelerate their 19b-4 filings on May 20.

The sudden change resulted in Seyffart and fellow Bloomberg ETF analyst Eric Balchunas raising their spot Ether ETF approval odds from 25% to 75%.

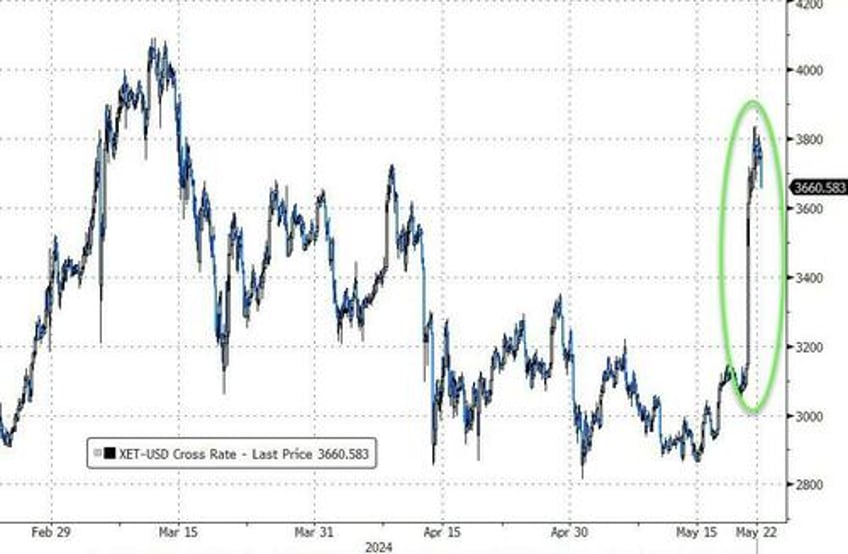

ETH is up 20.6% to around $3,800 since the SEC’s reported U-turn, according to CoinGecko.

Finally, CoinTelegraph reports that Bitcoin and Ethereum-based exchange-traded products (ETPs) are set to debut on the London Stock Exchange (LSE) following approval by the Financial Conduct Authority (FCA) on May 22.

WidomTree’s physical Bitcoin ETP with ticker symbol WBTC and the physical Ethereum ETP (WETH) will be among the first set of crypto ETPs to be listed in the United Kingdom and are expected to begin trading on May 28, reported ETF Stream.

The physical ETPs will only be available to professional and institutional investors as the retail ban on crypto trading and sale of crypto derivatives and ETPs was enacted in January 2021. The listing of WisdomTree's two ETPs comes nearly two months after the LSE’s public notice.

Alexis Marinof, head of Europe at WisdomTree, said that the FCA approval of their crypto ETPs’ prospectus will make it easier for the UK-based professional investors to invest in crypto-backed products which currently access crypto ETPs via overseas exchanges,

In a public announcement on March 25, LSE notified that applications for the cryptocurrency ETPs are open until April 8; accepted funds will be listed the following month, subject to clearance by the nation’s financial regulator, thFCA.

To gain FCA approval, the crypto ETPs should only be denominated in Bitcoin or Ether, be physically backed, and be non-leveraged. The issuers must also partner with an Anti-Money Laundering licensed custodian in the United States, the United Kingdom, or the European Union and hold the underlying assets in cold storage.

The approval of Bitcoin ETFs by the United States Securities and Exchange Commission and its subsequent success, which saw billions flow into these ETFs weekly, have prompted several other governments around the globe to offer crypto accessibility to investors.

Apart from the U.K., Hong Kong was another region to approve the listing of Bitcoin and Ether ETFs. These spot cryptocurrency ETFs from Hong Kong were regarded as a significant improvement over their U.S. counterparts due to features like in-kind transfers and denominations in three fiat currencies. Investors can instantly purchase and redeem ETF units using Bitcoin or Ether.