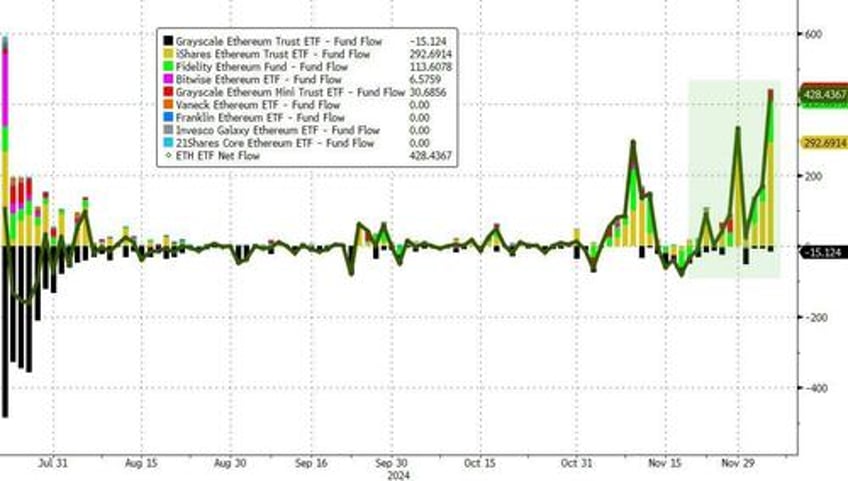

US Spot Ether ETFs just had their biggest single day of inflows in history and a ninth consecutive trading day of positive flows for the rallying cryptocurrency...

Source: Bloomberg

As CoinTelegraph reports, it was the largest daily inflow since the funds launched on July 23, eclipsing the previous record of $333 million on Nov. 29.

The Ether ETFs have been at a daily net positive since Nov. 21 and have accumulated more than $1.3 billion over the past fortnight.

The massive inflow day brought the total net inflow to over $1 billion, a figure that is steadily increasing now that Grayscale’s Ethereum Trust has slowed its bleed.

"Spot ether ETFs now with over $1.3 billion net inflows since July launch," said Nate Geraci, president of the ETF Store.

"They have done this despite nearly $3.5 billion of outflows from ETHE, no staking allowed, no options trading, no in-kind creation/redemption, and very limited access to major wirehouses (plus Vanguard)."

The BlackRock iShares Ethereum Trust contributed the lion’s share of the day’s inflows with a record $295.7 million, bringing its total inflow to $2.3 billion.

Fidelity’s Ethereum Fund inflow reached $113.6 million on the day, while Grayscale’s Ethereum Mini Trust had $30.7 million and the Bitwise Ethereum ETF recorded $6.6 million.

Grayscale’s Ethereum Trust registered an outflow of $15.1 million and the rest of the funds recorded zero flows.

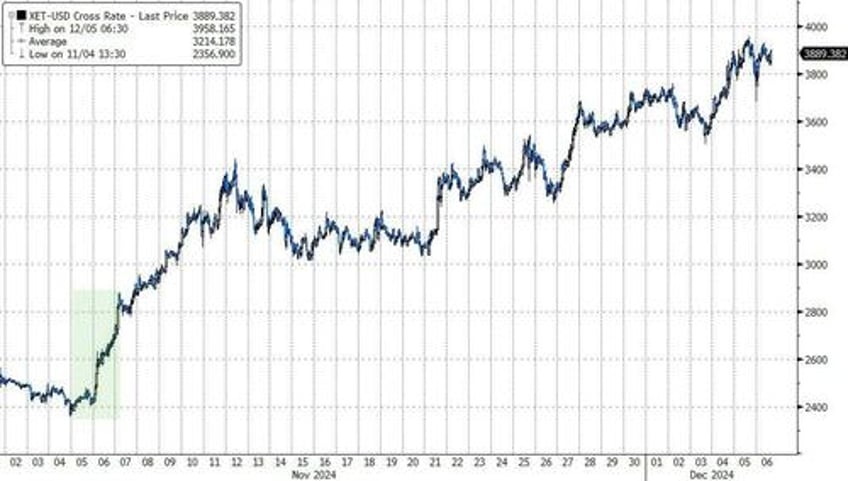

The flows come after the second-largest cryptocurrency by market cap has risen about 60% in the past month. It's currently trading at around $3,900.

