By Zoltan Vardai of CoinTelegraph

Tether, the issuer of USDT — the world’s largest stablecoin — has minted over $1.3 billion worth of stablecoins since the market bottom, as investors prepare to buy the dip.

Tether’s treasury has printed over $1.3 billion worth of USDT since the market bottomed on Aug. 5. The $1.3 billion was transferred to some of the most popular centralized cryptocurrency exchanges — including Kraken, Coinbase, OKX and Bullish — according to an Aug. 9 X post by Lookonchain.

1.3B $USDT has been transferred from #TetherTreasury to exchanges since the market crash on Aug 5! pic.twitter.com/BYtMqgVRyZ

— Lookonchain (@lookonchain) August 9, 2024

Large stablecoin inflows to crypto exchanges could signal incoming buying pressure, as stablecoins are the main on-ramp from the fiat to the crypto world used by investors.

Is the local crypto market bottom in?

Following the aggressive $510 billion crypto market sell-off, the local market bottom may be in.

The 1.3 billion USDT has been minted since Aug. 5, when Bitcoin price bottomed at a five-month low of above $49,500 before starting to recover, according to Bitstamp data.

Since then, Bitcoin price has staged an over 21% recovery to trade at $60,271 as of 10:44 am UTC. The world’s first cryptocurrency has risen over 5.2% during the past 24 hours.

Can USDT help push Bitcoin above the key $65,000 mark?

Bitcoin could still see more downside volatility unless it manages to reclaim the crucial $64,000–$65,000 mark.

This price level acts as the short-term whale holder realized price for large Bitcoin holding entities, according to an Aug. 9 X post by CryptoQuant.

Pay attention to #Bitcoin short-term whales

— CryptoQuant.com (@cryptoquant_com) August 9, 2024

“The short-term holder whale realized price is in the 64K-65K range. This level may present itself as a resistance.” – By @XBTManager

Get the full insight 👇https://t.co/MgZCbsB060 pic.twitter.com/Rqs3GPtht3

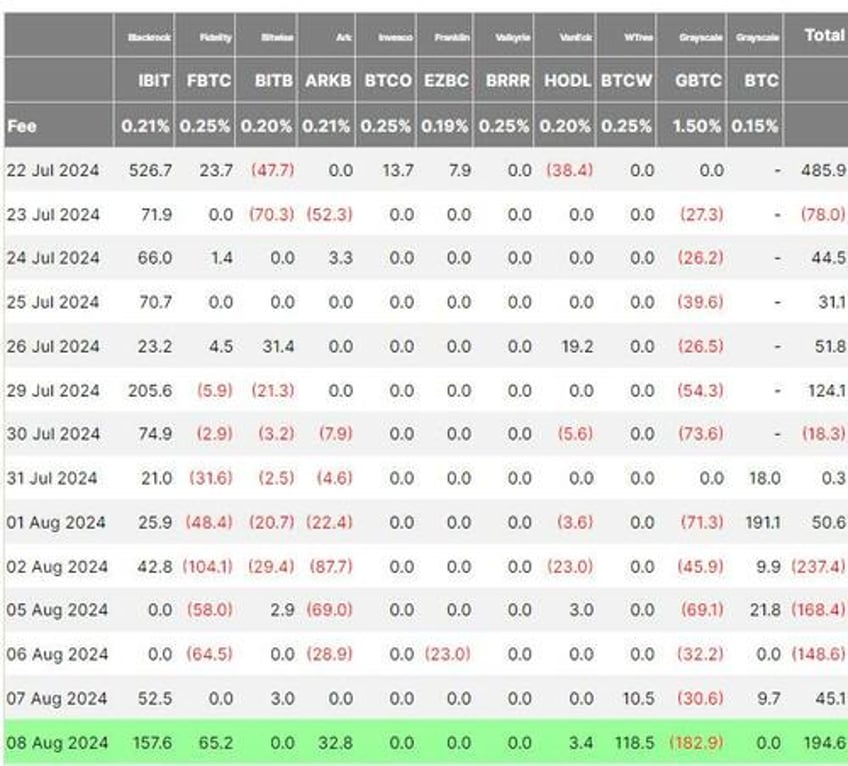

Inflows from the United States spot Bitcoin exchange-traded funds (ETFs) have also turned positive, which could contribute to Bitcoin’s price appreciation. The US Bitcoin ETFs amassed a cumulative $194 million worth of net positive inflows on Aug. 8, according to Farside Investors data.

ETF inflows can significantly contribute to a cryptocurrency’s price appreciation. For Bitcoin, ETFs accounted for about 75% of new investment in the cryptocurrency by Feb. 15 as it surpassed the $50,000 mark.