Bitcoin may have made upward of 100,000 U.S. dollar millionaires as it enters its sixteenth year.

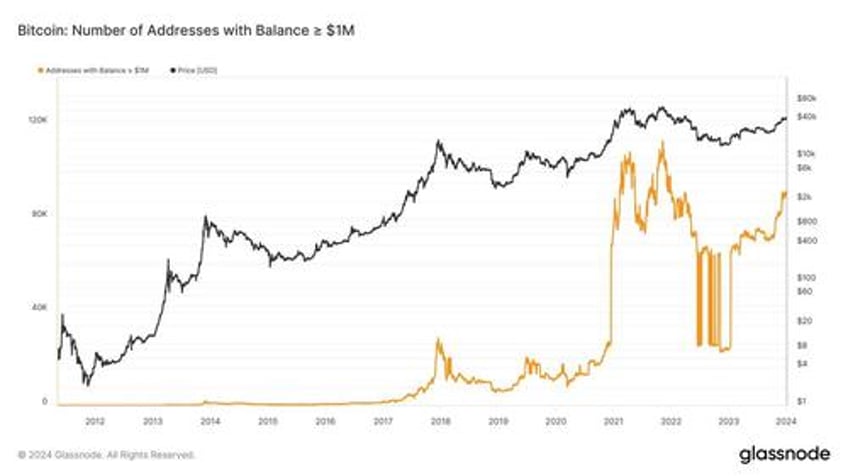

As CoinTelegraph's William Suberg reports, data shows that the number of wallets containing BTC worth at least $1 million is up nearly 300% since the start of 2023.

Bitcoin is now the ninth most valuable asset in the world as it celebrates its fifteenth birthday.

Fifteen years to the day that the genesis block was mined, Bitcoin has a market cap of around $900 billion.

The past year has marked a renaissance for Bitcoin hodlers, with BTC emerging from the pit of its longest-ever bear market to gain 160% in USD terms.

Now, per on-chain analytics firm Glassnode, Bitcoin “millionaires” number more than 91,000.

Measured as unique addresses with a balance of at least $1 million, the tally - while not yet at all-time highs seen in November 2021 - is still nearly four times higher than on Jan. 3, 2023.

“Let us not forget that Bitcoin is the 9th most valuable asset in the world. In less than 15 years, it surpassed 7,963 other assets to accomplish this,” author Oliver Velez commented on Bitcoin’s metamorphosis.

“By the end of 2025, I suspect it to be in the top three. We shall see.”

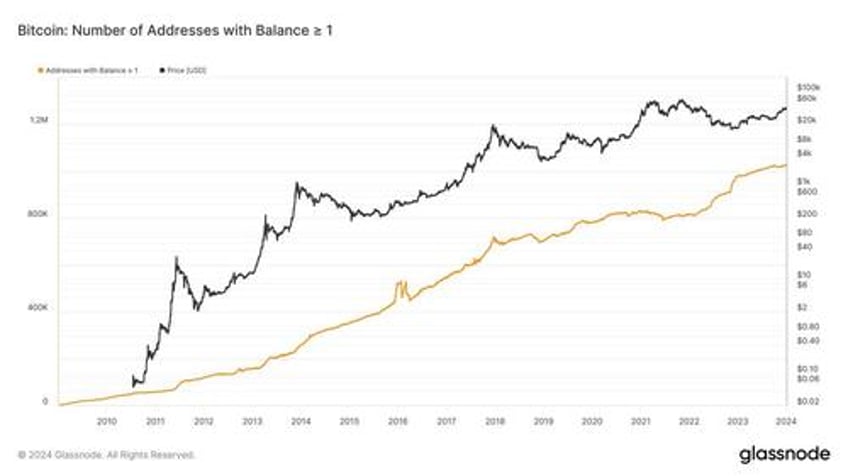

Meanwhile, "wholecoiners" - those unique addresses containing at least 1 BTC now number more than 1 million for the first time, Glassnode shows.

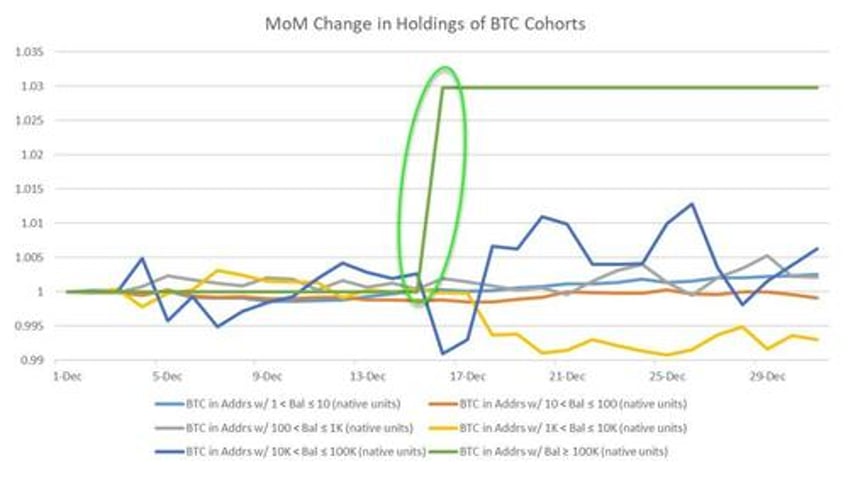

And interestingly, it has been the largest among these crypto millionaires that have been the biggest buyers of both Ethereum and Bitcoin in December.