Meanwhile, spot Bitcoin ETFs in the US continue to see solid momentum....

The BlackRock iShares Bitcoin Trust was responsible for most of the figure, with an inflow of $751.6 million, as Grayscale’s Bitcoin Trust outflowed $148.8 million, according to CoinGlass.

The BlackRock ETF has now seen inflows of almost $2.5 billion over the past five trading days, bringing its total inflow since launch to a whopping $34 billion.

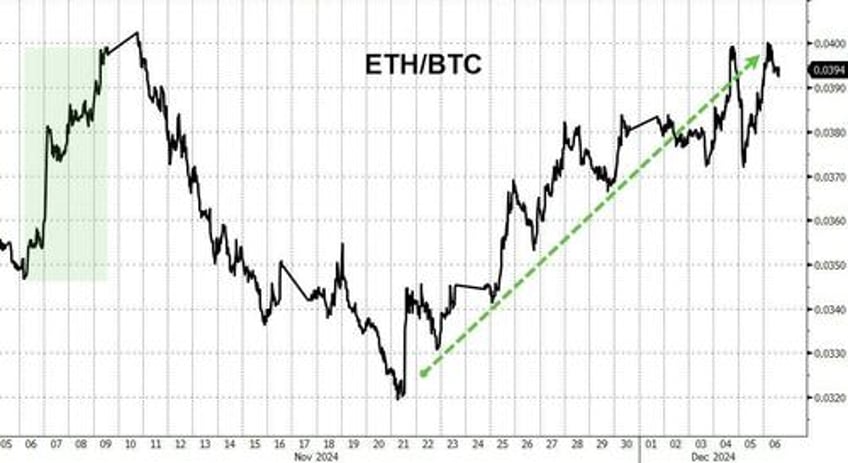

Ether’s strength against Bitcoin - or the ETH/BTC ratio - should go higher over the next six to 12 months after a stretch of underperformance, according to analysts.

The ratio is currently at 0.04, having increased by 14.5% over the past month, according to TradingView.

Crypto's renaissance since the election, as Gensler, Warren, et al. remove their boots from bitcoin's necks, has prompted some to rethink their constant derogatory commentary on this new digital money.

Most specifically, as CoinTelegraph's Brayden Lindrea reports, FT Alphaville - a daily news commentary service created by the Financial Times - was slammed on X after it issued a spiteful “apology” to Bitcoiners as the asset breached $100,000 on Dec. 5.

The op-ed - published on the same day - was seen as a tongue-in-cheek apology to those who chose not to invest in Bitcoin since FT’s first article on June 6, 2011, when Bitcoin was trading at $15.90.

”We’re sorry if at any moment in the past 14 years you chose based on our coverage not to buy a thing whose number has gone up. It’s nice when your number goes up,” said Bryce Elder, city editor of FT’s op-ed section, Alphaville.

“We’re sorry if you misunderstood our crypto cynicism to be a declaration of support for tradfi, because we hate that too.”

Source: FT Alphaville

FT Alphaville has staunchly argued Bitcoin is a “negative-sum game” that is “chronically inefficient” as a means of exchange and “compromised” as a store of value.

It has also portrayed Bitcoin’s price as an “arbitrary hype gauge that’s disconnected from any utility,” Elder noted, adding that FT Alphaville continues to “stand by every single one of those posts.”

The so-called “apology” didn’t go down well with the crypto community.

One post on X called it a “Cope-Pology,” while another described it as a “faux apology.”

Source: Brandon

“Imagine being so wrong and still having this lack of humility,” another said.

FT Alphaville opinion writers have attacked Bitcoin from virtually every angle, including its pseudonymous creator, Satoshi Nakamoto, who was likened to a “reckless” doctor overprescribing drugs by a former United States Federal Reserve risk examiner in 2014.

Mark Williams argued that Satoshi built a poorly designed Bitcoin supply schedule that fails to factor in the “ebbs and flow” of economic cycles.

“It ignores the ebbs and flow of economic cycles – a reckless approach that is the equivalent of a doctor giving penicillin to every patient without first checking whether they are suffering from infection, depression or mania.”

Despite Bitcoin’s rise to $100,000, it still boasts an army of critics — most notably Berkshire Hathaway’s Warren Buffett, JPMorgan’s Jamie Dimon and financial commentator Peter Schiff — who incorrectly predicted that Bitcoin would never hit $100,000 in November 2019.