As Goldman Sachs Crypto team highlight, value held across cohort group (separated into addresses whose balance included a number of native units within a certain range) for BTC in Dec were mostly flat across the smaller cohorts, but has increased by +3.0% for the largest cohort (BTC addresses with balances above 100K BTC), marking two months of consecutive inflow...

BTC network for Dec continued the previous month's trend of increased transactional activity, with average daily transaction count and mean transaction fees increasing +3.4% and +124.6% MoM.

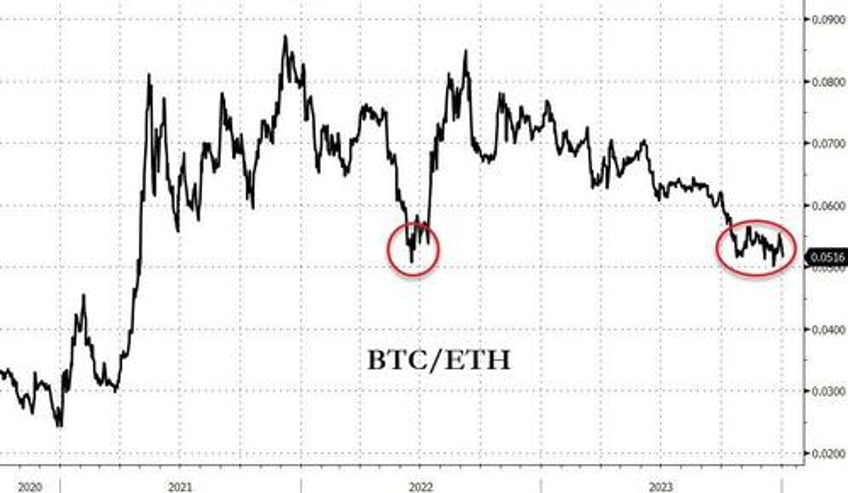

But, while the BTC/ETH pair remains significantly depressed...

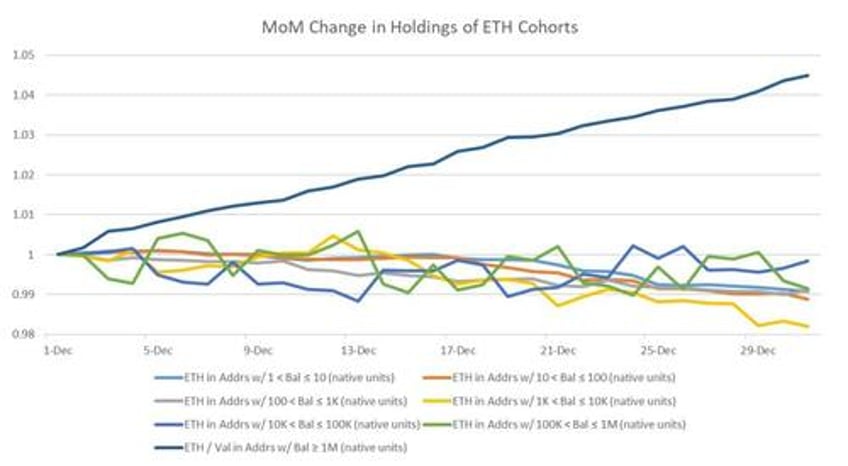

Demand for Ethereum was even greater than for Bitcoin in December, especially among the very largest whales.

Value held across cohort groups (separated into addresses whose balance included a number of native units within a certain range) for ETH in Dec saw a notable decrease of around ~1% for the smaller cohorts, but an increase of +4.7% for the largest cohort (ETH addresses with balances above 1M ETH)...

Similar to BTC network, ETH network activity continued its previous month uptrend of increased transactional activity, leading to average daily transaction count and mean transaction fees up +4.6% and +26.6% over the month.

Unlike BTC network which showed a slight downturn in address metrics, average daily active addresses and average daily new addresses for ETH is also up +11.4% and +15.1% respectively over the month.

CoinTelegraph's Marcel Pechman notes that Ether’s price increase has also been boosted by research published by Ethereum co-founder Vitalik Buterin on Dec. 28, which proposes a method to reduce the load on validators, theoretically reducing the number of required signatures by 70% and making the process more quantum-resistant.

The proposal offers three solutions:

decentralized staking pools,

a “light” staking method and,

a rotation between accountable committees.

Finally, Ethereum’s upcoming upgrade, Cancun, is set to undergo testing starting on Jan. 17.

It aims to lower transaction fees and introduces new features for bridges and staking pools.

Notably, it will include Ethereum Improvement Proposal 4844, or “proto-danksharding,” which will enhance rollup networks’ efficiency by temporarily storing transaction data in a new format called “blobs,” significantly reducing layer-2 transaction fees.

Data shows that Ether’s rally has been fueled by increased network and ecosystem use, dominance in terms of DApp deposits, and expectations of further improvements stemming from upgrades. Those changes will likely solidify its leadership in terms of smart contract processing and staking mechanisms.